- 👨🏿🚀TC Daily

- Posts

- Jumia keeps profitability dream alive

Jumia keeps profitability dream alive

Inside: Airtel Money to IPO in 2026.

TGIF. ☀️️️

Congratulations to Cardinal Robert Prevost on becoming Pope Leo XIV, the 267th pope in history. His selection process was one of the fastest in history. My colleague joked that the cardinals were itching to get back their phones.

If you’re curious about the tech that safeguards the conclave’s secrecy, WIRED has a beautiful explainer for you. Don’t forget to take time out to recharge this weekend and maybe see the Conclave movie if you haven’t.

Let’s get into today’s dispatch!

Features

Quick 🔥 Fire with Ilamosi Ivienagbor

Ilamosi Ivienagbor is a senior sales manager at Big Cabal Media, where she leverages her diverse skills to create and implement effective sales strategies. Ilamosi previously worked in the business development team at Flutterwave.

With a background in mass communication (BSc and MSc), Ilamosi has a fine blend of experience across media, sales, admin, and people operations. Outside of her corporate role, she runs a footwear business, designing custom footpieces for both men and women. Ilamosi also takes on freelance voice-over projects, appears in TV commercials, and hosts shows.

Explain your job to a five-year-old.

I help people buy cool things from us, like when you want a new toy. But instead of toys, I sell ideas and services to companies. My job is to find out what they need (in terms of advertising) and then tell them how we can help them get the visibility they need.

What is your sales superpower and why?

I think my superpower would be "listening with empathy." It’s like having the ability to understand exactly what someone is feeling and needing, even if they don’t say it out loud. It helps me find the right solution, even if it’s something they didn’t know they needed yet.

What is the worst part about working in sales?

The worst part is when people don’t follow through. It’s frustrating when you put a lot of time and effort into a deal, only for it to fall apart at the last second. Also, there’s a lot of rejection, which can be tough on days when things don’t go your way.

Why did you get into the media industry and how has the journey been?

I’ve always loved storytelling, whether it was presenting or hosting shows. (I mean, not to brag, but I have 2 degrees in mass communication.) Media is something I’m very passionate about. I got into the media industry because it’s dynamic and always evolving, and it gave me the chance to connect with people. The journey has been a rollercoaster with lots of learning, growth, and finding new ways to be creative while staying grounded in business.

What’s one sales strategy you swear by that most people overlook?

Building real relationships. It's easy to get caught up in the numbers, but trust is everything in sales. People want to do business with people they like and trust, so I spend a lot of time nurturing relationships and making sure I’m genuinely invested in helping them succeed, not just closing a deal.

What is one moment in your tech sales career you are proud of?

I’m really proud of a partnership I closed last year for moonshot that came with visibility in countries like Kenya, South Africa and Ghana. That exact coverage was what we needed to shine light on the good we were doing with the Moonshot conference here in Nigeria.

Let's try a #SellMethisPen elevator pitch about sales: sell your footwear brand in a short sentence.

You know how you always wish you could find footwear that are both comfortable and durable, but without paying a crazy price? That’s exactly what we do at Efia By Illy. Affordable, long-lasting comfort and you don’t even have to break the bank for it. How many pairs should I make for you? 😉

Seamless Global Payments With Fincra.

Issue accounts in NGN, KES, EUR, USD & more with one integration. Send & receive funds seamlessly across borders; no more banking hassles or complex conversions. Create an account for free & go global today.

E-commerce

Jumia set profitability target for 2027

Jumia says it’s on course to break even by 2027, but getting there won’t be easy.

The company reported a pre-tax loss of $16.5 million in Q1 2025, its best quarterly result in two years. However, the e-commerce giant’s revenue plunged 26% year-over-year to $36.3 million, well below analyst expectations.

Corporate sales in Egypt slumped, and currency headwinds in core markets like Nigeria and Egypt didn’t help. Still, there are silver linings: orders rose 12% to 5.1 million, and rural regions accounted for 58% of total volume, suggesting Jumia’s geographic bet might be working.

CEO Francis Dufay remains optimistic. He now sees profitability—on a pre-tax basis—within reach by 2027. The CEO is forecasting a 2025 loss before income tax of $50–55 million, shrinking to $25–30 million in 2026. Jumia also expects its gross merchandise volume (GMV) to rise as much as 15% this year, buoyed by physical goods sales and a growing consumer base.

Despite these gains, investors are unconvinced. The company’s stock dipped nearly 5% to $2.40 following the update. Cash efficiency is also in focus—Jumia’s liquidity position dropped by $23.2 million in Q1 2025, with higher inventory costs and a $21.2 million operational cash burn ahead of its Anniversary campaign.

With JumiaPay gaining ground and international products surging 61%, the platform is expanding its offering. But until it can convert operational improvements into net profits, Jumia remains a work in progress in Africa’s challenging economic terrain.

The e-commerce giant is betting its rural push and low-cost customer acquisition tactics—like SEO and radio jingles—will pay off. With a sharpened focus on consumers, the company is pivoting from past missteps and reworking its playbook. The road to 2027 may be long, but Jumia is moving with intent.

Power Your Business With Paga Engine

Join businesses already building smarter with Paga Engine. Get started today.

Companies

Airtel Africa plans to go public with its mobile money business in H1 2026

Airtel Africa, the third-largest telecom operator on the continent by subscriber base, has announced plans to take its mobile money arm, Airtel Money, public. The IPO was initially expected in July 2025, but that timeline has now been pushed to the first half of 2026.

The delay gives Airtel more time to firm up its position in Africa’s booming mobile money sector, where it still trails competitors like Safaricom's M-Pesa, MTN’s MoMo, and Mixx in the markets it operates in.

Airtel Money is one of the top two mobile money operators in Uganda—its biggest mobile money market—alongside MTN’s MoMo. In Tanzania, it has 12.1 million customers, trailing M-Pesa and Mixx which have more.

In Kenya, Airtel Money holds a solid 3.76 million customers—8.9% of the market—in a space still dominated by M-Pesa. Across all 14 countries, Airtel Money serves 44.6 million users, with transactions hitting $146 billion in 2024.

From an operational setup, Airtel Africa is based in London, controlled from India, and operates solely in Africa—giving it several listing options. While the company hasn’t confirmed where it will list Airtel Money, the likely venue is either the London Stock Exchange (LSE) or Nigerian Exchange (NGX). Airtel Africa is primarily listed on the LSE, with a secondary listing on the NGX; London looks likely the front-runner.

A London listing would offer greater access to capital and investor familiarity. A regional listing on the NGX, though less likely, would raise local visibility but faces currency risks and lower liquidity.

India is off the table, as Airtel Money is part of Airtel Africa, which isn't registered in India. However, listings on other African exchanges are possible. Kenya’s Nairobi Securities Exchange (NSE), with a market cap of KES 1.88 billion ($15 billion), is a contender. Airtel could also look at Uganda or Tanzania, though these exchanges offer less liquidity than Nigeria or Kenya.

The LSE brings deeper investment pools but higher costs: initial fees for companies with over £1 billion ($1.3 billion) market caps, like Airtel Africa, can exceed £449,000 ($595,000), versus 0.25% of offer size or a few million naira on the NGX.

The IPO delay suggests a desire to tighten operations, improve numbers, and enter the market with a stronger hand. With mobile money now essential infrastructure in many African economies, Airtel is hoping that by 2026, investors will see its payments business not just as a telecom side hustle, but as a serious fintech contender.

Never miss an update from Paystack

Subscribe to Paystack for a curated dose of product updates, insights, event invites and more. Subscribe here →

Startups

Seven African Healthtech Startups Join i3 Programme to Transform Pharmacy Access Across the Continent

Seven African healthtech startups—Chefaa, Dawa Mkononi, Meditect, mPharma, myDawa, RxAll, and Sproxil—have been selected for the third cohort of Investing in Innovation Africa (i3), a programme supporting the growth of pharmacy services across the continent. Backed by major global health partners, the initiative helps these companies scale practical, technology-driven solutions to improve how medicines and healthcare services reach people. Operating in 19 countries, the cohort is working to make healthcare more accessible, create jobs, and strengthen health systems serving millions.

Post Jobs on Jobberman for Free!

Hiring just got easier! Post your jobs on Jobberman for FREE and connect with 3 million+ qualified candidates. No fees, no stress - just smart, seamless recruitment. Start here.

Insights

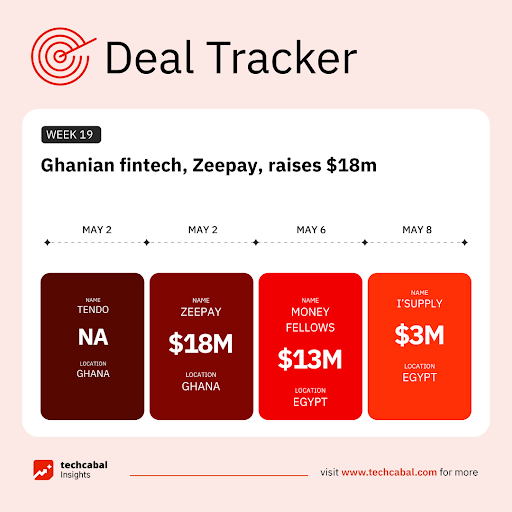

Funding tracker

This week, Ghanaian fintech Zeepay raised $18 million in senior secured venture debt. The deal was structured by investment firm Verdant IMAP. (May 2)

Here are other deals for the week:

- Egyptian pharmaceutical distribution startup i’SUPPLY raised $3 million in Sharia-compliant revenue-based revolving financing from Bokra. (May 8)

- Egyptian fintech digital platform MoneyFellows raised $13 million in a new financing round. This round was co-led by Al Mada Ventures (AMV) and DPI Venture Capital via the Nclude Fund, with notable contributions from Partech and CommerzVentures. (May 6)

- Ghanaian retail-tech startup Tendo raised an undisclosed amount of funding from Renew Capital. (May 2)

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements. Before you go, how can African tech deliver more exits?

Be the First to Access the Nigerian Payments Report 2025

The Nigerian Payments Report 2025 dives into the trends, challenges, and innovations shaping the future of digital payments. Join the waitlist today to get early access to the report when it goes live! Join the waitlist

CRYPTO TRACKER

The World Wide Web3

Source:

Coin Name | Current Value | Day | Month |

|---|---|---|---|

| $102,807 | + 3.96% | + 34.37% | |

| $2,209 | + 16.35% | + 51.84% | |

| $0.00001097 | + 25.80% | + 76.93% | |

| $162.54 | + 8.08% | + 54.07% |

* Data as of 06.45 AM WAT, May 9, 2025.

Job Openings

- Moniepoint — Product Manager — Remote (Nigeria)

- Loubby AI — Junior Product Manager, Content Marketing Manager, Python Developer, Technical Support Specialist — Nigeria, Kenya, Ghana

- Tuteria — Content Creator and Social Media Manager — Lagos, Nigeria

- Token Metrics — Crypto Product Manager — Lagos, Nigeria

- GoWagr — Growth Marketer — Hybrid (Lagos, Nigeria)

There are more jobs on TechCabal’s job board. If you have job opportunities to share, please submit them at bit.ly/tcxjobs.

Written by: Opeyemi Kareem, Emmanuel Nwosu, and Stephen Agwaibor

Edited by: Faith Omoniyi

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

How did you find today's edition of #TCDaily? |