- 👨🏿🚀TC Daily

- Posts

- More crypto rules in Nigeria

More crypto rules in Nigeria

Plus: Five million Lagosians have two weeks to register their cars.

Good morning ☀️

The numbers are in. From January to June 2024, African startups raised $779.4 million, the lowest half-year raise since 2020.

Logistics and transportation startups received the biggest share—about $218 million—while the proptech sector is the lowest with just $2 million in funding. The good news here is that funding is flowing more easily into countries other than the Big 4—Nigeria, Kenya, Egypt and South Africa. Benin and Ghana, for example, raised more funds than Nigeria and South Africa in Q2 2024.

If you want more numbers, our State of Tech in Africa report has the numbers you need to make intelligent decisions. Get it for free right here.

Nigeria wants to monitor all crypto trades

Trading cryptocurrency is like joining a global board game where everyone can see the moves players make, but no one is in charge. Unlike traditional finance, crypto transactions are only traceable on the blockchain ledger, and funds cannot be recalled, making it attractive to nefarious traders.

Yet, the opportunity to hold some value against the weak naira is why Nigerians continue to embrace digital assets.

The Nigerian government wants to control that opportunity. At the peak of the Binance saga in March, Nigerian authorities ordered the crypto exchange to hand over data of its top 100 Nigerian users, citing claims of market manipulation and illicit trade activities that affected the country's economy. The demand was part of the country’s action against the crypto company which has seen the six-month detainment of one of its executives,

Today, these authorities are getting their way. The Nigeria Securities & Exchange Commission (SEC) wants to monitor crypto trades the Orwellian way to curb fraudulent activities going on in the self-regulated crypto ecosystem. The organisation wants all Virtual Assets Service Providers (VASPs) registered under its purview to share weekly and monthly trading statistics of users in Nigeria.

Recently, the agency also stated that all CEOs or managing partners at VASPs must have physical offices in Nigeria to hold founders liable.

As regulators tighten their grip on crypto players, some crypto enthusiasts may seek refuge in decentralised exchanges (DEXs) to maintain their autonomy.

Read Moniepoint’s 2024 Informal Economy Report

90% of businesses in Nigeria's informal economy earn less than N500,000 in monthly profit. Click here to explore the financial profile of Nigeria’s informal economy from Moniepoint’s latest report.

Jumia’s share price continues to rally

Jumia's 2024 stock rally is remarkable considering its poor performance since it last peaked at $65.51 in February 2021. Its latest uptrend has caught the attention of Wall Street analyst Fawne Jiang who says that the stock is not done yet.

Jumia's stock is on a hot streak, with its share price jumping 52.5% in five days. This surge has pushed the company's market value to $1.32 billion, a milestone not seen since 2021. On Friday, Jumia's shares closed at $13.07, up from $8.46 on July 8.

Big changes: After the firing of its long-time leaders in late 2022, new CEO Francis Dufay has been shaking things up. He's cut nearly half the workforce, pulled back from struggling markets, and shut down the food delivery arm.

These bold moves are paying off. In the first quarter of 2024, Jumia's losses shrank by 71%, while sales grew by 18.5%. This growth came despite currency troubles in key markets like Nigeria. The company is also shifting away from selling its own goods, now getting over half its sales from third-party sellers. This change is helping Jumia earn more from commissions, which shot up 78% compared to last year.

But it's not all smooth sailing. Despite rallying stock performances in 2024, Jumia hasn't turned a profit in the last twelve months and is projected to remain unprofitable for another three years. Retail investors who have held the stock since 2021 when its decline started have seen their money reduced to nothing.

Jumia also faces competition as new rivals in social media giants like Instagram and TikTok are pushing into online shopping. Amazon is also expanding in Egypt, one of Jumia's important markets.

Jumia's high volatility and 7.07 price-to-sales ratio relative to other e-commerce industry players like Amazon still constitute a concern for retail investors. However, investors seem impressed ahead of its Q2 2024 financial report announcement. Jumia's stock has soared 288.99% since the start of 2024—in comparison, Nvidia, which has garnered raucous media attention and high demand for its chips since this year is up 168.37%.

Issue USD and Euro accounts with Fincra

Create and manage USD & Euro accounts from anywhere. Fincra allows you to issue accounts to your users, partners & customers to collect payments without the stress of setting up and operating a local account. Get started today.

Nigerian Police set July 29 deadline for e-CMR Registration

“In Lagos, don't make/recieve a call while driving. The moment you are caught on camera, it's ₦20k penalty straight into your inbox.”

This August 2023 tweet, by one motorist, is the reality for many drivers across Nigeria’s most industrious state, Lagos. Inattentive motorists who break traffic laws wake up with text messages from the Lagos state government, informing them of what laws they broke, the fine, and the evidence.

What’s happening? In 2021, the Lagos state government installed over 280 traffic cameras and launched a Vehicle Inspection Service platform. This system uses number plate detection to identify vehicles without proper documentation or those breaking traffic rules, then sends fines to the offenders. This system helps police access important vehicle data quickly, aiding in crime prevention and investigation, including combating vehicle theft, terrorism, banditry, kidnapping, and armed robbery.

Now, the Nigerian Police wants all vehicle owners to register with the e-Central Motor Registry (e-CMR), an online database storing vehicle information which was launched in April 2023. On Saturday, the Nigerian Police Force (NPF) announced that it would begin enforcing the e-CMR as a required document, and is encouraging motorists to register by July 29, 2024.

The police force said the e-CMR will make it easier to transfer vehicle ownership, change license plates, replace engines, and replace chassis in a statement. It will also help ensure that vehicles are genuine and owned legally, making it easier to find and recover stolen vehicles and prevent people from buying stolen vehicles by mistake.

Although it is still uncertain whether the registration cost is the same or varies by vehicle type, at least two sources have confirmed that the registration fee is more than ₦5,000 ($3.09).

An impossible deadline: The NPF might find itself in the same situation that the CAC did when it set a 62-day deadline for 1.9 million POS operators. Lagos has over 5 million cars plying its road daily. The e-CMR has been online for about a year, but it’s unknown how many Lagosian motorists have registered—but if it’s anything like other agency regulations, we can guess it's not a lot. Millions of drivers in the state now have two weeks to confirm their registration, and if you’re one of them, you can start here.

Paystack Virtual Terminal is now live in more countries

Paystack Virtual Terminalhelps businesses accept secure, in-person payments with real-time WhatsApp confirmations and ZERO hardware costs. Enjoy multiple in-person payment channels, easy end-of-day reconciliation, and more. Learn more on the Paystack blog →

Gatekeeping digital lending in Africa

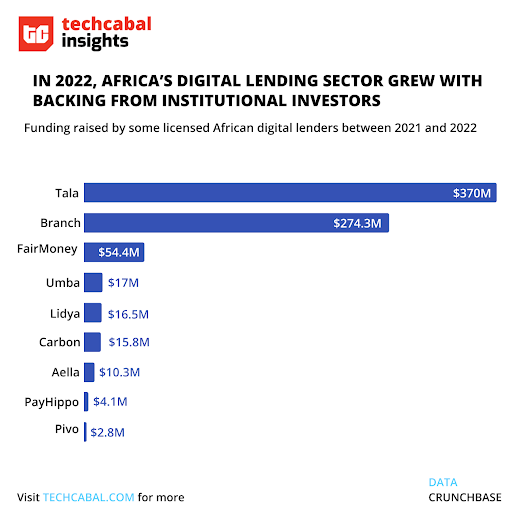

With a fast-growing digital finance consumer market in Africa, digital lending offers alternative funding options to Africans with flexibility and speed. This sector has also attracted large sums of investment to become a key growth driver in revolutionizing the continent’s overall consumer credit market. According to surveys by the Commonwealth Chamber of Commerce, 40% of Africans prefer online financial platforms, contextualizing the 102% increase in online alternative financing from $104 million in 2017 to $563.8 million in 2022.

By deploying credit-worthiness models based on borrowers' data, digital lending startups have become attractive to small businesses and individuals looking for quick loans. These startups have grown with strong investors' backing

There is not enough legislation on the regulatory framework for companies offering digital lending services in most African countries. Kenya and Nigeria are two of the most prominent African markets for digital lending, where most loan apps belong to unregistered and unlicensed tech companies making users susceptible to privacy abuse.

However, efforts to crack down on the illegal operations of unlicensed digital lenders have not brought the desired outcomes. But Nigeria’s regulator had fully or conditionally authorized the operations of 106 digital lenders as of January 2023. Also, the Central Bank of Kenya (CBK) has approved only 22 in its country, while nearly 300 startups await the apex bank’s approval.

Babatunde Akin-Moses, co-founder and CEO of Sycamore, a peer-to-peer lending platform, says while the regulation of Africa's digital lending sector is experiencing a state of awakening, the sector is currently receiving attention. "Thanks to a wave of alleged consumer complaint claims in the form of abusive follow-up messages to borrowers who default on loans. This is a big part of what has led to the recently increased oversight by regulators, but there is also the slow pace and high cost of regulatory compliance."

He however believes there are several products and services that the digital lending market needs that the licensed entities are not able to deliver based on regulatory constraints. "When you have such unmet demand in a big market, some will likely step in to plug this gap in ways that may blur the lines between being fully regulated or otherwise," Babatunde said.

Meanwhile, the app marketplaces like Google PlayStore and Apple AppStore wield significant powers with their market share to impose regulatory standards on African digital lenders and remove unlicensed apps. For instance, Google PlayStore is the biggest platform for discovering digital services in Africa. And since January 31, 2023, Google has strengthened its screening process to mandate digital lenders to obtain approval from local regulators.

While it is necessary to tackle the illegal operations of digital credit providers, an attempt to create excessively stringent laws will not only stifle the market but also limit the funding to small businesses and individual consumers in a tough economic environment. Regulators and digital lenders must work together to accelerate the transformation of Africa’s financial lending markets towards equitable and fair digital lending.

1,397: That's the number of tech workers that were laid off across the African tech ecosystem from January to June 2024.

Move to the Cloud with Servercore

Migrate your IT infrastructure from AWS, Azure, or Google Cloud to Servercore and get a special bonus: three times the amount of your previous cloud bills in credits to spend on Servercore Cloud. Apply now to test our cloud platform.

- You can still get an early bird ticket to the second edition of TechCabal’s Moonshot Conference! From October 9–11, 2024, at the Eko Convention Centre, Lagos, Nigeria, you can join Africa’s biggest thinkers and players like join Iyin Aboyeji, Wiza Jalakasi, June Angelides, Kola Aina on a global launchpad for change. If you want to join these stakeholders in Africa’s tech ecosystem for three days of insightful conversations, then get an early-bird ticket to Moonshot 2024 at 20% off.

- The Nigeria Fintech Forum is set to hold its third edition on July 25, 2024, at the Civic Centre, Victoria Island, Lagos. Nigeria Fintech Forum plays host to the most senior leaders across Nigeria’s fintech and banking, uniting industry stakeholders who are defining the future of the ecosystem, If your work resonates with fintech, payments or banking, This is where you should be. Get a ticket here.

- JICA will organize an event related to Nigeria's startup ecosystem in Japan on Sep 5th 2024. Find out more here.

Here's what we've got our eyes on

Written by: Emmanuel Nwosu & Mobolaji Adebayo

Edited by: Timi Odueso

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.