- 👨🏿🚀TC Daily

- Posts

- A $308M debt for expansion

A $308M debt for expansion

Inside: Transfers to China are cheaper now.

TGIF! ☀️

Perplexity, the AI startup analysts say is a ticking time-bomb, has finally made its Comet browser available on Android. If you've been too lazy to test it on desktop, you now have a chance to give it a spin from your comfy couch this weekend. Let's help a “struggling” $20 billion AI startup stay in business, so those analysts don't win. :)

Enjoy your weekend.

Features

Quick Fire 🔥 with Thelma Dike

Thelma Dike is a senior product designer at Chipper Cash, where she designs products that move the needle for users and the business alike. She has delivered multi-million dollar impact across fintech, enterprise, and consumer products—from a fintech network API dashboard that processed billions in transactions, to an in-house AI verification feature that cut costs significantly.

She modernised complex enterprise systems for a Fortune 500 company, collaborated with Verizon and NVIDIA on resource management tools, and designed consumer solutions like RXGO, a mobile health app that saved Americans millions.

- Explain your job to a 5-year-old.

I draw things on a computer that help people use their phones easily. When you watch your cartoon or play your games, I make sure what you see is easy to press and understand.

- You’ve designed products that have moved billions in transactions and saved companies millions. What’s one design decision you’re most proud of?

One design decision I'm most proud of was merging our transfer experience into a single flow at Chipper Cash. Initially, international transfers, local methods, and recent beneficiaries lived in separate places. Users had to struggle to understand our internal structure just to send money. I redesigned it so that everything appears in one view, and users simply choose how they want to send in one tap. This change reduced decision fatigue, drop-offs, and made the experience generally faster.

- You currently work at Chipper Cash. Can you walk us through your role in the recent Zambian launch and what made the design critical to its success?

For the Zambian launch, I led the end-to-end design for onboarding, KYC, and core money-movement flows. The goal was to translate new regulatory requirements into a clean, familiar experience. One thing we did was to localise the KYC journey and ensure fees and limits are displayed upfront.

I also worked with engineering to confirm that Zambia-specific logics could fit seamlessly into our existing patterns, reducing the need for one-off exceptions. Design was critical because early trust makes or breaks a market launch. My focus was on clarity and reducing friction, so users could onboard and complete their first transaction with little to no confusion.

- What’s one misconception people have about product design, especially in fintech?

A lot of people think good fintech design is just about making things look simple. But the real work goes deeper. It’s about untangling all the messy stuff underneath: regulations, risk checks, KYC/AML steps, financial logic, and all the edge cases that come with money moving around. A clean UI can still hide broken logic.

I’d say the best fintech design happens when you’re working closely with risk, compliance, operations, and engineering, to understand how things actually work, and then turning that complexity into something users can trust.

- Outside of work, what inspires you creatively or keeps your problem-solving skills sharp?

I read fiction whenever I can; it helps me think differently. Stories have a way of forcing you to follow someone else's logic and see the world through a new lens. I also stay active: strength training and sprinting help clear my head and let ideas come naturally.

Powering businesses across Africa to pay and get paid in local currencies.

With Fincra, businesses, startups, global enterprises and platforms can easily send and receive payments in multiple African currencies, empowering trade, and growth across the continent. Create your account in 3 minutes.

Telecoms

Safaricom to raise $308 million in bonds

Safaricom, Kenya’s largest telecom company, is gearing up for another network flex as it just received a green light from Kenya’s Capital Markets Authority (CMA) to raise $308 million in debt for infrastructure expansions across Kenya and Ethiopia.

State of play: Since entering Ethiopia in 2022, Safaricom has been laying down network sites, expanding fibre networks, and scaling mobile money. Though it is a relatively new market, the losses recorded in its operations have been on a steady decline.

Kenya remains the operator's powerhouse, as its 2024 full-year profit increased by 11% to $540 million. The money is headed straight into these pipes as the growth in these markets is too big to ignore.

What's Safaricom doing? With this new fundraising, Safaricom seems to be arming itself for a long game. The bond gives it cheaper capital to modernise its networks, push deeper into Ethiopia, and reinforce its dominance in Kenya without using daily resources.

It also signals that Safaricom is confident in its growth because you don’t raise this kind of money unless you see a clear runway to set the pace for East Africa’s connectivity race.

Enjoy smooth payments while you're home this Detty December

Coming home for Detty December? Enjoy smooth payments every day with your Paga US account. Send money to any bank instantly. Don’t miss out, get started now.

Companies

Standard Bank lays another brick on the Africa-China road

Standard Bank, South Africa's biggest bank, has become the first on the continent to connect directly to China's payment system. This gives African companies a new, faster way to pay their Chinese suppliers in China's currency, the Renminbi (RMB), rather than using US dollars for every transaction.

What does this mean? This is a significant shift for African businesses that import goods from China. By cutting out the US dollar as a routing currency, companies can avoid extra fees, delays, and the risk of the dollar's value changing unexpectedly. Trade with China is massive and growing, with over a third of African businesses now importing Chinese goods. This direct payment channel means sectors like manufacturing, electronics, and construction can now pay their bills more simply and cheaply, easing cash flow pressures.

What next? The move is part of a larger global trend where countries are exploring ways to rely less on the US dollar for international trade. For South African businesses, this means smoother and more efficient trade with their largest trading partner. For Standard Bank, this strengthens its role as a key financial bridge between Africa and the world, potentially paving the way for more African banks to follow suit and deepen economic ties with China.

Paystack introduces Pay with Pesalink in Kenya!

With Pesalink and Paystack, businesses in Kenya can now get paid directly from customer bank accounts. Learn more here 👉

insights

Funding Tracker

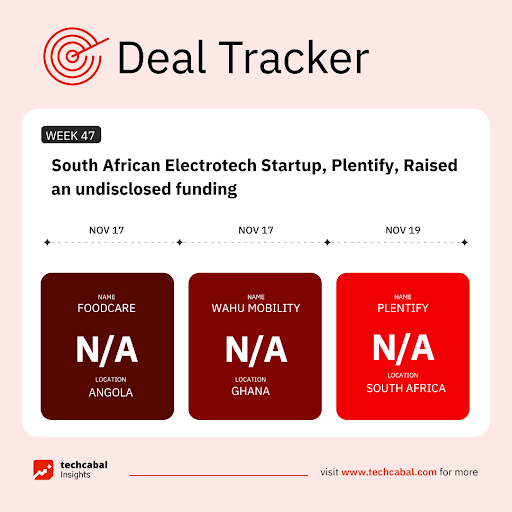

This week, Plentify, a South African electrotech startup, raised an undisclosed funding in a Series A round. The round was led by Secha Capital, Buffet Investments, E3 Capital, Fireball Capital, Endeavor SA’s Harvest Fund, Satgana, and several family offices. (Nov 19)

Here are the other deals for the week:

- FoodCare, an Angolan agrifood processing startup, secured an undisclosed investment from Kimbo Fund. (Nov 17)

- Wahu Mobility, a Ghanaian electric mobility startup, has secured an undisclosed funding from Sahara Impact Ventures. (Nov 17)

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements. Before you go; is cybercrime outpacing Africa’s digital revolution? Find out here

AI in a Nutshell gives you weekly AI knowledge and insights

Want to stay close to AI but hate long reads? AI in a Nutshell gives you weekly AI knowledge, news, tools, and insights - short, smart, and fun. Perfect for curious (but lazy) readers who still want to stay ahead. Subscribe here.

CRYPTO TRACKER

The World Wide Web3

Source:

Coin Name | Current Value | Day | Month |

|---|---|---|---|

| $87,986 | - 2.59% | - 20.00% | |

| $2,897 | - 2.52% | - 26.11% | |

| $2.03 | - 2.03% | - 16.90% | |

| $880 | - 1.31% | - 17.90% |

* Data as of 00.00 AM WAT, November 21, 2025.

Job openings

- Busha — Business Development Manager, Reconciliation and Settlement Analyst — Hybrid (Lagos, Nigeria)

- Trust Wallet — Android Engineer, Frontend Engineer, Growth and Performance Marketing Analyst, Talent Acquisition Specialist — Remote

- Paystack — Senior Fullstack Engineer — Remote (Lagos, Nigeria)

- Paystack — Business Development Partner — Lagos, Nigeria

- Flutterwave — Treasurer, Africa — Lagos, Nigeria

- Big Cabal Media — Senior Financial Analyst, Junior Sales Analyst — Hybrid (Lagos, Nigeria)

There are more jobs on TechCabal’s job board. If you have job opportunities to share, please submit them at bit.ly/tcxjobs.

Written by: Emmanuel Nwosu, Opeyemi Kareem, Zia Yusuf, and Success Sotonwa

Edited by: Emmanuel Nwosu & Ganiu Oloruntade

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- TC Scoops: breaking news from TechCabal

- Francophone Weekly by TechCabal: insider insights and analysis of Francophone’s tech ecosystem

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

How did you find today's edition of #TCDaily? |