- 👨🏿🚀TC Daily

- Posts

- African startups raised $144.3 million in October

African startups raised $144.3 million in October

Here's your roundup of the leading African tech moves from last month.

TGIF ☀️

Before we dig into everything that made the headlines last month, here’s a reminder that our Future of Commerce Trends Report 2024 is now out.

And it’s free too.

If you want to know why 67% of MSMEs in Nigeria, Kenya and South Africa are using social media for their businesses, or why the social commerce trade in Africa and the Middle East will reach $41.9 billion by 2021, then download the Future of Commerce Trends Report.

In today's edition

1. Funding: Energy startups continue to lead funding

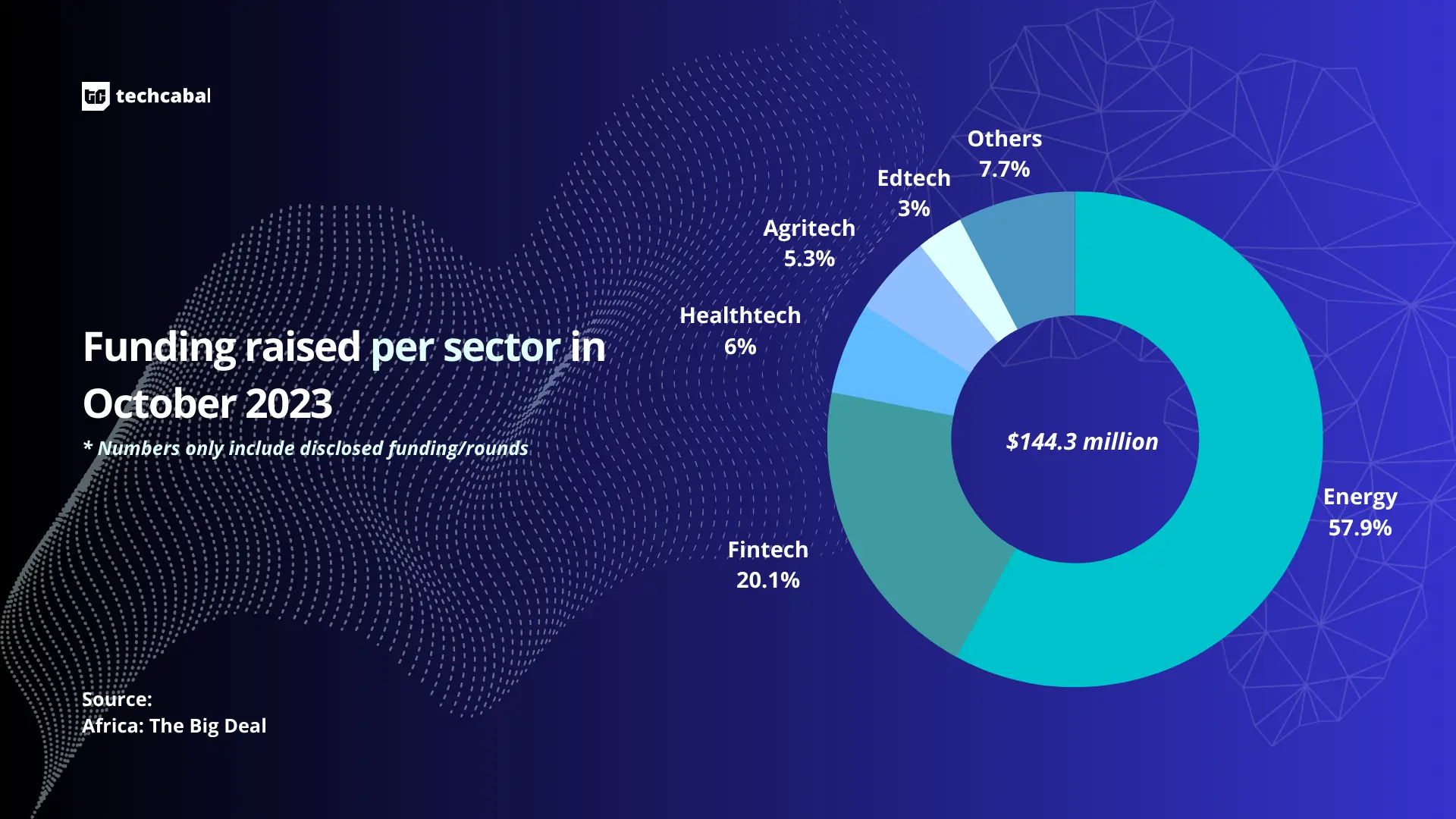

In October 2023, 27 African startups secured $144.3 million in funding through 27 fully disclosed investment rounds. This marks a 23.6% rise compared to the $116.7 million raised in September 2023.

It’s, however, a 22.6% decrease from October 2022’s $186.4 million.

The three sectors with the highest funding are energy with $86.3 million in raises, fintech with $29 million, and healthtech with a modest $8.6 million.

In terms of sector performance, various sectors—most notably fintech—within the ecosystem have observed a decline in funding when compared to the levels from the previous year.

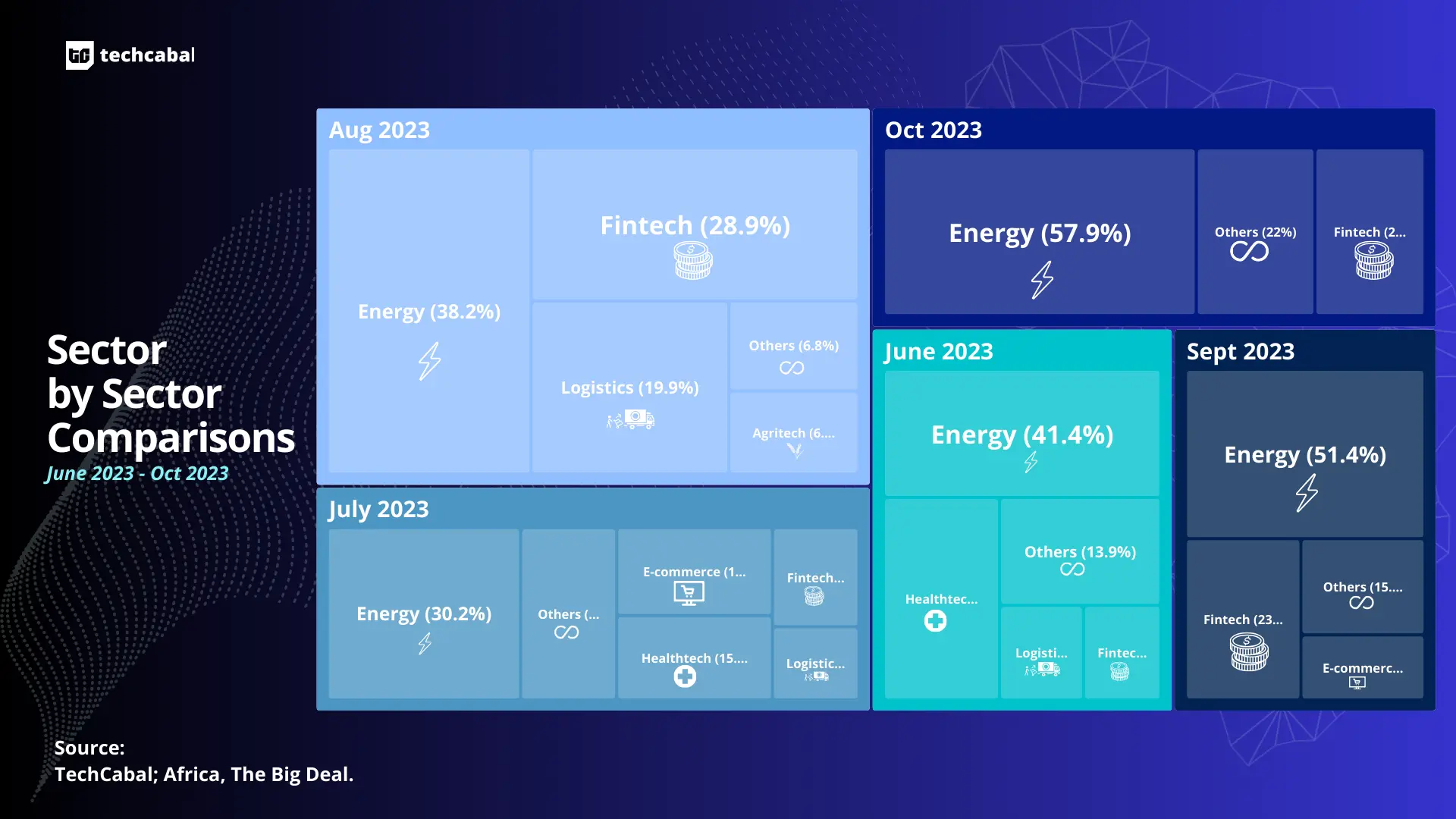

Nonetheless, an intriguing trend has surfaced: the energy sector has consistently secured the lion’s share of funding since June 2023, constituting a substantial 43.7% of the total capital raised between June 2023 and October 2023.

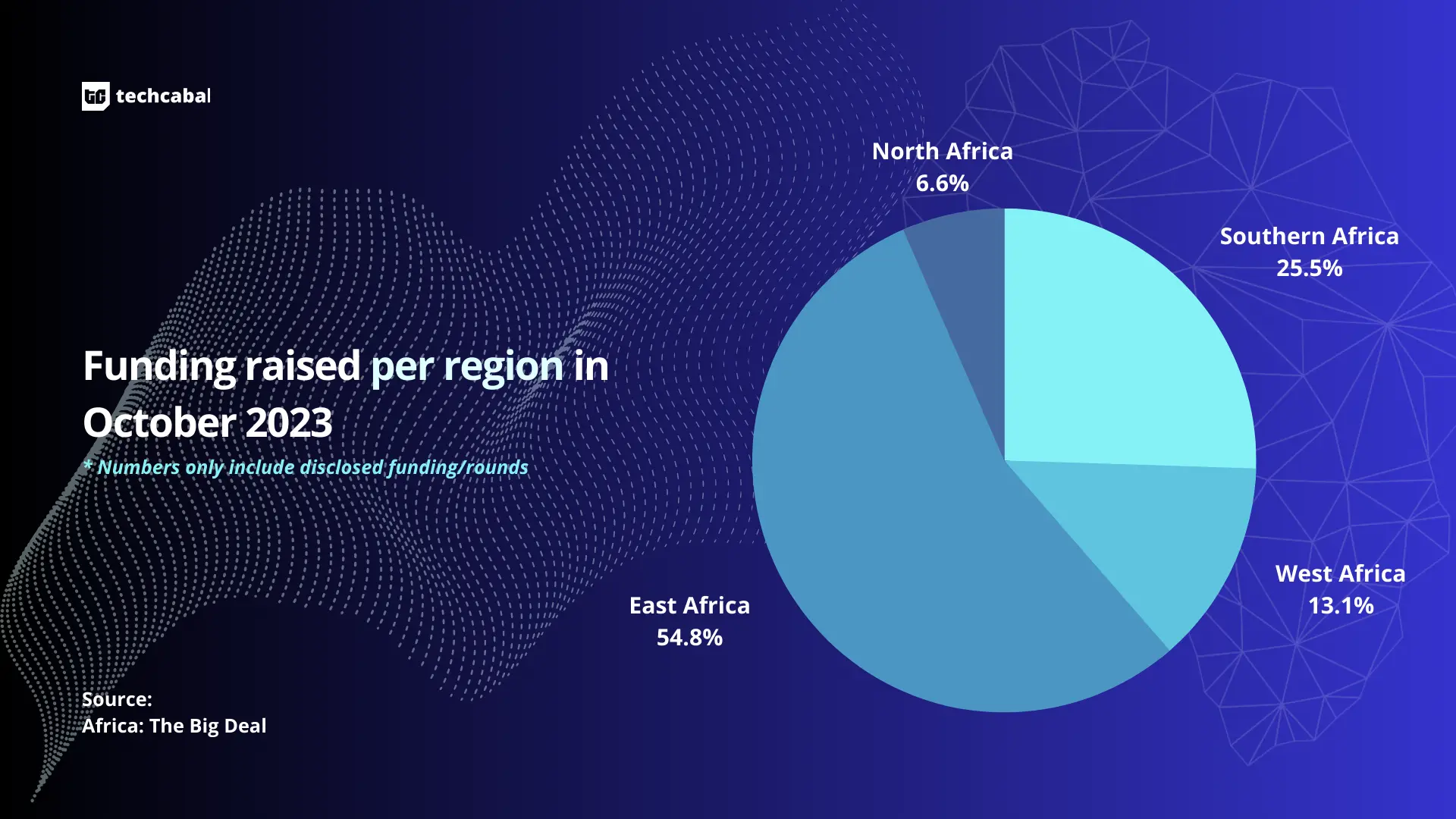

In October 2023, East African startups dominated the fundraising landscape, securing an impressive $79.1 million in investments. Southern African startups claimed the second spot with $36.8 million in capital raised, while West and North Africa followed closely, securing $18.9 million and $9.5 million, respectively.

The top 5 disclosed deals of the month are:

- Kenyan startup M-Kopa’s $65 million debt round from IFC.

- South African fintech Stitch’s $25 million Series A extension.

- Nigerian cleantech WATT’s $13 million raise.

- Kenyan agritech One Acre Fund’s $7.5 million raise.

- Kenyan healthtech Maisha Meds $5 million raise.

*Note: This data is inclusive only of funding deals announced in October 2023. Raises are often announced later than when the deals are actually made. This data also excludes estimated grants from accelerators.

Access payments with Moniepoint

Moniepoint has made it simple for your business to access payments while providing access to credit and other business tools. Open an account today here.

2. Startups: Patricia announces plans to kick off repayments

In October, crypto startup Patricia announced plans for the repayment of customer funds.

The startup, which suffered a $2 million hack in 2022, first offered users with assets stuck on the platform the chance to convert their funds into equity.

Patricia also announced that it would kick off repayment of customer funds in November. The startup had initially engaged DLM Trust, an SEC-licensed trust company, to handle the repayment, but DLM Trust pulled out after disagreements between the two parties.

3. Layoffs: Dash and WhereIsMyTransport shut down, and Majorel lays off 200 employees

Last month, Ghanaian fintech Dash announced its shutdown. Despite raising $86.1 million over five years, the company had to contend with mismanagement and financial misreporting, issues which the board of directors suspended CEO Prince Boakye Boampong for. Dash’s shutdown will see to the layoff of its 70+ employees.

South African startup Where Is My Transport also announced its shutdown in October after failing to raise new funding. The startup, which raised over $140 million since 2016, will lay off its 140 employees as it winds down.

Meanwhile, Majorel revealed that it would lay off 200 employees from its Kenyan subsidiary. Sources say the layoffs are due to the court case the content moderation firm is embroiled in with Meta and Sama.

4. M&As: Safaricom fully acquires M-Pesa Holdings, Writesea acquires CoverAI

October saw Safaricom complete its acquisition of M-Pesa Holding Company Limited from Vodafone BV. While the acquisition—which cost Safaricom just $1—was initially announced in May, the telecom had to get regulatory approvals before acquiring the corporate trustee company that holds all M-Pesa deposits.

Three-month-old Nigerian AI startup CoverAI was also acquired in October. Writesea, a US-based company which provides services to other companies to help them create and manage their online recruitment platforms, acquired the startup in a five-figure deal sources estimate to be $50,000.

5. Telecoms: Airtel Africa and MTN Nigeria record revenue increases

Right before the month wrapped up, Airtel Africa released its financial statement for the first nine months of the year. While the company recorded a 19.7% increase in revenue, it reportedly recorded $13 million after tax due to FX issues.

MTN’s Nigerian subsidiary also recorded a 21.76% increase in revenue. The telecoms financial statements show that while revenue grew by 21.76% to ₦1.77 trillion ( $2.1 billion) in the first nine months of 2023, profits declined by 45.22% to ₦148 billion ($188 million).

MTN Nigeria also received troubling news in October after a tax appeal tribunal ordered the telecoms to pay $72.6 million in back taxes for the years 2007–2017. The telecom, afterwards, revealed that it would be appealing the decision.

The evolution of agency banking in Africa

In this longform Decode Fintech piece, Paystack explores agent networks in Africa, how they converge with SMEs, and what the future of agency banking means for how money moves across the continent.

6. Economy: Nigeria announces plan to upskill 3 million people in tech

In October, Nigeria’s country’s minister of communications, innovation, and digital economy, Bosun Tijani, announced plans to equip 3 million early-to-mid-career Nigerians with tech skills by 2027 as part of the ministry’s strategic blueprint.

At TechCabal’s Moonshot Conference Tijani explained that 3MTT—short for the “3 Million Technical Talent (3MTT) Programme”—would be deployed with a 1–10–100% model that will 1% of the 3 million intended participants trained by February 2024.

7. Big Tech: Amazon confirms South Africa launch for 2024

E-commerce giant Amazon confirmed the launch of its online shopping service in South Africa in 2024. South Africa will become the second African country, after Egypt, to host a locally-dedicated Amazon shopping website.

The company’s launch in South Africa should have happened earlier, but it experienced a pushback after a Western Cape High Court ordered a stop to the construction of its African headquarters. While the decision has now been overturned, Amazon still has local retailing laws in South Africa to adhere to before it can kick off business in South Africa.

8. Companies: Eskom records R24 billion in losses for 2022/23 FY

Last month, South African power-generating company Eskom released its financial report for the year 2022/23.

The company suffered losses up to R24 billion ($1.2 billion), twice the R11 billion ($588 million) in losses it recorded for the 2021/22 financial year. The company blames its decreasing generating capacity as well as increased municipal debt for the loss.

CEO Calib Cassim, however, says that this is the last of such losses for Eskom.

9. Economy: South African Airways makes a comeback

South Africa’s national carrier made a comeback in October.

After a three-year hiatus stemming from a declaration of bankruptcy in 2029, South African Airways (SAA) relaunched in October and announced a new route connecting Cape Town and Johannesburg to São Paulo, the largest city in Brazil.

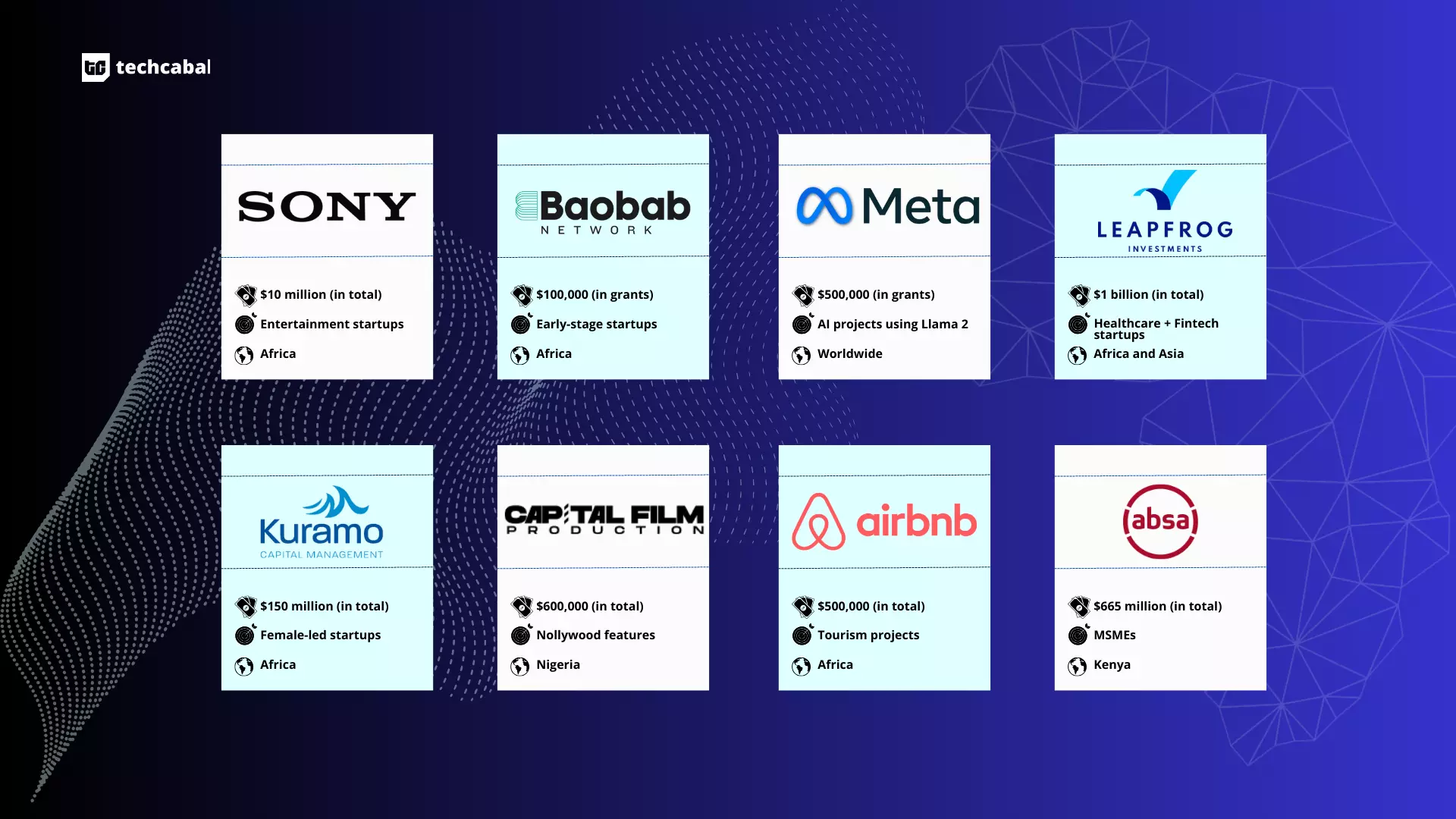

10. Investments: Eight organisations to invest in various sectors

While funding may be low at the moment, October saw several firms announce new funds which will be injected into several ventures across the continent.

Attend the KB4-CON Virtual Summit

KB4-CON EMEA is a free virtual event that focuses on cybersecurity and is designed for CISOs, security awareness, and cybersecurity professionals in Europe, the Middle East, and Africa. You can find the full agenda for the event here.

The World Wide Web3

Source:

Coin Name | Current Value | Day | Month |

|---|---|---|---|

| $34,818 | + 0.62% | + 25.02% | |

| $1,799 | -2.47% | + 8.29% | |

$40.31 | - 6.29% | + 70.41% | |

| $2.40 | - 7.75% | + 14.41% |

* Data as of 00:35 AM WAT, November 3, 2023.

Sourcing for institutional size liquidity for African currencies to G25 currencies including USD, GBP and EUR is a pain. Oneliquidity is Africa’s leading Liquidity provider; we provide the best prices and reliable liquidity for institutional players 24/7 via OTC, API and GUI. Onboard now and start getting quotes.

Written and Edited by -