- 👨🏿🚀TC Daily

- Posts

- A decade later, Lidya calls it a day

A decade later, Lidya calls it a day

Inside: 492 Nigerian digital lenders meet new capital rules.

TGIF. ☀️

The Future of Commerce Report: Beyond the First Wave is TechCabal Insights' annual report, launched at Moonshot by TechCabal in October 2025.

Africa's next wave of innovation isn't in payments or marketplaces—it's in the "X Areas": the overlooked, unglamorous back-office challenges holding millions of businesses back.

This report reveals where investment and innovation are heading next and what it means for founders, investors, and policymakers shaping Africa's trade backbone.

Features

Quick Fire 🔥 with Ibikunle Peters

Ibikunle Peters is an IT and telecom infrastructure expert with over a decade of experience, recognised for his work powering Nigeria’s largest network deployments and national-scale digital operations. With over a decade of experience across Airtel Networks Nigeria, 9mobile, and Huawei, Peters has delivered and managed high-stakes systems, enabling secure elections, nationwide censuses, and critical telecommunications services trusted by millions.

He specialises in network systems integration, application uptime and resilience, enterprise software management, and real-time operational troubleshooting. His voice shapes how critical technology enables national stability, digital access, and business transformation in Africa’s fast-evolving markets.

- Explain your job to a 5-year-old.

I make sure phones and computers can talk to each other properly. Imagine that your cartoon stops working or your mum can’t call grandma. I’m the one who fixes it behind the scenes, so everything works again, and you can continue to watch your cartoons and enjoy those pleasant moments.

- You cut your teeth working as a Billing Application Engineer at Huawei for nearly ten years. That sounds like it must’ve been an important role. What did you do in that position?

At Huawei, I was responsible for the charging & billing systems used by major telecom operators at the time. These systems processed millions of transactions daily—calls, texts, data sessions. My role involved ensuring service quality met regulatory standards and that systems were accurate, secure, and always available. I also applied my data science techniques to detect anomalies in transaction patterns, optimise system performance, and support national rollouts like SIM registration and mobile number portability. It was high-pressure work, but it taught me how to build and maintain systems that scale.

- You’ve worked behind the scenes on systems that keep Nigeria connected. What does a typical high-stakes day look like for you?

It starts with monitoring bespoke dashboards and alerts. If something critical breaks—say, a billing outage or a network disruption—I lead the response, coordinating with vendors and internal teams to restore services quickly within acceptable SLAs. Sometimes it’s about deploying updates without affecting millions of users. Other times, it’s preparing systems for high-stakes national events like elections or censuses, where failure isn’t an option.

- What’s one major crisis you’ve handled that taught you something you still carry today?

During a nationwide SIM/KYC registration campaign, a backend system crashed under unexpected load. I led the recovery effort, working overnight with multiple teams to restore services. Beyond the technical fix, I used data analytics to identify bottlenecks and predict future load patterns, which helped redesign the system for better scalability. That experience taught me the importance of calm leadership, contingency planning, and the power of data-driven decision-making.

- What do people often get wrong about how telecom networks actually work?

Most people think telecom is just about antennas and signals. But the real complexity lies in the backend, including the Base stations, Controllers, billing systems, databases, APIs, and integrations that keep everything running. These systems handle authentication, charging, fraud detection, and regulatory compliance. It’s a tightly woven ecosystem that requires constant monitoring and fine-tuning.

eCommerce Without Borders: Get Paid Faster Worldwide

Whether you sell in Lagos or Nairobi, customers want local ways to pay. Let shoppers check out in their local currency, using cards, bank transfers, or mobile money. Set up seamless payments for your global online store with Fincra today.

Startups

Lidya, a Nigerian digital lender, shuts down after nearly a decade of operations

“Nigeria’s tech-savvy lending ecosystem is the ideal launchpad for our solutions, which support data-driven decision-making.” — Tunde Kehinde, co-founder and CEO of Lidya.

Nearly two years after this statement, Lidya, a Nigerian SME lending company, has closed its operations after nearly a decade of its launch.

Here’s what happened: In an email seen by TechCabal, the company said it had endured severe financial distress despite its efforts to restructure and sustain operations. It described that its financial distress currently makes it unable to process funds or settle claims.

The shutdown comes nearly two years after Lidya exited its European operations to focus on Nigeria. In 2019, the digital lender expanded into Poland and the Czech Republic, following up with an $8.3 million pre-Series B round the following year. Three years after its European expansion, it pulled out of those markets to focus on Lidya Collect, its loan recovery tool, in its home market.

Red flags: In October 2024, reports said Lydia’s CEO, Kehinde, had stepped down from his role and exited the company amidst customer complaints about its product, Lidya Collect. Earlier in September 2024, the company’s CTO, Cristiano Machado, also stepped down from his role. A former employee also claimed Lidya was unable to pay the salaries of its Portugal-based tech team.

Gone too soon? Lidya has raised a total of $16.5 million, including a $1.3 million seed round in 2017, $6.9 million Series A in 2018, and its $8.3 million Series B raise. Lidya’s closure marks the end of a once-promising venture in Nigeria’s digital lending sector.

Paga is in USA

Paga is live in the U.S.! Whether you're in Lagos or Atlanta, manage your money effortlessly. Send, Pay, and Bank in both Naira and US Dollars, all with Paga. Learn more.

Fintech

FCCPC’s $69,000 rule sparks a registration rush among loan apps

Who has 100 million or 19% of their turnover to spare? Surely not the new digital lenders that just scrambled to register under the Federal Competition and Consumer Protection Commission (FCCPC)’s freshly enforced Digital, Electronic, Online, or Non-Traditional Consumer Lending Regulations, 2025. Somehow, nearly 500 loan apps in Nigeria have done just that.

The new rules demand that all digital lenders register with the FCCPC within 90 days of starting operations. Since the rules took effect on July 21, 2025, the number of legally operating lenders shot up to 492, as operators rushed to dodge the regulator’s ₦100 million ($69,000) fine for non-compliance. Of the 492 apps, 434 now have full approval and 36 await conditional clearance, while 22 CBN-licenced lenders remain under watch.

What else is new? The rules also ban loan apps from dipping into users’ contact list or gallery, force lenders to disclose real interest rates and repayment dates, and forbid those name-and-shame recovery messages that once terrorised borrowers’ friends and family.

Zoom out: These apps may have scrambled to comply with these regulations out of fear, but they are also racing to stake their claim in Nigeria’s booming digital lending market. Just ask FairMoney, whose gross revenue grew 62% in 2024. It proves that there might be real money to be made from keeping Nigerians perpetually credit-hungry.

Join Paystack and Unwind Fest for Founders Rant!

Building a company is exciting and hard. Come hear founders share the real stories behind the highs, lows, and lessons of building in Africa. Buy tickets here →

Insights

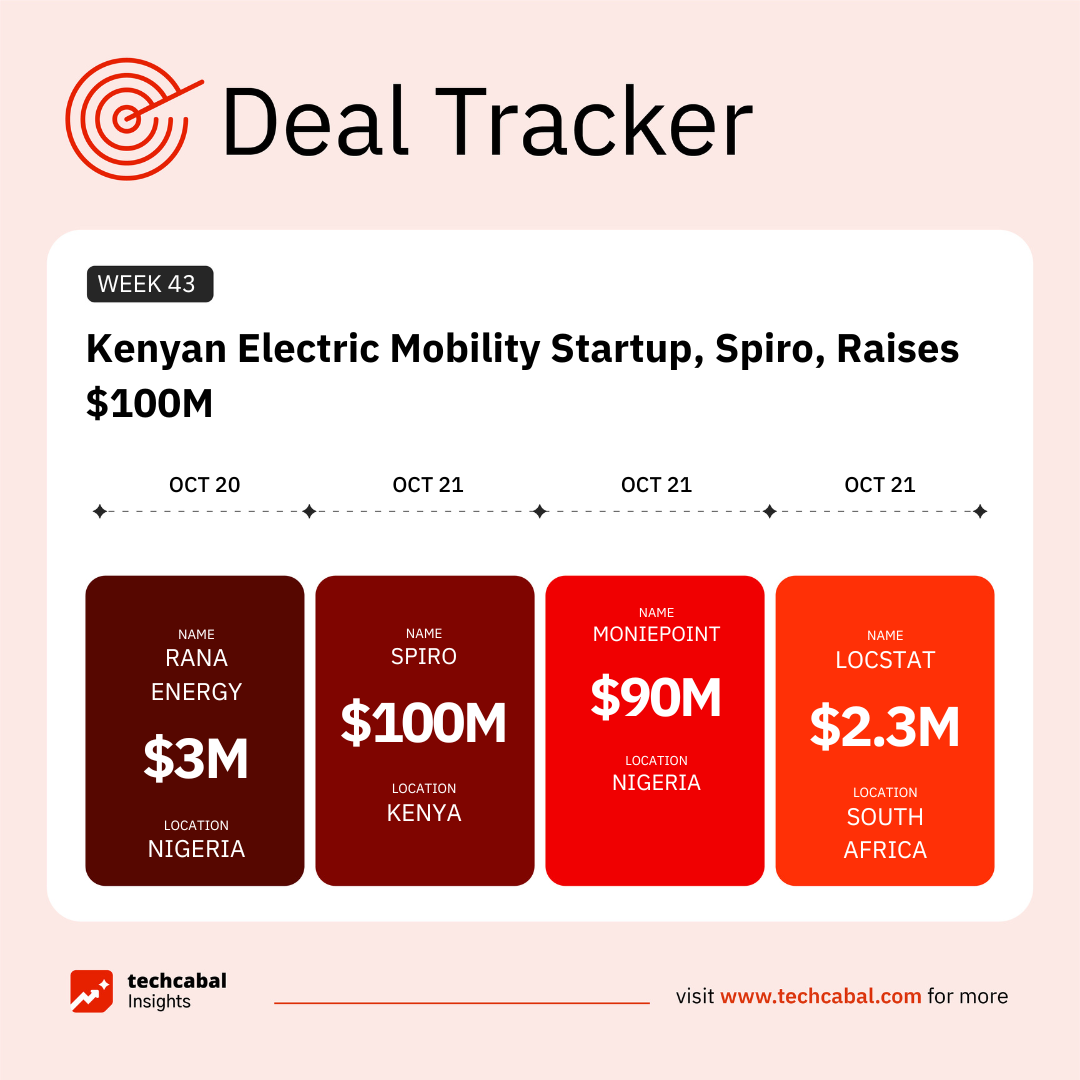

Funding Tracker

This week, Spiro, a Kenya-based electric mobility startup, secured $100 million in funding, the largest-ever investment in Africa’s e-mobility sector. The round was led by Fund for Export Development in Africa (FEDA), consisting of $75 million, and the rest from other strategic investors. (Oct 21)

Here are the other deals for the week:

- Egyptian AI company Nanovate raised $1 million in a pre-seed funding round. The funding comes from a group of angel investors. (Oct 17)

- Julaya, an Ivorian fintech startup, raised $1.4 million through a convertible bond investment led by CDC-CI Capital. (Oct 17)

- Rana Energy, a Nigerian-founded startup that provides solar and battery storage systems to businesses on a subscription basis, has raised $3 million in funding. The funding comes from Techstars, EchoVC Eco, and angel investors Chinedu Azodoh and Tayo Bamiduro. It comprises $500,000 in funding and a $2.5 million local currency green debt facility arranged by Optimum Global and backed by Nigerian asset manager FSDH Asset Management. (Oct 20)

- SehaTech, an Egyptian insurtech for medical insurance, raised a $1.1 million seed round led by Ingressive Capital with other participants, including VC, strategic angels, A15, Beltone Venture Capital, and a veteran industry operator. (Oct 20)

- Moniepoint, one of Nigeria’s most prominent fintechs, raised $90 million in investment from the African Development Partners III (ADP III) fund, LeapFrog Investment, Lightrock, Alder Tree Investments, Google’s Africa Investment Fund, Visa, the International Finance Corporation (IFC), Proparco, Swedfund, and Verod Capital Management. (Oct 21)

- Locstat, a South African-founded startup that enables continuous analysis and visualization of real-time data from multiple sources, raised $2.3 million in pre-Series A funding led by Portugal Gateway Fund (PGF) and ANZA Capital. (Oct 21)

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements. Before you go,find out why Africa’s commerce problem isn't consumer-facing anymore.

PalmPay is Showing Nigerians the Smarter Way to Bank

Want to stay protected from fraud and scams? Set up your security center in the PalmPay app. PalmPay’s multi-layered security system is built to protect your funds and keep every transaction safe. Say yes to reliable, secure banking with PalmPay. Learn more.

CRYPTO TRACKER

The World Wide Web3

Source:

Coin Name | Current Value | Day | Month |

|---|---|---|---|

| $108,214 | + 0.58% | - 5.34% | |

| $3,864 | + 0.01% | - 9.81% | |

| $0.09275 | - 8.97% | + 20.96% | |

| $184.61 | + 0.64% | - 19.90% |

* Data as of 06.30 AM WAT, October 24, 2025.

Opportunities

- Bigger, bolder, and more intentional. Following the resounding success of the inaugural summit in 2024, Growth Padi is thrilled to announce Growth Africa Summit 2025 (GAS 2.0) with the trailblazing theme: “Redefining the Growth Playbook.” Set against the backdrop of a fast-evolving entrepreneurial landscape, this year’s summit will challenge outdated strategies and usher in a new wave of radical, resilient, and relevant growth models tailored for African businesses. Register to attend by November 1.

- Got a startup story worth telling? My Startup in 60 Seconds is TechCabal’s one-minute spotlight for founders to share their journey, from vision and challenges to major wins. It’s more than just visibility; it’s a chance to reach investors, potential customers, and Africa’s wider tech ecosystem. Be featured in My Startup in 60 Seconds or explore other TechCabal advertorial opportunities and let the ecosystem hear your story. This is a paid opportunity.

- Calling all AI enthusiasts for Africa’s premier all-expense-paid AI and Data Science learning experience this October, powered by Data Science Nigeria (DSN). The AI Bootcamp 2025 will run from October 20–25 at the University of Lagos, bringing together learners from 36 states and 13 African countries for practical training, mentorship, and collaboration under the theme “AI for All: Democratizing Intelligence and Driving Impact.” Join the free city classes to qualify for the Bootcamp. Register here.

Written by: Opeyemi Kareem, Emmanuel Nwosu, and Success Sotonwa

Edited by: Ganiu Oloruntade

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- TC Scoops: breaking news from TechCabal

- TNW: Francophone Africa: insider insights and analysis of Francophone's tech ecosystem

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

How did you find today's edition of #TCDaily? |