- 👨🏿🚀TC Daily

- Posts

- Chery EVs hit Kenya

Chery EVs hit Kenya

Special Number: MTN made $91.6M in 9 months.

Good morning ☀️

This week, all eyes are on the USDX stablecoin after a dramatic depegging wiped 40% of its value and shook investor confidence. It is a reminder of the risks posed by algorithmic stablecoins backed by invisible code and smart contracts rather than fiat-collateralised assets.

Lately, the stablecoin space has been commoditised. Everyone wants to launch the next coin because if usage scales, it is a profitable business. But the rush cannot last forever and soon the weaker projects will be exposed. USDX is a warning shot and a chance to separate hype from real stablecoin opportunity.

Elsewhere in tech, keep an eye on Gozem expanding to Brazzaville, Congo, and Anda, an Angolan mobility startup, raising a $3.4 million seed from Breega and Speedinvest. These are two startup stories to watch in the coming months.

Let's get into today's dispatch.

funding

First Circle Capital secures $6M investment to back early-stage fintechs across Africa

First Circle Capital, a venture capital firm based in Morocco and Uganda, has raised an additional $6 million from the International Finance Corporation (IFC), part of the World Bank Group, to invest in early-stage fintechs across Africa.

Why is this important? The firm is creating a $30 million fund to back pre-seed and seed companies working on payments, lending systems, credit infrastructure, and digital finance tools. First Circle Capital has also secured $2 million from the Women Entrepreneurs Finance Initiative (We-Fi) and $3 million from the Dutch Good Growth Fund, alongside support from regional development institutions and private tech operators, including FSD Africa, the Micro, Small, and Medium Enterprise Development Agency (MSMEDA), and Axian Group.

Have there been other funds? The IFC has been steadily building a portfolio of Africa-focused venture and growth funds, backing managers that invest in technology, financial services, and small business enablement. Its commitments include early-stage vehicles like Ventures Platform’s Pan-African Fund II and P1 Ventures, both focusing on seed and pre-Series A companies across markets such as Nigeria, Kenya, Egypt, and francophone Africa.

In 2023, the IFC made a $75 million equity investment in Apis Growth Markets Fund III, a private equity firm, to focus on fast-growing companies using technological innovations to expand access to financial services across Africa, South Asia, and Southeast Asia.

Why this matters: Recent funding data shows a mixed but improving picture for African startups. Although the first half of 2025 recorded a 78% rebound in funding as compared to the previous year, the IFC notes that there was a sharp fall in VC funding post-2022, with Africa also impacted. The rebound in H1 2025 and IFC’s new investment suggest renewed investor interest in the ecosystem.

eCommerce Without Borders: Get Paid Faster Worldwide

Whether you sell in Lagos or Nairobi, customers want local ways to pay. Let shoppers check out in their local currency, using cards, bank transfers, or mobile money. Set up seamless payments for your global online store with Fincra today.

mobility

China's EV maker Chery launches in Kenya

Chery, a Chinese electric vehicle (EV) manufacturer, has launched in Kenya, bringing its first lineup of affordable electric and hybrid SUVs to the market through a partnership with Caetano Kenya.

On Friday, the automaker debuted new EVs—the Tiggo 4 Pro, Tiggo 7 Pro, and Tiggo 8 Pro Max—designed for Kenya’s growing class of tech-savvy, style-conscious drivers. The newly-shipped cars cost at least KES3.9 million ($30,200) and come with seven-year, 200,000km range warranties. Chery is betting that Kenya’s middle class, which prefers used cars to brand-new cars—due to cost—will be eager to test the road with these new “low-cost” electric SUVs.

Yet, the big question is whether these vehicles are truly affordable. Kenya’s car market is still dominated by second-hand imports, which is growing at 3.21% annually and predicted to reach $1.5 billion in 2030. For global automakers, that represents a challenge and an opportunity. Their new playbook is to win over buyers who have long relied on used cars by offering vehicles that are modern, efficient, and cheaper to run.

State of play: Chery’s strategy includes a plan to begin local assembly in 2026, a move that could help lower prices, create jobs, and transfer manufacturing skills. It’s also a smart alignment with Kenya’s “Buy Kenya, Build Kenya” industrial push.

Africa’s growing EV story is gaining momentum beyond Nairobi. South Africa remains the region’s biggest draw for electric car-makers because of its established manufacturing base and access to battery minerals like platinum and manganese. China’s BYD and Leapmotor are already active there. Nigeria is also attracting a different kind of suitor: Russian automaker AvtoVAZ, which plans to produce compressed natural gas (CNG) vehicles as part of a broader clean transport push.

Zoom out: With a global mobility manufacturing wave now reaching Africa, the continent is no longer an afterthought for automakers. Yet cost and consumer trust will remain the key factors determining who builds staying power and who fades quietly into the background in the coming years.

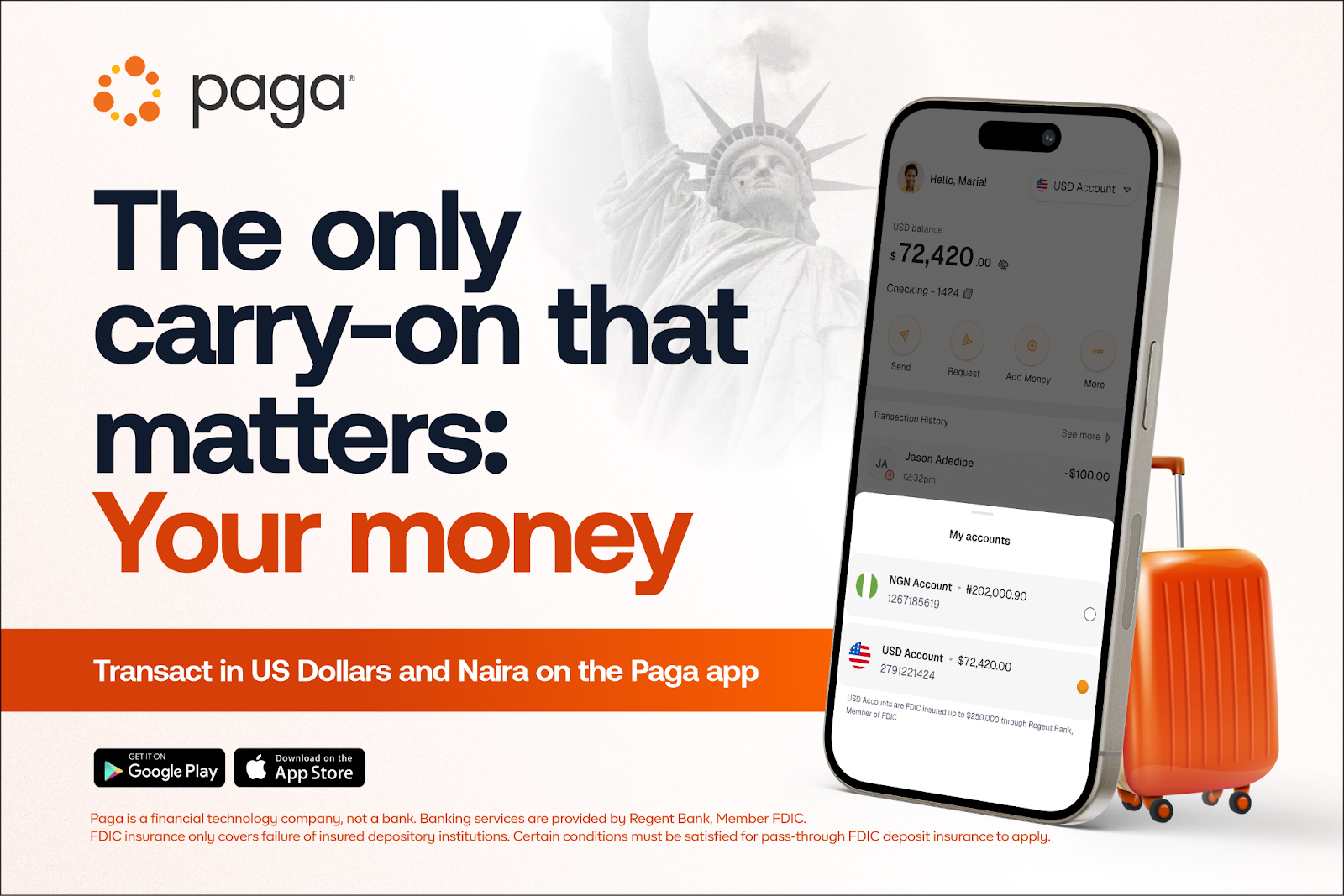

Paga is in USA

Paga is live in the U.S.! Whether you're in Lagos or Atlanta, manage your money effortlessly. Send, Pay, and Bank in both Naira and US Dollars, all with Paga. Learn more.

policy

Nigeria moves to unlock digital trade and services exports

Nigeria is building the rules and structures needed for citizens to earn from ideas, data, design, software, and creativity.

Here’s what happened: Nigeria has approved a set of new policies that push the economy toward digital trade, intellectual property protection, and services export growth. Three key reforms were cleared: a national framework to protect and commercialise intellectual property, the ratification of the African Continental Free Trade Area (AfCFTA) Protocol on Digital Trade that establishes the first continent-wide legal framework for e-commerce, data, governance, cybersecurity, and digital consumer protection, and a coordinated system for growing Nigeria’s services exports, led by the National Talent Export Programme (NATEP).

Why it matters: By ratifying the AfCFTA Digital Trade Protocol, adopted by the African Union in February 2025, Nigeria now has the power to help shape continental standards for e-commerce, digital payments, data sharing, and online consumer protection. This is critical for businesses selling across African markets. The reforms make participation in Africa’s online marketplace simpler and more predictable.

Vision 2030: The reforms are part of a longer-term vision to transform Nigeria into a continental hub for digital services and creative industries. By 2030, the government aims to create a million jobs, increase GDP contributions from digital and service exports of up to $10 billion, train 10 million Nigerians for the global digital economy, and attract $15 billion in investments across the digital and creative industries.

Paystack introduces Pay with Pesalink in Kenya!

With Pesalink and Paystack, businesses in Kenya can now get paid directly from customer bank accounts. Learn more here 👉

Mobile Money

M-PESA plugs into Ethiopian banks—but can distribution help it win the market?

When Safaricom, Kenya’s largest telecom company and owner of M-PESA, expanded into Ethiopia three years ago, it made one key bet: that the same mobile money revolution it built at home could take hold in Africa’s second most populous nation. That bet is finally paying off.

Safaricom’s latest half-year earnings show profit after tax jumped 52% to KES 42.8 billion ($331 million), powered by steady M-PESA growth and a sharp reduction in losses from its Ethiopian unit. Losses fell to KES 13.3 billion ($103 million) from KES 28.2 billion ($218 million) a year earlier, as Safaricom Ethiopia nearly doubled its subscriber base to 11.1 million.

The momentum is getting a further lift from a major milestone: On October 27, M-PESA Ethiopia integrated with EthSwitch, the national payment network that links 15 commercial banks. The move means M-PESA users can now send money directly to bank accounts and receive funds, a crucial step toward real financial interoperability in a market long dominated by Ethio Telecom.

Ethio Telecom, the state-backed incumbent, is not backing down. Its own mobile money service, Telebirr, is evolving into a super-app that blends payments, banking, and other digital services in a single platform. It sets the stage for a fierce battle between an entrenched local powerhouse and a regional giant betting on its fintech expertise to win hearts and wallets.

The big picture: For Safaricom, Ethiopia’s 120 million people remain the big prize. With usage growing, regulation easing, and the ecosystem opening up, the company is digging in for the long run. As CEO Peter Ndegwa put it, “Ethiopia is full of promise.” The real test is whether M-PESA can recreate its Kenyan success story in this new and complex market.

PalmPay is Showing Nigerians the Smarter Way to Bank

Millions are up for grabs in the PalmPay & Jumia Black Friday campaign. Shop on Jumia and get up to ₦2,000 cashback when you pay with PalmPay on the Jumia app. Spend N5,000 to earn ₦1,000 or ₦20,000 to earn ₦2,000. Offer active every Wednesday to Friday, from November 7 to December 1, 2025. Smart shopping meets smarter banking. T&Cs apply. Learn more.

SPECIAL NUMBER

$91.64 million

₦131.62 billion ($91.64 million), that is how much MTN made in the first nine months of 2025. But mostly on the back of airtime lending (Xtratime).

Core fintech revenue (excluding Xtratime) stood at ₦6.8 billion ($4.73 million), a 142.86% jump from ₦2.8 billion ($1.95 million) in the previous year. MTN’s fintech dream is still largely powered by its core telecom offering, airtime.

Learn more about businesses and their many money-making schemes in this week’s Follow The Money column. Every Monday, TechCabal unpacks the most important earnings, business models, and growth strategies shaping the future of Africa’s tech ecosystem.

CRYPTO TRACKER

The World Wide Web3

Source:

Coin Name | Current Value | Day | Month |

|---|---|---|---|

| $103,395 | + 2.08% | - 7.43% | |

| $3,562 | + 4.77% | - 7.31% | |

| $2.36 | + 3.38% | - 0.18% | |

| $164.28 | + 3.96% | - 12.89% |

* Data as of 01.02 AM WAT, November 10, 2025.

Job Openings

- Busha — Business Development Manager, Reconciliation and Settlement Analyst — Hybrid (Lagos, Nigeria)

- Trust Wallet — Data Scientist, iOS Engineer (Web3), Growth and Performance Marketing Analyst — Remote

- Paystack — Performance Marketing Specialist — Remote (Lagos, Nigeria)

- Amazon Kuiper — Senior Tech Business Development Manager, Kuiper Site Acquisition, Africa & Middle East — South Africa

- Flutterwave — Treasurer, Africa — Lagos, Nigeria

Written by: Emmanuel Nwosu and Opeyemi Kareem

Edited by: Ganiu Oloruntade

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Francophone Weekly by TechCabal: insider insights and analysis of Francophone's tech ecosystem.

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

How did you find today's edition of #TCDaily? |