- 👨🏿🚀TC Daily

- Posts

- A Stitch with Efficacy saves nine

A Stitch with Efficacy saves nine

Inside: MTN Nigeria survived an 8-hour cyber siege.

Happy pre-TGIF! ☀️

Let's get into today's dispatch.

Fintech

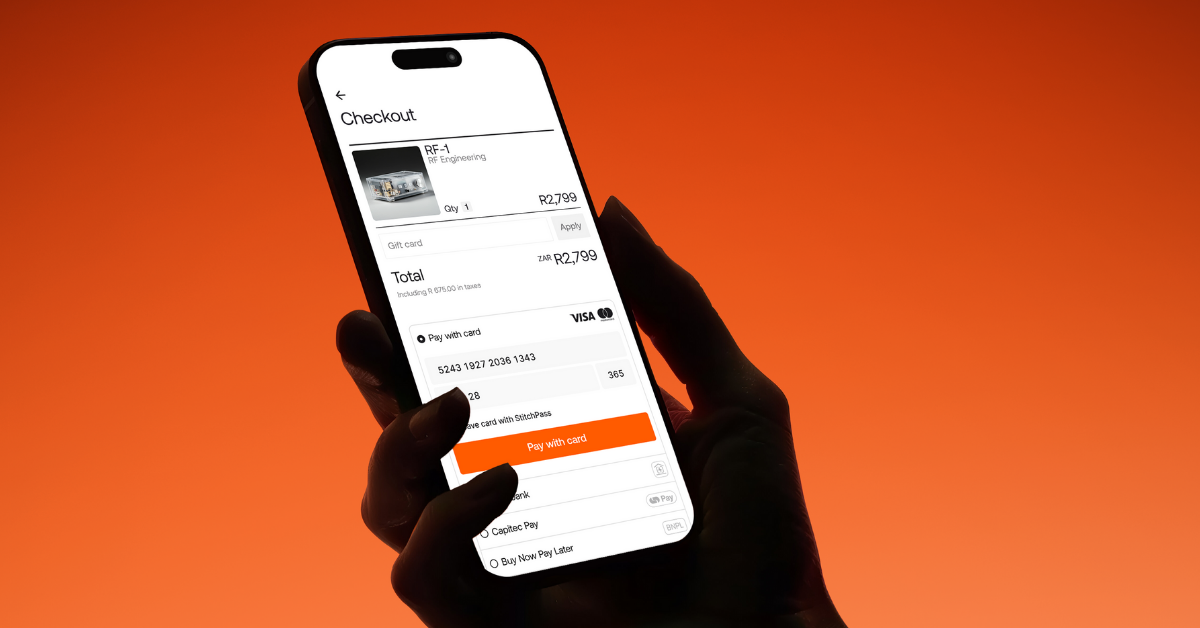

South Africa’s Stitch acquires Efficacy Payments to become a direct card processor

Stitch now owns every inch of the card payment pipeline, and it's not slowing down.

The South African payments infrastructure company, has acquired Efficacy Payments, a digital payments startup with access to the national clearing system.

With this acquisition, Stitch now has direct access to South Africa’s national clearing system, something that was once only available to licensed banks and a handful of big processors.

What does this mean? Access to the national clearing system lets Stitch move money between banks directly, enabling faster payment settlements, reduced reliance on intermediaries, and greater control over the entire payment flow. Stitch has become one of the only fintechs in South Africa, apart from Adumo, that can handle the entire card acquiring process, from gateway to switching to settlement.

This move follows Stitch’s earlier acquisition of ExiPay, giving it a foothold in point-of-sale infrastructure. With Efficacy now in the fold, Stitch controls both the in-store and online card payments, offering a fully integrated stack for merchants.

Is Switch trying to be a bank? Not quite, but it's definitely moving into a territory that was once bank dominated. The company doesn't collect deposits or hand out loans, but it is positioning itself as a payments infrastructure layer that rivals what banks typically offer to merchants and businesses.

Think of it like: Banks used to own the whole yard for card payments. Now Stitch has built its own fast lane, and is letting businesses drive on it directly. Together, these moves position Stitch as the payments backbone for South Africa’s card payments system—expected to reach $159 billion in 2025. End to end, and on its own terms.

Paying 2% or more on every transaction adds up fast.

For businesses in e-commerce, logistics, travel, fintech, and more, every naira counts. Fincra helps you save more with 1% NGN fees capped at ₦300. Ideal for high-value or high-volume transactions. Get started for free with just your email address!

Cybersecurity

MTN Nigeria survived an 8-hour cyber siege

On the 2nd of August, 2023, MTN Nigeria was under fire—literally.

For eight hours, the telecom giant was locked in a digital standoff, forced into full defence mode as attackers battered its system in waves. Each time they reinforced their defence, Anonymous Sudan hit back harder.

The hacktivist group launched one of the biggest Distributed Denial of Service (DDoS) attacks ever recorded for a West African company, flooding MTN's network with junk traffic.

But it wasn't an isolated attack, and MTN was somewhat prepared. A few days earlier, Kenya’s Citizen portal had gone dark and M-Pesa faltered. Tanzania stumbled, and MTN Nigeria guessed they might be next, so it burst into action. Firewalls were optimised. Suspicious packets were dropped. Government and industry players were alerted. No subscriber data was lost. But the financial and operational costs were steep.

Here's the real problem: Telecoms are the soft underbelly of digital Africa, and not all telecom operators are MTN. They don't have scale, budget, or early warning systems. If they don't take cybersecurity seriously, DDoS will not just mean slow internet speeds, but a collapse of national systems.

These attacks are cheap to launch, expensive to stop, and powered by thousands of unsecured devices. Anonymous Sudan may sound like a meme, but they're turning African telecommunication infrastructure into a battlefield.

Paga Engine powers the boldest ideas in Africa

"Across various use cases and industries, Paga Engine provides reliable rails for your business needs to run smoothly and grow sustainably." - Tayo Oviosu. Read the full article.

Funding

Kenya’s Leta expands to Ghana after $5 million seed round

Kenya’s Leta, a software startup that builds logistics software for businesses, has expanded into Ghana, its seventh market on the continent.

Why does it matter? This expansion comes a few months after its $5m seed round in March 2025. At a time when logistics startups in Africa saw a 69% decrease in funding, it signals growing investor confidence in Leta’s mission to help businesses improve supply chain and logistics efficiency using AI-powered tools. By adding Ghana, Leta is strengthening its continental footprint. Its entry could help boost competition in Ghana’s logistics sector and provide businesses with more innovative tools to transport goods efficiently.

Leta was founded in 2021 by Nick Joshi as a software development company that creates supply chain and logistics solutions to enable the optimal and efficient movement of goods. Since then, it has expanded into five other markets: Uganda, Nigeria, Zimbabwe, Zambia, and Mauritius. It has also raised over $8 million in two rounds, including its most recent one in March 2025, which was led by a European venture capital (VC) firm, Speedinvest, alongside Google’s Africa Investment Fund and Equator, an Africa-focused climate tech fund.

State of play: With its entry into Accra, Leta’s first Ghanaian client is Simbisa Brands, one of Africa’s biggest fast-service restaurant groups, which already boasts of over 600 outlets in 11 countries.

The big picture: The startup's entry into Ghana demonstrates its broader ambitions to become the default logistics software provider for businesses across the continent. If its growth continues, Leta could help revive a declining investor interest in the logistics space on the continent.

Accept Apple Pay with Paystack today!

Anyone can get paid globally. With Paystack and Apple Pay, let customers pay you instantly and securely from 60+ countries. Get started here →

Infrastructure

After the Ramses fire, banking and telecom services in Egypt are nearing full return

On July 7, a major fire broke out at Egypt’s Ramses Central data centre, a key telecom facility operated by Telecom Egypt, the state-owned telecom company, in Cairo. In a fatal unfolding of events, the fire killed four people and injured 27 others.

Between the lines: The Ramses data centre is a critical infrastructure for Egypt's banking and telecom companies. It stored and carried data for the majority of the country's top telcos, including Vodafone, Orange, WE, and e&. As the main hub for internet, mobile, and data services, Ramses kept everything running, from banking and payments to the stock exchange, government services, and even airports.

So when it went down, the effects were felt across the country. The fire incident showed how risky it is to depend so much on one facility:

- The Egyptian Exchange (EGX) had to stop trading for a day.

- Phone and internet outages left millions cut off from calls, online access, and digital payments.

- Banks, ATMs, and fintech apps stopped working, and long lines formed at branches as e-banking went dark.

- Emergency hotlines and some airport operations were also hit.

Catch up: After the incident, officials quickly shifted their data traffic to other data centres. As of yesterday, most telecom and internet services were back to 95% of normal levels outside the affected area, and the EGX reopened. The Central Bank of Egypt (CBE) raised cash withdrawal limits for individuals and businesses from EGP 250,000 ($5,000) to EGP 500,000 ($10,000) to ease pressure, and the government promised support for affected users. Repairs near Ramses are still ongoing, with full recovery expected soon.

Zoom out: This fire is a warning for Egypt and the wider region. Data centres are the backbone of today’s economy; when one fails, everything else can grind to a halt. The Ramses fire makes it clear that Egypt needs stronger backup systems, better emergency plans, and more investment in spreading out its digital infrastructure.

Launch Africa's Next AI Startup. Start at Mest.

IApplications are open for MEST’s fully funded AI Startup Program. Train with Global Experts | AI - focused | Incubation | Seed Funding Potential | Apply by August 22 → #MESTAI2026

CRYPTO TRACKER

The World Wide Web3

Source:

Coin Name | Current Value | Day | Month |

|---|---|---|---|

| $111,014 | + 1.95% | + 1.93% | |

| $2,779 | + 5.32% | + 3.86% | |

| $0.1809 | + 4.81% | - 5.31% | |

| $157.31 | + 2.81% | - 0.47% |

* Data as of 06.45 AM WAT, July 10, 2025.

Unlock the secrets to financial freedom at the Naira Life Conference by Zikoko

The Naira Life Conference will bring together finance experts, industry leaders, creators, and entrepreneurs who will share their own journeys and offer actionable strategies to make your financial dreams a reality. Think: bold conversations, immersive workshops, and content tracks that hand you a playbook for building real wealth. It's happening on August 8 at the Jewel Aeida, Lekki. Get tickets here to secure a spot.

Opportunities

- MEST Africa has opened applications for its 2026 AI Startup Programme. The 12-month training and incubation programme will equip West African software developers aged 21–30 with the skills to build scalable AI startups. Selected participants will undergo seven months of hands-on training in Ghana starting January 2026, followed by a four-month incubation for the most promising teams. Applications close August 22, 2025. Apply here.

- Applications are still open for the 2025 FATE Institute Fellowship, a two-year, part-time and virtual programme for experienced Nigerian professionals passionate about entrepreneurship and policy reform. The fellowship is open to candidates with at least 10 years of relevant experience and a completed or ongoing Master’s or PhD in fields like Economics, Law, or Political Science. Fellows will work remotely, contribute to research on Nigeria’s entrepreneurship ecosystem, engage with policymakers, and take part in virtual policy discussions, without needing to leave their current roles. Apply by July 25.

- We're launching TechCabal Insights Market Researcher™, a tool that helps you find and analyse African tech and business data in seconds. Whether you're looking for startup funding numbers, market trends, or investor activity, it does the digging for you—fast and accurately. Be the first to try it. Join the waitlist.

Written by: Opeyemi Kareem, Emmanuel Nwosu, and Ifeoluwa Aigbiniode

Edited by: Faith Omoniyi

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- TC Scoops: breaking news from TechCabal

- TNW: Francophone Africa: Insider insights and analysis of Francophone's tech ecosystem

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

How did you find today's edition of #TCDaily? |