- 👨🏿🚀TC Daily

- Posts

- Cut rates or pay up

Cut rates or pay up

Inside: Stanbic IBTC has a new CEO.

TGIF. ☀️

Let's dive in.

Features

Quick Fire 🔥 with Greg Cooke

Greg Cooke is a South African entrepreneur currently based in the UK, leading Growth and Product at Rafiki, a startup he co-founded after several years in performance and growth marketing. At Rafiki, he is building software that simplifies cross-border subcontracting by using stablecoin rails and multi-party invoicing.

Backed by the Baobab Network, Jobtech Alliance, CVLabs, and founder-angel investors, Rafiki is currently in private beta and opening its pre-seed round as it prepares for a wider rollout.

- Explain what you do to a 5-year-old.

I make it easy for adults to work together.

Imagine you want some lemonade. To make lemonade, you need lemons, some water, some sugar, and a cup. I built a special lemonade stand, called Rafiki, which makes it easy for the lemon person, the water person, the sugar person, and the cup person to work together to make tasty lemonade.

- What’s the hardest part about paying people across borders?

Payments are still slow, expensive, and fragmented—often taking days to clear, cutting off as much as 5% in fees, and requiring one-by-one transactions. Rafiki fixes this by collapsing multiple bills into one workflow, enabling instant stablecoin settlement, and making off-ramping seamless across regions.

- If Rafiki were a superhero, what power would it have?

In many ways, Rafiki already is a superhero. As the confidante to Mufasa in The Lion King, Rafiki possesses powers of immense wisdom, spiritual guidance, and foresight, to unite and guide those around him. Rafiki is all about collaboration, harmony, and the greater good.

- What’s one story from your early days that made you realise Africa’s subcontracting problem is massive?

Our ‘aha’ moment came last year on a project for a German client. We pulled together five freelancers and a small agency across South Africa, Kenya, Nigeria, and the UK. Paying everyone was painfully manual, so we tried freelancer platforms, payroll tools, and fintechs. None worked; they were all built for 1:1 engagements, not real collaboration.

As we spoke with senior freelancers and agency founders, two things became clear: subcontracting and collaboration were on the rise, and the pain points we faced were the same ones everyone else was struggling with.

- What’s the biggest misconception people have about multi-party subcontracting?

The biggest misconception about multi-party subcontracting is that it’s a cost-cutting hack. That view of chasing cheap rates and sacrificing quality completely misses the point.

Done right, subcontracting is about collective value creation. Think of construction: a beautiful home isn’t built by one person, but by contractors orchestrating plumbers, painters, plasterers, and more. The same is true for strategy, design, marketing, and tech. Specialists working in harmony create results that no solo provider can.

That’s what Rafiki’s Talent Services and Rafiki OS enable: orchestrated collaboration, not exploitation. If you still think only agencies or traditional teams can deliver, you are stuck in outdated models.

- If you could wave a magic wand and fix one thing in Africa’s freelance economy, what would it be?

Independents and micro-agencies are the fastest-growing yet most overlooked part of Africa’s creative and professional economy, lacking security, benefits, and quality financial services. Closing that gap and enabling collaboration can de-risk their work, unlock bigger clients, and make flexible careers sustainable at scale.

- What excites you most about the future of fractional collaboration in Africa?

It has the potential to unblock and unlock a significant proportion of value creation. While it’s nascent, the fractional economy across Africa has immense potential to become a leading powerhouse globally.

eCommerce Without Borders: Get Paid Faster Worldwide

Whether you sell in Lagos or Nairobi, customers want local ways to pay. Let shoppers check out in their local currency, using cards, bank transfers, or mobile money. Set up seamless payments for your global online store with Fincra today.

Banking

CBK blows hot (again) about banks refusing to lower lending rates

Kenyan banks are in the crosshairs of their regulator, the Central Bank of Kenya (CBK). The regulator has warned lenders that it will begin to impose daily penalties on banks failing to cut loan pricing in line with its policy.

CBK just wants to make credit more accessible. This warning comes after the regulator cut the Central Bank Rate (CBR) seven consecutive times since June 2024, easing it from 13% to 9.5%. Yet, while a few banks cut their lending rates in August according to the CBK directive, eight banks opted to push lending costs higher.

DIB Bank Kenya, Consolidated Bank of Kenya, Co-operative Bank of Kenya, Kingdom Bank, UBA Kenya Bank, Diamond Trust Bank Kenya, Premier Bank Kenya, and Access Bank Kenya are among the defaulting banks.

These banks cite expensive deposits and market pressures as the reason for their defiance. However, the CBK has expressed no tolerance for banks that fail to comply. The regulator can impose a daily penalty of KES 100,000 ($773) per violation on lenders.

Catch up: CBK recently introduced a revised risk-based model pegging lending rates to a new interbank benchmark for transparency. Under this model, interest on new loans will be tied to the Kenya Shilling Overnight Interbank Average (KESONIA), a renamed version of the overnight rate that reflects actual lending rates between banks.

CBK flexed its muscles earlier in February, threatening daily fines for sluggish compliance. Maybe this time, a tougher stance—and actual fining of non-compliant lenders—could be in the cards, or the CBK risks being perceived as a regulator that barks but won't bite.

Paga is in USA

Big news! Paga is now live in the United States, with digital banking services designed for Africa’s diaspora! Eligible users can send, pay, and bank in US Dollars & Naira, safe, regulated, and borderless. Learn more.

Banking

Stanbic IBTC appoints Chukwuma Nwokocha as new CEO

Stanbic IBTC Holdings Plc, a Nigerian financial service holding company, is closing 2025 on a strong footing. After posting nearly 66% in pre-tax profit for H1 2025 in September, the lender has now pushed for another level of growth with the appointment of Chukwuma Nwokocha as its new Group CEO, effective October 2.

Stanbic had an impressive H1. Its pre-tax profit grew to $168 million, from $98 million recorded year-on-year.

Between the lines: Nwokocha will take over from Adekunle Adedeji, who returns to his role as Executive Director and Chief Finance and Value Management Officer.

Stanbic IBTC also confirmed that it has completed its rights issue ahead of the Central Bank of Nigeria (CBN)’s March 2026 recapitalisation deadline. It reported an oversubscribed ₦181.4 billion ($123 million) raise from Nigeria's capital market.

Nwokocha served as the Chief Executive of Standard Bank SA (the Mozambican subsidiary, after joining the group in 2005 as Chief Financial Officer. He has held several Chief Executive and Board-level roles in leading financial institutions.

Zoom out: As CEO, Nwokocha will immediately get thrown into Stanbic’s ambition to meet the capital requirement and continue to steer the bank to record profits.

Connect Paystack to the world’s best tools!

With the Paystack Integrations Directory, connect to 60+ powerful apps to streamline your business. Learn more here →

Insights

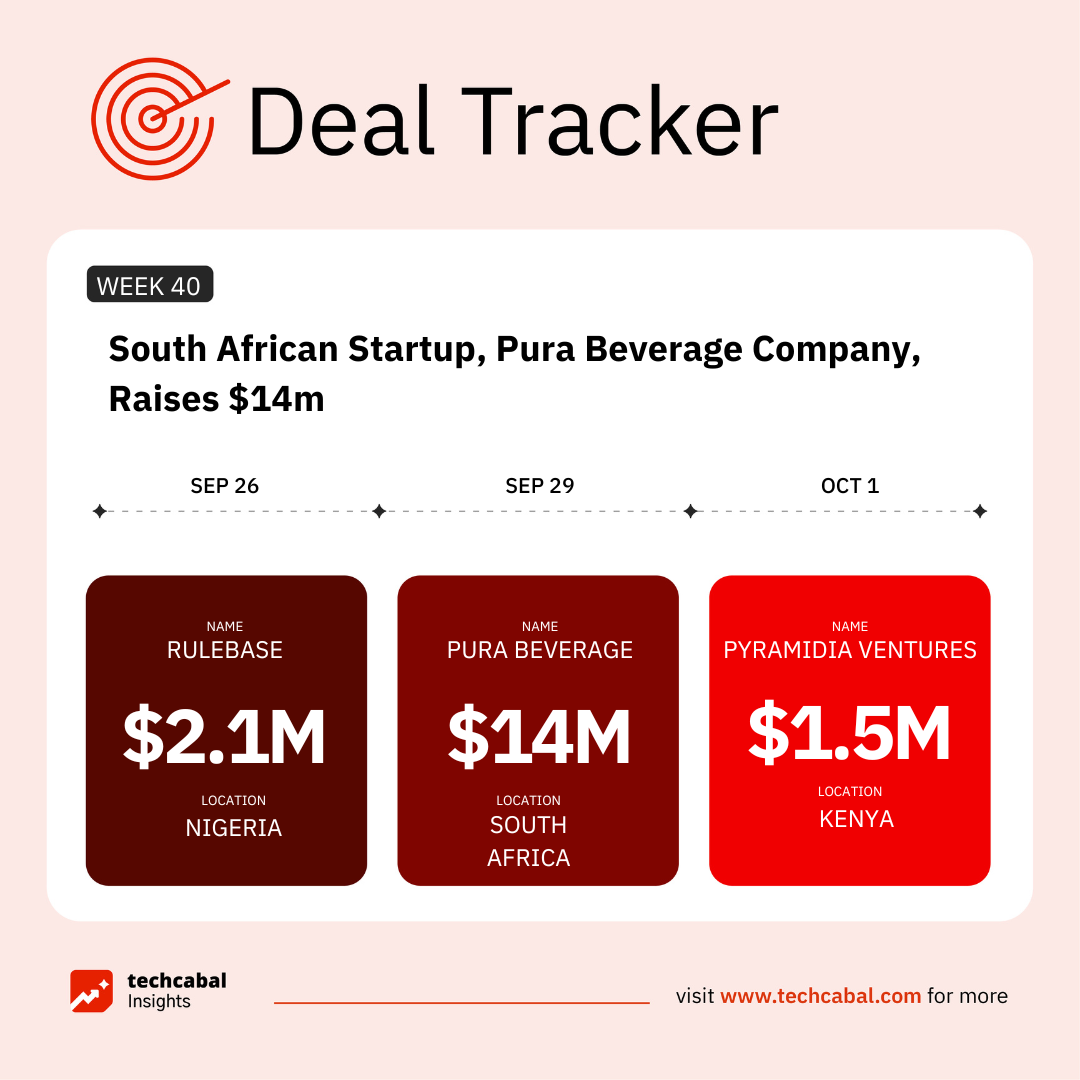

Funding Tracker

This week, Pura Beverage Company, a South Africa- and UK-headquartered disruptor in the global drinks industry, secured a $14 million investment from an undisclosed global investment firm. (Sep 29)

Here are the other deals for the week:

- Rulebase, a Nigerian-founded startup that tackles compliance and back-office automation in financial services, raised a $2.1 million pre-seed round led by Bowery Capital, with participation from Y Combinator, Commerce Ventures, Transpose Platform VC, and several angel investors. (Sep 26)

- Kenyan agri-tech venture studio Pyramidia Ventures raised $1.5 million in funding. The funding comes from Dutch impact investor Triple Jump, consisting of a $1.3 million funding commitment and $200,000 for technical assistance and business development support, provided through the Dutch Good Growth Fund (DGGF). (Oct 1)

- OKO, a Malian climate and agritech startup, raised an undisclosed funding round led by Catalyst Funding and two existing investors.

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements. Before you go,can technology transform Africa’s food security crisis? Find out here.

CRYPTO TRACKER

The World Wide Web3

Source:

Coin Name | Current Value | Day | Month |

|---|---|---|---|

| $120,032 | + 1.25% | + 8.26% | |

| $4,480 | + 1.91% | + 3.53% | |

| $48.03 | + 0.04% | + 0.04% | |

| $230.88 | + 2.68% | + 10.22% |

* Data as of 06.45 AM WAT, October 3, 2025.

🚨 Flash Sale: 25% Off Moonshot Tickets 🚨

For a limited time only, you can save your seat at Africa’s biggest tech gathering with an exclusive 25% discount. On October 15 & 16, the Eko Convention Centre in Lagos will host founders, investors, policymakers, creatives, and operators shaping Africa’s innovation economy. Moonshot 2025 will feature deal rooms, investor lounges, immersive exhibitions, and the TC Startup Battlefield. Moonshot 2025 is designed for real connections and lasting impact. This offer ends soon.

🎟️ Secure 25% off your Moonshot ticket now. Get tickets.

Events

- Bigger, bolder, and more intentional. Following the resounding success of the inaugural summit in 2024, Growth Padi is thrilled to announce Growth Africa Summit 2025 (GAS 2.0) with the trailblazing theme: “Redefining the Growth Playbook.” Set against the backdrop of a fast-evolving entrepreneurial landscape, this year’s summit will challenge outdated strategies and usher in a new wave of radical, resilient, and relevant growth models tailored for African businesses. Register to attend by November 1.

Written by: Emmanuel Nwosu, Opeyemi Kareem, and Stephen Agwaibor

Edited by: Ganiu Oloruntade

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- TC Scoops: breaking news from TechCabal

- TNW: Francophone Africa: insider insights and analysis of Francophone's tech ecosystem

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

How did you find today's edition of #TCDaily? |