- 👨🏿🚀TC Daily

- Posts

- Logidoo’s new haul business

Logidoo’s new haul business

Special Number: GTBank’s digital business makes $24.6bn.

Welcome to Moonshot week. 🚀

Hustle can start a business, but it rarely builds one that lasts. The companies that endure focus on resilient infrastructure, designed to adapt to change, withstand shocks, and recover stronger.

Sabi embodies this vision. Known as Africa’s leading B2B marketplace for informal trade, it now powers traceability and digital infrastructure in supply chains for critical minerals, driving the green energy transition.

At Moonshot this year, Olumide Okubadejo, Sabi’s Head of Product, will share lessons on building scalable, resilient systems that support both informal and formal economies. The session will equip founders, operators, and product leaders with tools to scale sustainably and build businesses that can thrive through volatility.

Don’t miss out. Tickets to Moonshot 2025 are still available here.

Logistics

Logidoo cracked 3D logistics chess with Kamtar acquisition

Logidoo, a Senegal-based pan-African digital logistics startup, has acquired a majority stake in Kamtar, an Ivorian road freight startup, and in typical fashion, both companies declined to disclose the value of the deal.

State of play: Logidoo’s acquisition of Kamtar shows a strategic move to consolidate digital innovation and on-the-ground freight operations, amplifying Logidoo’s reach and operational muscle in West Africa’s fast-growing logistics sector.

Between the lines: A digital logistics platform like Logidoo builds systems that match shippers and carriers, but it still depends on trucking companies to move goods. Owning Kamtar gives Logidoo direct access to trucks, drivers, and routes across Côte d’Ivoire. It means fewer middlemen, better control, and more reliable delivery. The merger tightens the link between software and physical transport, turning Logidoo into a company that not only coordinates movement but also executes it.

For Logidoo, this step adds real strength. It now has more trucks on the road and deeper coverage across Francophone West Africa. This scale will help attract bigger clients that want one provider to manage everything from booking to delivery, turning Logidoo from a tech connector into a logistics heavyweight.

Saviu’s saviour moment: Saviu Ventures, which raised a $26 million fund in February to back seed to series A Francophone Africa startups, gains a clean exit after selling the majority stake to Logidoo, and proves that its early bets can mature into solid acquisitions.

Zoom out: Logistics, which has historically been a tough market in most regions, might be becoming one of Francophone Africa’s most dynamic sectors. Rising trade, e-commerce, and cross-border demand are creating room for companies that blend tech with transport. Global investors should start watching this space closely.

eCommerce Without Borders: Get Paid Faster Worldwide

Whether you sell in Lagos or Nairobi, customers want local ways to pay. Let shoppers check out in their local currency, using cards, bank transfers, or mobile money. Set up seamless payments for your global online store with Fincra today.

Fintech

COMESA to end dollar trade with new cross-border payment platform

The Common Market for Eastern and Southern Africa (COMESA) 21-nation trade bloc that counts Kenya and Egypt among its members, has introduced a new digital payments platform that could support how the continent trades. Dubbed the Digital Retail Payments Platform, this system lets traders settle cross-border deals in their national currencies, instead of the US dollar.

Details are lean: COMESA has kept its implementation partners unnamed so far, only mentioning two digital financial-service providers and a foreign-exchange firm. This leaves regional traders and tech observers guessing who will be writing the rules for the new infrastructure. The platform is currently being tested between Malawi and Zambia. But the plan is to establish the platform across the COMESA region.

This isn’t a new idea. The Pan-African Payment and Settlement System (PAPSS), built with Afreximbank and central banks, is already enabling cross-border payments in local currencies among many African countries, and in July, rolled out an FX marketplace to deepen liquidity.

Why do they need this platform? Trade between the COMESA member countries remains low, making up for less than 10% of the bloc’s total trade. The regional secretariat attributes this to currency conversion costs, limited financial connectivity, and the reliance on the US dollar for settlements.

What would change? COMESA bets that the new system will keep costs below 3% of the value of each transaction, rather than the current average of 8%. With the system already reducing reliance on the US Dollar, this platform might be the saving grace for intra-COMESA trade. For SMEs that handle the bulk of regional commerce, it could shave fees and speed up settlement.

Zoom out: If the pilot in Malawi and Zambia works, the experiment could unlock real liquidity for COMESA’s 640 million people and prove that local currencies can be used reliably in trade corridors.

Paga is in USA

Big news! Paga is now live in the United States, with digital banking services designed for Africa’s diaspora! Eligible users can send, pay, and bank in US Dollars & Naira, safe, regulated, and borderless. Learn more.

CTelecoms

South Africa's Absa wants MVNO money

Absa, South Africa’s third-largest bank, said it wants to become a mobile virtual network operator (MVNO). An MVNO rents network capacity from the mobile network operators (MNOs), like MTN or Vodacom, and repackages it under its own brand.

Why does a bank want to play dress-up as a telecoms network provider?

Two reasons: first, every bank now wants to own the customer’s daily life. If people live on their phones, banks want to live there too. Second, the mobile business has become a data goldmine. The more Absa knows how customers spend, talk, and move, the sharper its financial products and cross-sell strategies become. Owning the SIM card means owning a richer data loop.

Late-to-market is not a weakness: Absa is late to the MVNO wave—Capitec, FNB, Standard Bank, and Nedbank all got there first—but that might not be a weakness, according to Absa CEO Nick Nkosi. The early crowd proved that South Africans are open to banking-branded mobile services. Absa now walks into a market that understands the model and is already hungry for cheaper data and simpler bundles. If it gets the offer right—family plans, easy control through the app, and solid coverage—it could turn that delay into precision.

Between the lines: The catch is that MVNOs are low-margin and depend on tight execution. Running a mobile network, even virtually, takes serious coordination with an MNO partner. If Absa’s service is patchy or dull, customers will shrug and stick to Capitec Connect.

But if it works, the payoff is big. Mobile connectivity can anchor users inside the Absa ecosystem, where payments, loans, and savings become one tap away. The phone becomes the bank. That is the real play here: not airtime, but attention.

Stay up to date with the latest Paystack news!

Subscribe to Paystack for a curated dose of product updates, insights, event invites and more. Subscribe here →

Ride-hailing

Uber is getting cancelled in South Africa

Uber’s shine in South Africa is starting to dim. The ride-hailing giant is now wading through a storm of frustration from riders, drivers, and regulators.

Users are complaining: Over the past few months, users in Pretoria, Johannesburg, and Cape Town have made several complaints, service is slipping, and safety is questionable. There are complaints of cancelled trips, overcharging, reckless driving, and missing parcels.

And regulators are stepping in. New transport rules across South Africa are forcing e-hailing platforms to tighten up their operations: drivers must now hold operating e-licences, vehicles need visible branding, and every car must be fitted with panic buttons. Apps that allow unlicenced drivers to operate could face fines of up to R100,000 ($5,714) or even jail time. However, gig drivers say the sweeping regulations make no sense.

For Uber, it’s a reckoning. The company’s decade-long run in South Africa was built on convenience and scale, but now it must prove compliance and rebuild trust. If Uber doesn’t get its house in order, competitors Bolt, inDrive, or even local challenger startups like Wanatu, eager to play by new rules, could swoop in and seize the moment.

SPECIAL NUMBER

$24.6 billion

GTBank’s tech bet is finally paying off. Its two digital platforms, GTWorld and GAPS/GAPSLite, processed ₦35.8 trillion ($24.6 billion) in transactions in the first half of 2025, highlighting strong customer adoption of its digital channels. The bank’s growing transaction volume underscores how traditional banks are holding their own against neobanks and fintechs that are dominating the digital payments space.

Learn more about businesses and their many money-making schemes in this week’s Follow The Money column. Every Monday, TechCabal unpacks the most important earnings, business models, and growth strategies shaping the future of Africa’s tech ecosystem.

CRYPTO TRACKER

The World Wide Web3

Source:

Coin Name | Current Value | Day | Month |

|---|---|---|---|

| $114,660 | - 0.04% | - 1.06% | |

| $4,349 | + 2.21% | - 0.83% | |

| $1.35 | - 3.95 % | + 1704.67% | |

| $220.94 | + 3.37% | - 0.94% |

* Data as of 06.40 AM WAT, October 13, 2025.

Events

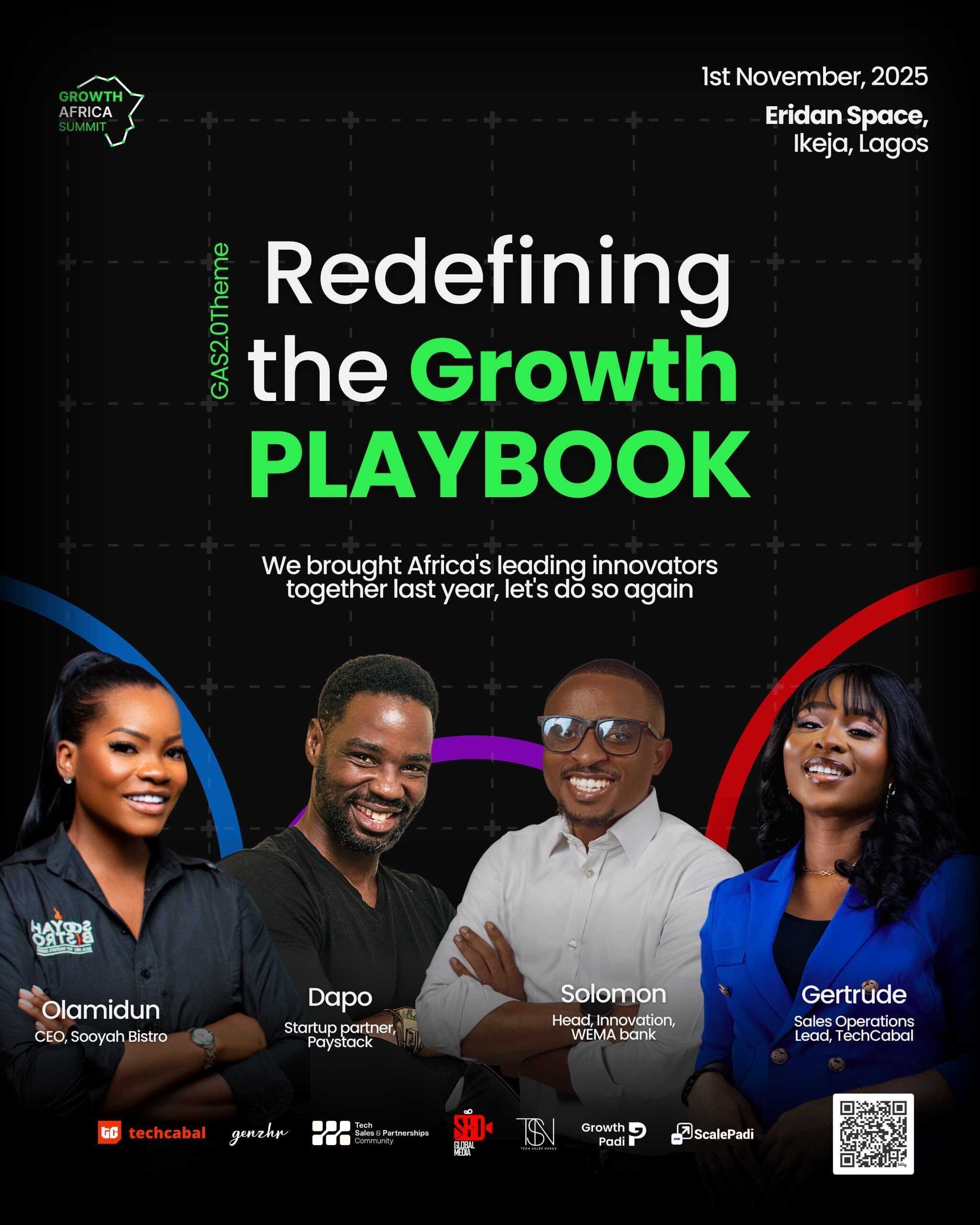

- Bigger, bolder, and more intentional. Following the resounding success of the inaugural summit in 2024, Growth Padi is thrilled to announce Growth Africa Summit 2025 (GAS 2.0) with the trailblazing theme: “Redefining the Growth Playbook.” Set against the backdrop of a fast-evolving entrepreneurial landscape, this year’s summit will challenge outdated strategies and usher in a new wave of radical, resilient, and relevant growth models tailored for African businesses. Register to attend by November 1.

- Got a startup story worth telling? My Startup in 60 Seconds is TechCabal’s one-minute spotlight for founders to share their journey, from vision and challenges to major wins. It’s more than just visibility; it’s a chance to reach investors, potential customers, and Africa’s wider tech ecosystem. Be featured in My Startup in 60 Seconds or explore other TechCabal advertorial opportunities and let the ecosystem hear your story. This is a paid opportunity.

- Countdown to Moonshot 2025. Africa’s biggest gathering of dreamers, doers, and disruptors returns on October 15 & 16, 2025. From startup founders to policy shapers, everyone who’s building the continent’s future will be there. Secure your spot today and be part of the movement.

- Calling all AI enthusiasts for Africa’s premier all-expense-paid AI and Data Science learning experience this October, powered by Data Science Nigeria (DSN). The AI Bootcamp 2025 will run from October 20–25 at the University of Lagos, bringing together learners from 36 states and 13 African countries for practical training, mentorship, and collaboration under the theme “AI for All: Democratizing Intelligence and Driving Impact.” Join the free city classes to qualify for the Bootcamp. Register here.

Written by: Emmanuel Nwosu and Opeyemi Kareem

Edited by: Emmanuel Nwosu & Ganiu Oloruntade

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- TC Scoops: breaking news from TechCabal

- TNW: Francophone Africa: insider insights and analysis of Francophone's tech ecosystem

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

How did you find today's edition of #TCDaily? |