- 👨🏿🚀TC Daily

- Posts

- Jumia eyes new markets

Jumia eyes new markets

Inside: Lesaka gets a green light for Bank Zero deal.

Happy mid-week. ☀️

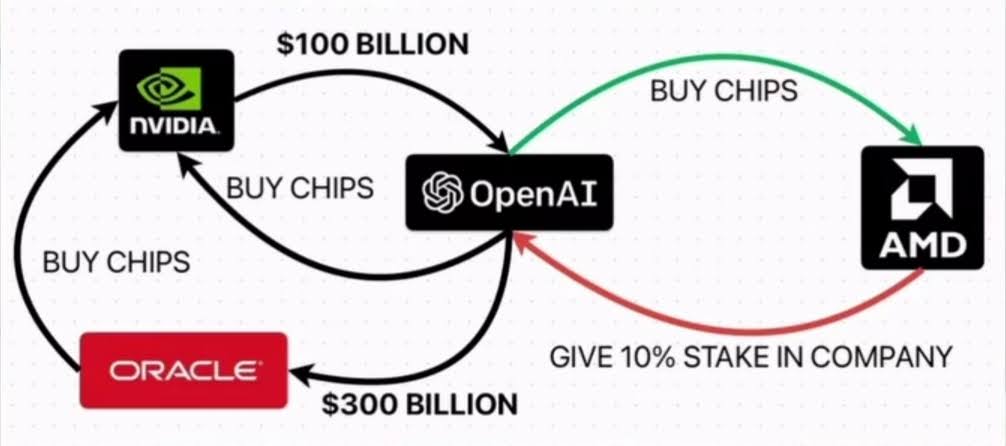

Yesterday, Microsoft and NVIDIA said they plan to invest $15 billion in Anthropic, the AI startup that owns Claude. Now, don't get me wrong; this is exciting news for the bookies and the AI nerds who have been secretly wishing for a super-marriage between all the heavy-hitters in AI.

But the cynical side of me is this close 🤏 to calling it all some complex engineering (not the cute, nerdy finance type from my POV). Everybody is just exchanging a few billion dollars at this point, sorry.

Add the Microsoft + NVIDIA + Anthropic and the Cohere deals, and you're officially confused.

Anyway, let's get into today's business.

Ecommerce

Jumia considers Tanzania and Angola for expansion

Jumia, the African e-commerce giant, is preparing for a new phase of expansion. Only a year after exiting South Africa and Tunisia to cut losses, the company is now eyeing Tanzania and Angola as possible comeback markets. It’s a surprisingly quick pivot for a startup that spent the year consolidating operations, cutting costs, and tightening its logistics engine in pursuit of profitability by 2027. The company exited Tanzania in 2019 as part of ongoing portfolio optimisation efforts.

Why the change of heart? In 2025, Jumia survived a turbulent period that saw its largest institutional investor, Baillie Gifford, divest its stake and exit. However, Axian Telecom, a telecommunications company, was not too far behind, acquiring nearly 10% of the e-commerce company’s stock to become its largest shareholder. This vote of confidence may be giving Jumia the latitude to enter new markets like Tanzania and Angola, even though it had previously exited one of those markets.

Why Tanzania and Angola? Tanzania's e-commerce market revenue is projected to hit $1.69 billion by 2030, while that of Angola is expected to pass $710 million by the same year. Both markets give Jumia scale, but only if FX, seller pipelines, and sufficient capital hit internal thresholds.

Meanwhile in Kenya: The startup has repositioned its operations toward rural buyers, who now drive the majority of its volume. The model relies on a national web of small business owners managing more than 80% of its pick-up stations. It cuts capital costs, speeds delivery in remote towns, and leans heavily on community-based logistics, allowing Jumia to expand reach without heavy capital spending.

Powering businesses across Africa to pay and get paid in local currencies.

With Fincra, businesses, startups, global enterprises and platforms can easily send and receive payments in multiple African currencies, empowering trade, and growth across the continent. Create your account in 3 minutes.

Fintech

Lesaka gets the green light to buy Bank Zero

Lesaka Technologies, a financial service company, has received South Africa's Competition Commission approval to acquire digital bank Bank Zero, the zero-fee digital bank, for about $64 million, clearing a major regulatory hurdle. The deal was first announced in June 2025. Once the deal is complete, Bank Zero shareholders will own roughly 12% of Lesaka’s fully diluted shares and up to $5 million in cash.

What does this mean? The acquisition gives Lesaka access to Bank Zero’s banking licence, modern digital infrastructure, and an opportunity to tap into new revenue streams. Lesaka moves from being just a fintech to a fully integrated financial services group. With Bank Zero’s digital infrastructure plus Lesaka’s merchant and consumer reach, the combined business entity could scale more efficiently.

The competition shake-up: Now that Lesaka has a fully licenced bank under its wing, other digital challengers, including TymeBank and Happy Pay, as well as regional entrants looking to scale, may have to rethink their pricing, features, and customer experience to stay relevant or risk losing ground to the duo soon-to-be merged entity.

Enjoy smooth payments while you're home this Detty December

Coming home for Detty December? Enjoy smooth payments every day with your Paga US account. Send money to any bank instantly. Don’t miss out, get started now.

Cybersecurity

South African companies have suffered 1,947 security breaches since April

When the year finally ends, I think we should gather African tech companies in a room and ask how many of them survived without suffering a single cybersecurity attack.

It's becoming that bad. But before you pull a strand out of your hair, please relax; no one got attacked this time. Yet, South Africa’s Information Regulator said there were 2,374 security breaches in the 2024/25 financial year; that’s about 198 breach notifications popping up in situation rooms every month.

And somehow, it got even worse this year. About 1,947 of those breaches happened from April 2025 to date. It’s like more talented attackers have been inspired to put on a V for Vendetta mask and become self-described “hacktivists.” That, or these people are just angry.

Across Africa, several companies have suffered direct and third-party breaches this year, including Kenya’s M-Tiba, which was hit recently, and others like Safaricom, Eskom, and various government agencies across the continent.

In South Africa, telecom companies Cell C and MTN suffered ransomware and data breach attacks. Another report said the country’s State Security Agency (SSA), its intelligence service (don’t laugh), was possibly attacked by RedNovember, an alleged Chinese state-sponsored group, in September.

The trend is increasingly worrisome, and company executives across industries have been calling for stronger security measures. Yet in an erratic market like Africa, where other concerns such as compliance, product, and marketing often dominate budgets, should tech companies really be paying significantly more for security than for everything else?

Paystack introduces Pay with Pesalink in Kenya!

With Pesalink and Paystack, businesses in Kenya can now get paid directly from customer bank accounts. Learn more here 👉

AI

Microsoft’s new Project “Gecko” wants to make AI finally work for Africans

Generative AI is cool, but it mostly speaks English and works best for the well-connected West. It’s the AI divide in action: the technology expected to reshape the global economy is advancing while overlooking most of the world, including the 2,000+ languages spoken in Africa.

This is where Microsoft’s Project Gecko, led out of Microsoft Research Africa in Nairobi, comes in.

Announced on Tuesday, the goal of the project is to build an AI from the ground up that is local, low-cost, and culturally aware. Its first big win was the MMCTAgent, a multimodal AI that's already helping smallholder farmers in Kenya and India get hyper-local agricultural advice in their native languages, including Kikuyu, Swahili, and Kalenjin—through speech, text, and community-generated videos.

Why this matters: For years, Africa has pushed for localisation and contextualisation in technology. Now it is finally happening with institutional support.

The significance is two-fold. First, it addresses a core issue for African fintechs and digital services: to scale, you need to speak the language of the masses, literally. Second, with agriculture as the starting point, the framework for Project Gecko is designed to be scaled into critical sectors like healthcare and education. This creates a foundation for inclusive AI that is built for Africans, a right step in building relevant technology.

Project Gecko suggests that the next generation of AI might actually be built for Africa. And that changes everything.

AI in a Nutshell gives you weekly AI knowledge and insights

Want to stay close to AI but hate long reads? AI in a Nutshell gives you weekly AI knowledge, news, tools, and insights - short, smart, and fun. Perfect for curious (but lazy) readers who still want to stay ahead. Subscribe here.

CRYPTO TRACKER

The World Wide Web3

Source:

Coin Name | Current Value | Day | Month |

|---|---|---|---|

| $90,304 | + 0.39% | - 18.77% | |

| $2,997 | - 0.31% | - 26.21% | |

| $0.2359 | - 3.60% | - 39.50% | |

| $137.29 | + 1.05% | - 28.69% |

* Data as of 06.45 AM WAT, November 19, 2025.

Opportunities

- The Breez Tech worldwide developer challenge is open to developers across Africa, with active communities in cities such as Lagos, Nairobi, Accra, Kampala, Johannesburg, Abuja, Douala, and Goma, among others. The competition invites participants to integrate Bitcoin into open-source apps using the Breez SDK – Nodeless for a share of the $25,000 prize pool and opportunities including residencies at DraperU and PlebLab. Submissions close December 16; winners will be announced in January. It's #TIME2BUILD. Register here.

- Every startup has a story worth hearing. My Startup in 60 Seconds by TechCabal offers founders a one-minute spotlight to share their vision, challenges, and achievements. Beyond visibility, it connects you to investors, customers, and Africa’s tech ecosystem. Apply to be featured or explore other TechCabal advertorial opportunities. This is a paid opportunity.

- Founder Institute Lagos, the Lagos chapter of the world’s largest pre-seed accelerator, is set to graduate its 12th Cohort at a physical ecosystem gathering themed “Build. Impact. Scale: Fueling Africa’s Growth through Scalable Innovation.” The event will celebrate 18 founders who have completed a rigorous and rewarding 14+ week virtual accelerator program, joined by operators, investors, and key ecosystem players. Register here to attend.

Written by: Opeyemi Kareem, Emmanuel Nwosu, and Fancy Goodman

Edited by: Emmanuel Nwosu & Ganiu Oloruntade

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- TC Scoops: breaking news from TechCabal

- Francophone Weekly by TechCabal: insider insights and analysis of Francophone’s tech ecosystem

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

How did you find today's edition of #TCDaily? |