- 👨🏿🚀TC Daily

- Posts

- African startups raised $3.2 billion in 2023

African startups raised $3.2 billion in 2023

Nigeria sits at the bottom with just $398.2 million while Kenya sits atop with $756.2 million

Happy New Year 🎉

Is this the year you keep all your New Year resolutions somewhere other than in your journals and Notion pages?

While we can’t answer that for you, we can definitely answer the big question: how much did African startups raise in 2023?

Welcome back to TC Daily folks! 🚀 You may not be able to read 50 books in 2024 or save $50 gazillion dollars by July, but a realistic goal you can achieve is to share TC Daily at least once a week. 😉

African startups raise $140.7 million in December 2023

In December 2023, 20 African startups secured $140.7 million in funding through 20 fully disclosed* investment rounds. This marks a 47.2% decline compared to the $266.2 million raised in November 2023.

💡 We didn’t have a funding roundup in November, so here’s a summary before we dive into December’s numbers. Twenty-six startups announced rounds in 2023’s penultimate month. Egyptian fintech MNT-Halan accounted for 48% of the month’s $266.2 million raise (it raised $130 million), and this put fintech as the sector leader for the month. While fintech-led, agritech saw an influx of deals in November with the sector having eight deals—the highest for a sector—worth $25.1 million.

While this trend did not continue into December, agritech did take the lead as the sector with the highest funding of the month with $50.2 million (35.86%) of the total funding raised in December. The other leading sectors for December 2023 are mobility with $37 million and e-commerce/retail with $21.5 million.

In December 2023, East African startups took back the baton from North African startups, securing an impressive $81.2 million in investments. West African startups claimed the second spot with $22.8 million in capital raised, while Southern and North African counterparts followed closely, securing $22.2 million and $14.5 million, respectively.

The top five disclosed deals of the month are:

- Kenyan agritech Twiga’s $35 million raise.

- Kenyan retail startup Copia Global’s $20 million Series C round.

- Rwandan logistics startup Ampersand’s $19.5 million raise.

- South African deep tech startup Sportable’s $15 million Series A.

- Ghanaian agritech Koa Impact’s $15 million Series B.

*Note: This data is inclusive only of funding deals announced in December 2023. Raises are often announced later than when the deals are made. This data also excludes estimates, grants from accelerators, and confidential reports that TechCabal cannot independently verify.

Access payments with Moniepoint

Moniepoint has made it simple for your business to access payments while providing access to credit and other business tools. Open an account today here.

African startups raised $3.2 billion in 2023

Now that December is, unfortunately, out of the way, let’s take a trip down funding lane to see how the African tech ecosystem did in 2023.

Per our friends at Africa: The Big Deal, a curated funding database, African startups raised $3.4 billion in 2023. At TechCabal, our number is at $3.2 billion because we define funding a bit differently. What’s important to note is that we’ve left out undisclosed funding and estimates in this. The ecosystem experienced a quarter-on-quarter decline from Q1 2023 when $1.2 billion was raised, to Q2 with $877.8 million and Q3 with $492.7 million. There was a slight uptick in Q4 which saw $551.2 million in raises.

At $3.2 billion—or even $3.4 billion, what’s clear is that 2023 marks the lowest funding for African startups since 2020’s $2.1 billion. It’s a 36% decline from 2022’s ~$5 billion total.

The good news is, much like the plight of abandoned New Year resolutions, the decline in venture funding isn’t just an African affair—it’s a worldwide trend. Per Crunchbase, the once-mighty flow of VC funding has been on a steady downhill slide since January 2022, which was the last time global tech funding exceeded $60 billion per month. January 2023 marked a descent to just under $40 billion, which, compared to the modest $19.2 million raised in November 2023, almost feels like a glorious beacon of hope.

The bad news—or as seers want us to believe—it’s only going to get steeper in 2024 with several forecasts finding investors being more cautious on whose mouth they put their monies. At least 10 of the 23 tech leaders we spoke to for our 2023 Wrapped article said as much, noting that 2024 will see more frugal investors, leaner startups and tougher economies…at least in the first half. Investors at global funds like Thomvest Ventures and QED who spoke to Business Insider also gave similar predictions.

It might not always be sunny in tech, but there’s a silicon lining to this gloomy news. To quote Healthcap founder Ola Brown, “Some of the largest tech companies in the world, such as Apple, WhatsApp, Slack, Microsoft, Amazon, and Uber, were born during “venture capital winters”. Funding winters push companies towards sustainable growth and innovation. 🫶🏾

How did the Big 4 perform?🌍

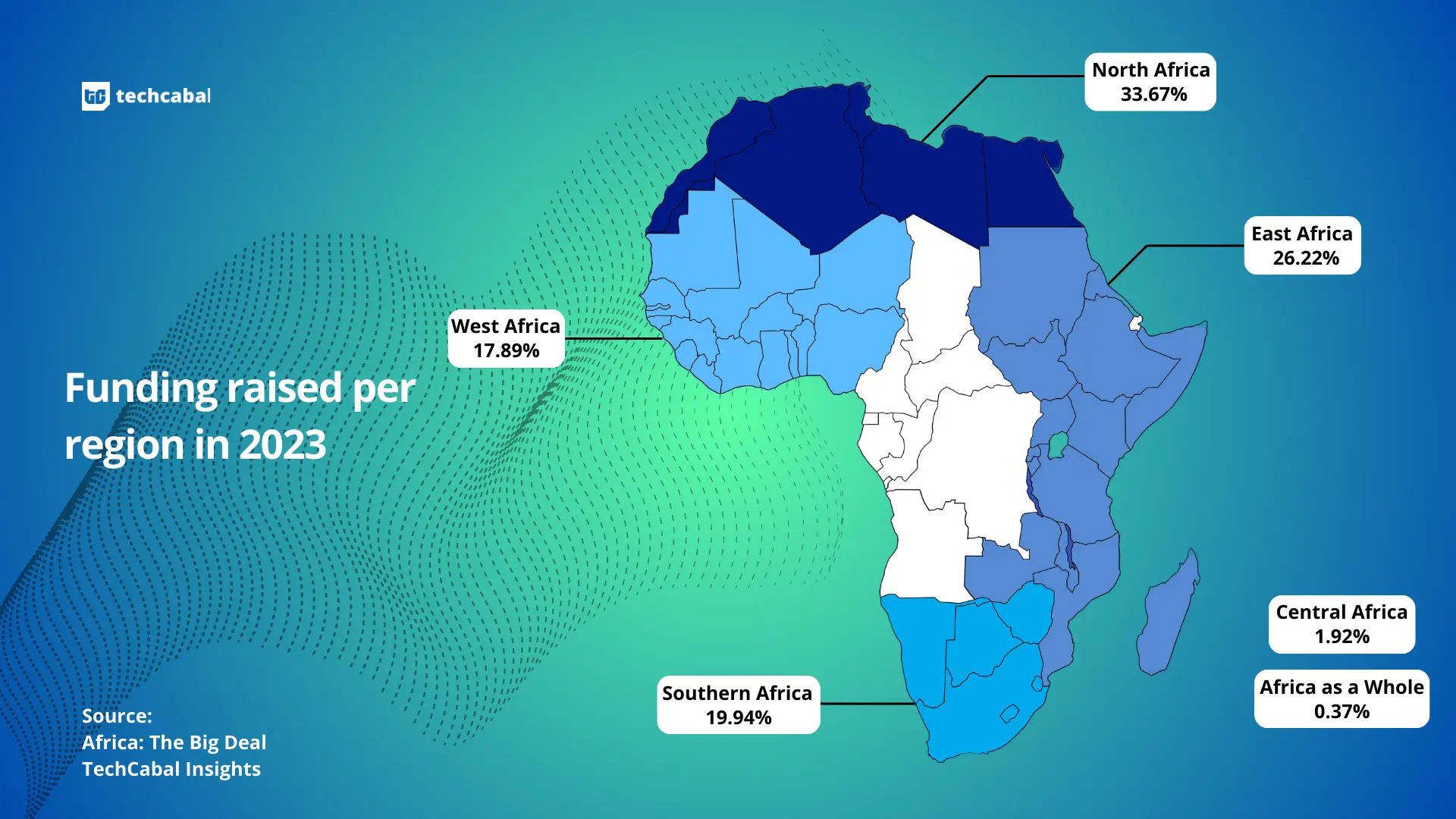

Region-wise, North African startups led the way in 2023 with $1.074 billion in raises. This, of course, was pushed by Instadeep’s $680 million acquisition led by BioNTech.

Meanwhile, across Africa’s top quartet, funding streams shrunk as harsh economies surfaced. The Big 4—Nigeria, Egypt, Kenya and South Africa—used to refer to the four countries that receive the most attention from investors, raised $2.37 billion—about 74.9%— in total. Surprisingly, Nigeria sits at the bottom of the ladder this year with just $398.2 million while Kenya sits atop with $756.2 million.

This is a major decline (66% 📉 ) for the West African giant which previously raised over $1 billion per year since 2021.

Secure payment gateway for your business

Fincra payment gateway enables you to easily collect Naira payments as a business; you can collect payments in minutes through cards, bank transfers and PayAttitude. Create a free account and start collecting NGN payments with Fincra.

Big Energy ⚡️

While Nigeria’s tech ecosystem might have not been fully charged in 2023, the continent’s energy—or cleantech—sector certainly was.

Don’t get it wrong, fintech is still king, accounting for about 45% of the total funding. But energy-led startups brought power to the industry, and new meaning to the phrase, more passion, more passion, more energy, more energy, more footwork…

Between June 2023 and October 2023, the energy sector continuously dominated funding, with a significant 43.7% of the total capital raised during that period.

In April and May, energy startups were the second-highest performing sectors after fintech. That’s seven out of twelve months with energy in the leaderboard for the African tech ecosystem. The biggest deals from this sector are led by Kenyan cleantechs with SunKing’s $130 million securisation deal and Wetility’s $48 million mezzanine round, and Nuru’s—a DRC startup—$40 million Series B round.

Who brought the moneybags out this year?💰

In 2023, there was a lot of talk about how much funding startups raised or didn’t raise, but so little about the moneybags behind them. But hey, investors are people too, right? If you were wondering which new VC firms popped up last year and which old ones raised new funds? Here’s what you need to know.

Exciting closes: Partech Africa took the crown with the close of its $263 million Africa Fund II, doubling their investment caps. Knife Capital also announced the close of its $50 million growth fund in the same month—August. And the party kept going with P1 Ventures, Verod-Kepple Africa Ventures, and others raising 8 figures in first closes, gearing to raise even more this year.

The VC scene went green: Specialised climate funds blossomed across the continent. Novastar led the charge with its $200 million Africa People + Planet Fund, while E3 Capital and Lion's Head joined forces with their $100 million Low Carbon Economy Fund. AfricaGoGreen added another $47 million to the mix, and local players like Echo VC chipped in with green-focused funds. Grovest, Sasol's Venture, Gaia Energy, and others also announced climate-focused funds.

New kids on the block: A number of fresh faces made big splashes. Accelerator Norrsken22 stormed into the year with a $250 million debut fund, while Black Ostrich Ventures and Seedstars Capital joined the continent's party with their maiden Africa-focused funds. Even established players like Emkan Capital debuted a new $31 million fund for early-stage startups. Equator's $40 million maiden fund also came in followed months later by Aduna Capital's $20 million fund which focuses on under-funded regions like Northern Nigeria.

Not so new kids: Established VCs doubled down in Q2: Ajim Capital, Oui Capital, Goodwell Investments and Alitheia Capital closed new funds, while Saviu Ventures neared its €32.8 million ($35 million) goal. Flat6Labs announced a $95 million seed fund to expand its investments to Nigeria, Ghana, Kenya, Morocco, and Senegal, and TLcom set sights on a $150–$180 million fund for the continent.

We also saw angels: Right at the start of 2023, Kazana Fund launched Angel Syndicate with over 190 investors in the network. The year also saw continued participation from angel investors with big names like Paystack's Shola Akinlade and Flutterwave’s Olugbenga Agboola making the list. Even footballers invested in francophone startups like StarNews Mobile. Companies joined the party too, with inDrive's $100 million fund and Safaricom's planned venture capital subsidiaries, showcasing the growing appetite for Africa's startup scene.

But what do the numbers say? Per the 2023 African Private Capital Industry Survey,

there was less investment in VC firms last year. However, even with the decline in the first three quarters of 2023 compared to the last two years, investment levels remain significantly higher than pre-pandemic levels. Overall, it was a mixed year for African VC, but the future looks bright. With more investors coming in and more startups emerging, the African VC ecosystem is poised for continued growth.

P.S.: If you want recaps of the biggest stories from each month in 2023, check out our monthly African Tech Roundups here.

The World Wide Web3

Source:

Coin Name | Current Value | Day | Month |

|---|---|---|---|

| $45,343 | - 0.17% | + 14.97% | |

| $2,379 | - 0.05% | + 10.01% | |

$0.73 | - 3.20% | + 148.65% | |

| $109.55 | - 3.88% | + 70.79% |

* Data as of 08:30 AM WAT, January 3, 2024. (We worked through the night, don't judge)

Effortlessly make global settlements in over 30 currencies across 120+ countries spanning four continents, delivering cost-effective and reliable solutions to your clients, suppliers, and customers. Get started today.

- Deji Alli ARM Young Talent Award (DAAYTA) 2024 for Innovative Nigerian startups (₦12,000,000 in funding) is open for applications. DAAYTA is an ARM initiative, in partnership with TechnoVision’s TVC Labs, that aims at providing young Nigerians with an opportunity to develop innovative startup ventures that add economic value to Nigeria. Apply by January 16.

- Applications are open for the World Press Photo Contest 2024 for Photographers Worldwide (5,000 euros cash prize). The Contest recognises and celebrates the best photojournalism and documentary photography produced over the last year, selected by an international independent jury. Apply by January 11, 2024.

- Applications are open for the Mastercard Foundations Scholars Program 2023/2024 at the Carnegie Melon University Africa. The programme provides generous financial, social, and academic support for students whose talents and promise exceed their financial resources. Apply by January 15, 2024.

- Applications are open for the Next Generation Social Sciences in Africa: Doctoral Dissertation Research fellowship 2024 (up to $15,000). The Social Science Research Council offers fellowships to support the completion of doctoral degrees and to promote next-generation social science research in Ghana, Kenya, Nigeria, South Africa, Tanzania and Uganda. The fellowships support dissertation research on peace, security, and development topics. Apply by February 11, 2024.

What else is happening in tech?

Written and Edited by: Timi Odueso, Ngozi Chukwu & Faith Omoniyi

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- In a Giffy: business decisions powered by data-driven insights and analysis you can trust.

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.