- 👨🏿🚀TC Daily

- Posts

- FairMoney, more money

FairMoney, more money

Inside: MTN eyes second public offer

TGIF! ☀️

Good morning. We hope you have an A+ day (and weekend). But if not, just know you’re still doing better than the naira. The currency’s been slipping faster than your phone on a rainy Lagos danfo seat—and at this point, $1 is moving like it’s trying to break its own personal best.

We bring you news from our sister publication Zikoko: Hertitude is a safe space for women to celebrate, connect, and dance the night away after the stress of Q1 2025. Get tickets for yourself and loved ones at 20% off when you use the code TECHSIS25.

Be there.

Fintech

FairMoney grew revenue to $78 million in 2024 on deposit-led lending

2024 was a great year for FairMoney.

The fintech remained profitable, grew its revenue, and increased its profit to ₦7.9 billion ($5 million) from ₦780 million ($490,000).

As revenue grew, FairMoney also improved its profit margin, increasing from 1% in 2023 to 4.79% in 2024. The fintech keeps roughly ₦6.5 from every ₦100 it makes.

However, all this growth was only possible because the fintech stopped relying on borrowing money from other sources like commercial papers to finance its loan book. It now uses customer deposits—which grew significantly from ₦2.9 billion ($1.9 million) to ₦72.9 billion ($46 million)—to finance over 55% of its loan book, thereby increasing its margins and profitability.

FairMoney makes money from lending to Nigerians. It offers quick loans, and within minutes, its customers can start spending money they borrowed from Fairmoney at a 10% monthly interest rate.

The high interest rate makes FairMoney’s approach to lending seemingly healthy, as its net interest margin stands at 64.72%, but it also makes it likely that several customers won’t repay their loans.

This was reflected by a 30% increase in its loan impairments. The company told TechCabal that this figure—₦59.4 billion ($37 million)—is inflated by the company’s accounting approach, which treats a loan as impaired immediately upon its issuance and until it is repaid.

The business can also argue that its model works on the continent because of its profits, growing revenue, and its high 81.7% net interest margin.

You can read TechCabal’s Muktar Oladunmade’s article about FairMoney’s 2024 financial report here.

Seamless Global Payments With Fincra.

Issue accounts in NGN, KES, EUR, USD & more with one integration. Send & receive funds seamlessly across borders; no more banking hassles or complex conversions. Create an account for free & go global today.

Telecoms

MTN Group to sell 11% of its Nigerian subsidiary

When we reported that MTN Group, Africa's largest homegrown telecom operator, was moving its Nigerian headquarters to Eko Atlantic City, the reactions had us rolling off the edge of our seats. Some sharp minds even theorised that MTN Nigeria was funding the move with cash from the telecom tariff hikes.

Yes, it cost an arm and a leg to build on Lagos’ futuristic city, but MTN Nigeria is likely not funding this from the tariff increase. If anything, it is through fundraising, share sales, revenue budgets, and commercial papers.

Case in point: MTN Group plans to sell 11% of its shareholding in its Nigerian subsidiary, MTN Nigeria. It currently holds 76% of shares in its Nigerian business and it will sell down to 65%.

The telecom company is yet to decide when it will begin the secondary sale of its business, whether the offers will be made public, or even how much a unit will cost. However, the company notes that it will consider selling after its Nigerian operations return to profitability.

And they’ll need that bounce-back. In 2024, MTN Nigeria bled ₦400 billion ($252 million), losing its crown as the group’s top cash cow. This isn’t their first sell-down, but it’s bigger than 2021’s retail investor offer which brought in ₦575 million ($362,000) and reduced MTN Group’s stake from 78.8% to 75.6% in the process.

MTN has made some interesting moves lately: relocating its Nigerian headquarters to Eko Atlantic, signing a deal to launch a Nollywood streaming platform, and developing a satellite-to-mobile project with Lynk Global to compete with Vodacom in South Africa.

With the sale, there are two things here: it will either use the extra cash to make its Nigerian business whole again, or we've grossly underestimated the length the telecom operator will go to launch that Nollywood streaming platform.

Introducing Zap by Paystack!

Zap is Paystack’s first consumer-facing app designed for simple, fast and secure payments via bank transfer. Download Zap on Android and iOS →

Internet

Bad weather, no satellite; Amazon’s Kuiper will try again for its satellite launch

Amazon’s rocket was ready. The countdown was ticking. But Mother Nature had other plans.

The much-anticipated launch of Amazon's Project Kuiper’s first 27 satellites was shut down by clouds and strong winds on April 9. Somewhere in Texas, Elon Musk probably chuckled and whispered, “Nice try, Bezos.”

Project Kuiper is Amazon’s answer to Starlink, with the low-earth orbit (LEO) project hoping to blast over 3,200 satellites into space to bring cheap, fast internet to the planet’s rural areas all over the world. And it has since partnered with Vodacom, a South African telecom company, to launch the satellites in the country, ahead of Musk's Starlink, which still doesn't have clearance to operate.

Well, both Vodacom, Amazon, and Bezos will now have to wait. No new date was announced. Meanwhile, MTN is flexing with its satellite buddy Lynk Global, having already made the first satellite-to-phone call in South Africa. That’s one small phone ring for man, one giant leap for mobile networks.

The trend signals that South African telecom operators are jumping in fast, hoping LEO-powered internet can fix what cell towers can’t. The market is buzzing, and a billionaire turf war between Musk and Bezos is possible in the near future.

Nonetheless, Amazon’s Kuiper launch will happen soon enough as it races against a July 2026 deadline to retain its licence. But until then, Starlink waits in agony, Vodacom watches the skies in hope, and MTN waves from orbit like, “We were here first.”

Get notified when the Moonshot Deal Book goes live

The Moonshot Book Dealbook is lauching very soon. Packed with a handpicked selection of the most promising startups, this exclusive resource is designed to connect top investors with high-potential opportunities. If you’re interested in being among the first to access the TC Dealbook, sign up on our waitlist today!

Insights

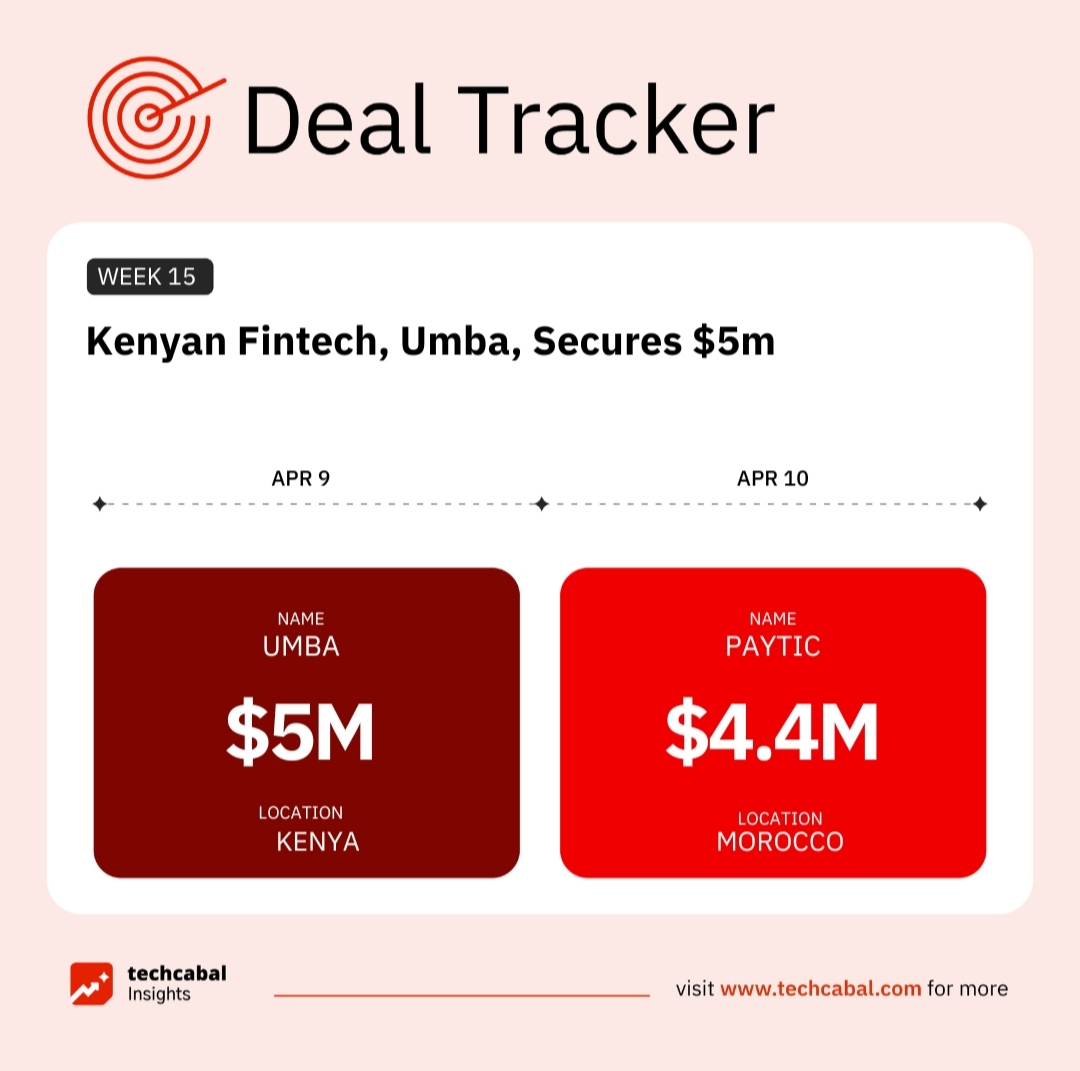

Funding Tracker

This week, Kenya’s Umba, a pan-African digital bank, secured a $5m debt facility from Star Strong Capital. (April 9)

Here’s the other deal for the week:

- Morocco-based fintech startup PayTic raised $4.4m in a new funding round led by AfricInvest, with backing from Axian Venture Lab, Mistral VC, and existing investors like CDG Invest, Build Ventures, Concrete VC, and ICP Ventures. (April 10)

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements. Before you go, what must happen for women-led African startups to record gains? Click this link to find out.

Get valuable insights into Nigeria's Startup scene.

The latest edition of the Nigeria Startup Ecosystem Report, developed by JICA in partnership with TechCabal Insights, offers a deep dive into the trends driving innovation across the country, covering everything from funding trends and policy shifts to major funding trends in Nigeria’s startup ecosystem. Get access to the report.

CRYPTO TRACKER

The World Wide Web3

Source:

Coin Name | Current Value | Day | Month |

|---|---|---|---|

| $80,753 | - 1.23% | - 1.20% | |

| $1,545 | - 4.47% | - 16.80% | |

| $0.0180 | + 60.50% | + 36.06% | |

| $115.24 | - 0.08% | - 5.08% |

* Data as of 05.30 AM WAT, April 11, 2025.

Opportunities

- Lagos Innovates (LSETF) is offering workspace vouchers to startups in Lagos to ease rising operational costs. Startups can access subsidised co-working spaces with reliable internet, power, and a supportive entrepreneurial community. The program is open to Lagos-based startups looking to reduce overheads and focus on growth. Apply now.

- After successes like Jamit, Pokecoin, and Tomachain, Lisk and CV Labs are back inviting African Web3 startups to apply for Batch 2 of the Lisk Blockchain Incubation Hub. The six-month program offers up to $20,000 in grants per project, mentorship, and access to additional funding of up to $100,000. Applications close on April 12, 2025, with the cohort starting on May 19, 2025. Apply here.

- Village Capital is offering early-stage startups in Africa the chance to join its Greentech Africa 2025 accelerator. The programme supports climate tech ventures building solutions in energy access, sustainable agriculture, circular economy, and related sectors. Selected startups will receive mentorship, investor connections, and capacity-building support. The programme is open to founders based in Africa with market-validated solutions tackling climate challenges. Apply here.

- Innovate Events is hosting a workshop for event professionals tomater the tips, tricks, and strategies to pull off effective event strategies for their businesses and organisations. The event holds on Friday, April 11, 2025. Register for free to attend.

Written by: Muktar Oladunmade and Emmanuel Nwosu,

Edited by: Faith Omoniyi

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

How did you find today's edition of #TCDaily? |