- 👨🏿🚀TC Daily

- Posts

- Nigeria enters its PoS monogamy era

Nigeria enters its PoS monogamy era

Inside: Kenya wants big companies to play VCs.

Happy mid-week. ☀️

If you're a PoS operator in Nigeria and your hustle still has side chicks, the Central Bank just said it’s time for you to pick one. 💔

Meanwhile, Kenya wants startups to get a slice of corporate CSR money, and M-KOPA’s finally turning a profit. Plus, our sister newsletter The Next Wave: Francophone Africa just dropped a brilliant deep dive on InstaDeep, Tunisia’s $700 million AI success story. Read it here.

In other news, it’s now only one week to Moonshot; get your tickets here. Let's get into today's dispatch.

Regulation

CBN’s new rule: One PoS agent, one operator

Nigeria's agent banking sector is getting a major change, thanks to new rules from the Central Bank (CBN). From April 2026, every point of sale (PoS) agent must choose—and stick with—one operator. In practice, this means agents will no longer be allowed to use multiple machines from providers like OPay, PalmPay, Moniepoint, or bank-issued platforms.

Why is the regulator doing this? The CBN says it wants to improve service quality and bring order to a fast-growing sector. Nigeria has over 5 million active PoS terminals that processed $7.15 billion in transactions in Q1 2025.

What does this new rule mean? Banks and fintechs will now enter a battle for an agent's loyalty, following the new exclusivity rule, which could lead to better services and incentives for agents. However, the policy also limits agents’ flexibility and may drive up their operational costs. Ultimately, that pressure will be passed down to customers, resulting in higher transaction charges as agents try to offset reduced earning potential.

More rules. The new guidelines also introduce significant changes like the geo-tagging of all PoS machines, which will lock them to a specific location, and a daily withdrawal limit of ₦1.2 million ($816.18) for each agent.

Zoom out: This exclusivity is a trade-off between the flexible convenience Nigerians enjoy with PoS agents for the promise of a more structured and regulated banking system. Whether it restores order or simply breaks the multi-operator model remains to be seen.

eCommerce Without Borders: Get Paid Faster Worldwide

Whether you sell in Lagos or Nairobi, customers want local ways to pay. Let shoppers check out in their local currency, using cards, bank transfers, or mobile money. Set up seamless payments for your global online store with Fincra today.

Startups

M-KOPA turns the corner, becoming profitable for the first time in more than 10 years

After years of incurring heavy losses, M-KOPA has finally turned a profit. The Kenyan pay-as-you-go (PAYGO) pioneer posted a profit of KES 1.2 billion ($9.2 million) in 2024, rebounding from a KES 3.2 billion ($25 million) loss the previous year as revenue increased 66% to KES 53.7 billion ($416 million).

State of play: The turnaround marks a key milestone for one of Africa’s most closely watched startups, which has long been seen as a test case for the continent’s asset-financing model. Founded in 2011 to sell solar systems on credit to low-income households, M-KOPA has evolved into a digital finance platform offering smartphones, cash loans, and insurance to millions across Kenya, Uganda, Nigeria, and Ghana.

Between the lines: The milestone comes at a time when investors are demanding clearer paths to profitability from African startups. The funding boom that once flooded fintechs has cooled, and companies that can demonstrate self-sustaining models are standing out.

Since 2022, the company has focused on smartphone financing, partnering with manufacturers such as Samsung and Nokia to offer pay-as-you-go devices. It has also established an assembly plant in Nairobi.

Paga is in USA

Big news! Paga is now live in the United States, with digital banking services designed for Africa’s diaspora! Eligible users can send, pay, and bank in US Dollars & Naira, safe, regulated, and borderless. Learn more.

Internet

Starlink promises over $145 million to enter South Africa

After what seemed like a media hiatus, Starlink, the Elon Musk-owned satellite internet company, is back singing a tune we are all familiar with. The company says it is ready (again) to enter South Africa and is willing to play by the country's rules to do that.

But this time, Starlink went a step further. It revealed its $145 million plan: it wants to comply with local empowerment laws (is this what we're thinking, Elon?), invest in local infrastructure, work with the National Sea Rescue Institute to equip rescue vessels, and provide free internet for 5,000 schools.

Between the lines: The satellite internet provider wants to work through local partners rather than go solo, by hiring South African internet service providers (ISPs) for installation, maintenance, and resale of its product in the country. The company is also looking to base parts of its global network infrastructure in the country to achieve its goal of making South Africa a regional hub for its operations.

Why this turnaround? For months, Starlink's entry into South Africa stalled over local ownership rules that required foreign telecoms to sell equity—something Starlink refused to do. Starlink's stance changed when regulators proposed an entry consideration for foreign firms through equity equivalence. This meant that instead of selling part of its shares, it would invest in projects that advance local empowerment, such as connecting 5,000 schools and investing in local infrastructure.

Zoom out: For all of Starlink's enthusiasm in the market, South African lawmakers are still having second thoughts about the equity equivalence pathway, citing it would undermine the Broad-based Black Economic Empowerment (BBEE) system, which has existed for years, and this has stalled entry plans for Musk's company.

Paystack introduces Pay with Bank Transfer in Ghana

WithGhanaian businesses can now accept secure, instant bank transfers on Paystack. Learn more here →

Companies

CSR, but make it venture capital

In a bold move, Kenya now wants big companies to share some of their CSR (Corporate Social Responsibility) cash with startups. The Kenya National Innovation Agency (KeNIA) is drafting a plan that would legally require corporates to channel part of their feel-good budgets into an innovation fund.

State of play: Imagine Safaricom, Equity, or KCB swapping a few football tournaments and scholarships for startup seed rounds. Sounds wild, right? But that’s the idea: build a steady local funding pipeline and rely a little less on Silicon Valley’s goodwill.

Between the lines: CSR is traditionally about giving back—funding schools, hospitals, or community events—but KeNIA’s pitch reframes it as ‘investing forward.’ The policy would turn community responsibility into innovation capital, nurturing early-stage ventures that rarely survive beyond the prototype stage.

The proposal borrows from India’s Companies Act of 2013, which requires large firms to allocate at least 2% of their net profits over three years to CSR initiatives. In India, companies with an estimated annual turnover of $112.6 million or a net profit of at least $560,000 are required to comply with these regulations.

Zoom out: Of course, not everyone’s clapping yet. Yet if this policy lands, Kenya could become the first African country to turn corporate responsibility into startup capital.

CRYPTO TRACKER

The World Wide Web3

Source:

Coin Name | Current Value | Day | Month |

|---|---|---|---|

| $121,243 | - 0.42% | + 8.21% | |

| $4,721 | + 4.55% | + 10.03% | |

| $2.99 | + 1.01% | + 6.06% | |

| $234.61 | + 1.52% | + 15.73% |

* Data as of 06.45 AM WAT, October 8, 2025.

Events

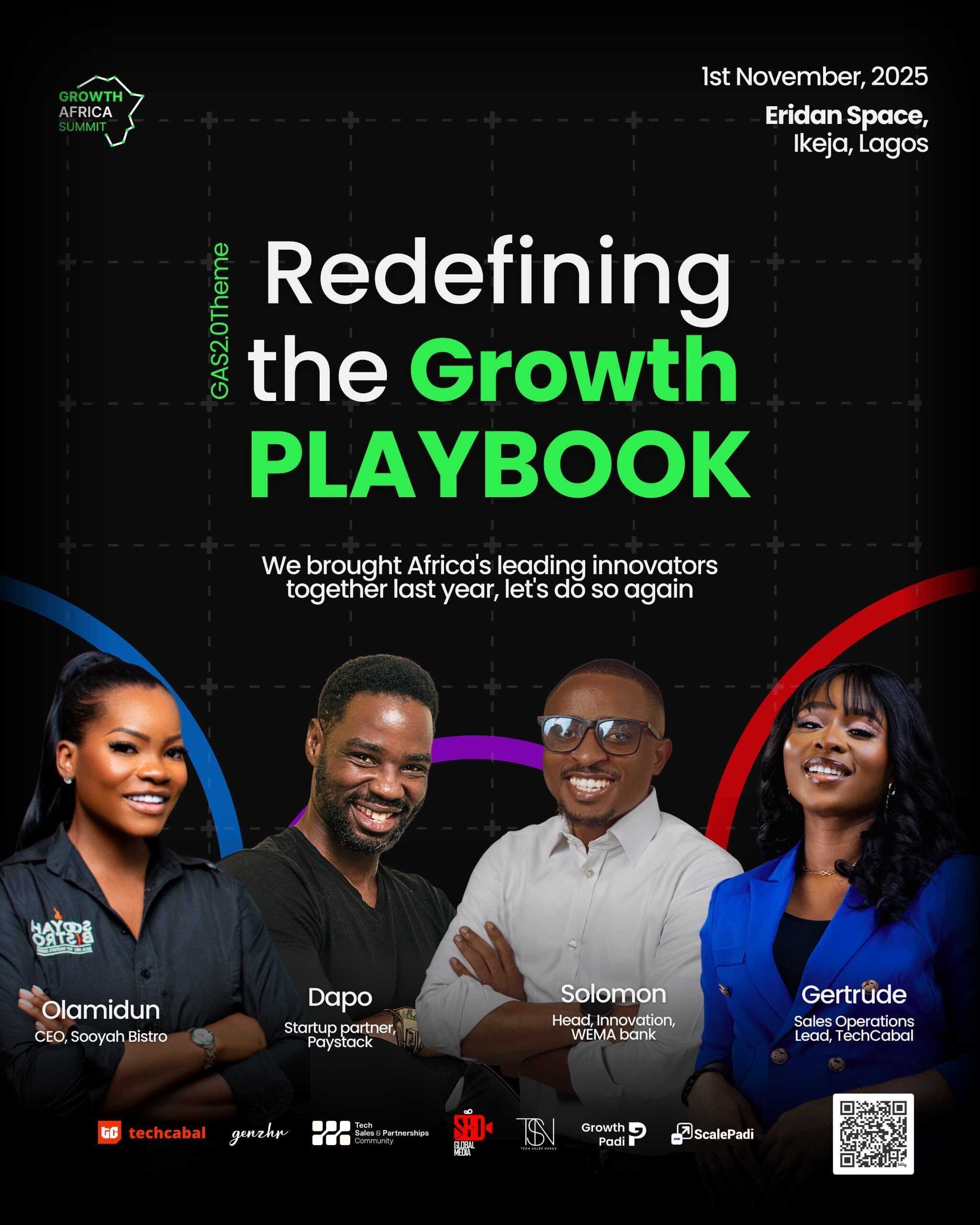

- Bigger, bolder, and more intentional. Following the resounding success of the inaugural summit in 2024, Growth Padi is thrilled to announce Growth Africa Summit 2025 (GAS 2.0) with the trailblazing theme: “Redefining the Growth Playbook.” Set against the backdrop of a fast-evolving entrepreneurial landscape, this year’s summit will challenge outdated strategies and usher in a new wave of radical, resilient, and relevant growth models tailored for African businesses. Register to attend by November 1.

- Got a startup story worth telling? My Startup in 60 Seconds is TechCabal’s one-minute spotlight for founders to share their journey, from vision and challenges to major wins. It’s more than just visibility; it’s a chance to reach investors, potential customers, and Africa’s wider tech ecosystem. Be featured in My Startup in 60 Seconds or explore other TechCabal advertorial opportunities and let the ecosystem hear your story. This is a paid opportunity.

Written by: Adonijah Ndege and Opeyemi Kareem

Edited by: Ganiu Oloruntade

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- TC Scoops: breaking news from TechCabal

- TNW: Francophone Africa: insider insights and analysis of Francophone's tech ecosystem

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

How did you find today's edition of #TCDaily? |