- 👨🏿🚀TC Daily

- Posts

- Nigeria is off the dirty money list

Nigeria is off the dirty money list

Special Number: GTCO USSD value declines to $342m.

Happy salary week. ☀️

Every startup has a story worth hearing. My Startup in 60 Seconds by TechCabal offers founders a one-minute spotlight to share their vision, challenges, and achievements. Beyond visibility, it connects you to investors, customers, and Africa’s tech ecosystem. Apply to be featured or explore other TechCabal advertorial opportunities. This is a paid opportunity.

Economy

Nigeria and South Africa exit the dirty money list

Nigeria and South Africa have finally been taken off the Financial Action Task Force’s (FATF) grey list, an unflattering watchlist for countries with shaky anti-money-laundering (AML) systems. The Paris-based global watchdog said both countries, along with Mozambique and Burkina Faso, are no longer under increased monitoring for deficiencies in their AML and counter-terrorism financing (CTF) systems.

It’s a big win for Africa’s two largest economies and a bigger sigh of relief for banks and fintechs that have spent years jumping through extra compliance hoops.

How did they even get on it? Nigeria and South Africa landed on the list in February 2023 after FATF flagged weaknesses in tracking dirty money and terrorism financing. That red mark in its ledger made global partners nervous and slowed cross-border payments. Global fintechs like Mercury, a US digital bank, which African startups use to access venture capital dollars, blocked new registrations and closed down old accounts of startups from grey-listed countries.

Blood, sweat, and tears: Since being put on the list, Nigerian and South African governments have worked night and day to clean up their image. Nigeria’s Central Bank (CBN) rolled out tougher Know Your Customer (KYC) checks and stricter licencing rules, such as the recent geo-tagging rule for PoS operators, while South Africa rolled out AML reforms, ticking off all 22 action items FATF demanded by mid-2024.

What does it mean now? For Nigeria, which receives at least $17 billion in global remittances every year over the last decade, delisting will ease compliance checks, streamlining remittance flows. It’s a market confidence boost for South Africa and proof that reforms work. Fintechs and banks can now reconnect to global payment rails without the ‘high-risk’ tag hanging over them. Yet with privilege comes great responsibility; these African countries will now be held to high standards to retain their freeman tag.

eCommerce Without Borders: Get Paid Faster Worldwide

Whether you sell in Lagos or Nairobi, customers want local ways to pay. Let shoppers check out in their local currency, using cards, bank transfers, or mobile money. Set up seamless payments for your global online store with Fincra today.

Economy

Lesotho still reels from US tariff hit as more workers lose jobs, trade dries up

While the world—except Canada, which is still playing a game of trade chess—learned to live with US President Donald Trump’s heavy-handed tariffs on African countries, Lesotho, the worst-hit on the continent, did not. The tiny mountain nation “nobody has heard of” is suffering key losses in its textile industry, which powers more than half of its economy.

Trade is drying up, and several workers have lost their jobs as Trump's 15% tariff—though cut from 50% in August, remains the highest in Africa—exacerbates the wound for one of the continent’s poorest nations.

Between the lines: Factories that once supplied denim for US retailers like Walmart, JCPenney, and Levi’s are scaling down or closing shop. Before the tariffs, nearly all of Lesotho’s textile exports entered the US duty-free under the now-ended African Growth and Opportunity Act (AGOA). The same goods now face levies that make them uncompetitive against producers in Kenya and Asia.

Prime Minister Sam Matekane has been lobbying Washington for relief to 10% or “maybe zero,” but with unemployment already above 30%, the damage is mounting. The textile sector, employing around 12,000 people and indirectly supporting 40,000 more, has contracted by up to 13% this year alone.

Was Starlink a mistake? In the face of economic strain, Matekane’s government has been courting tech investment—most notably granting Elon Musk’s Starlink an operating licence in April. Yet as Lesotho’s denim dreams unravel, the question lingers: in hindsight after Musk left the White House, was embracing his satellite venture a forward-looking hedge, a quid pro quo against collapse? Or was it misplaced faith that the technology could stitch together an economy coming apart at the seams?

Paga is in USA

Paga is live in the U.S.! Whether you're in Lagos or Atlanta, manage your money effortlessly. Send, Pay, and Bank in both Naira and US Dollars, all with Paga. Learn more.

Companies

Canal+ eyes full control of Showmax as MultiChoice prepares JSE exit

French media giant Canal+ is reportedly exploring the purchase of Comcast’s 30% stake in African streaming platform Showmax—a move that would cement its dominance in Africa’s media market. The talks, according to Bloomberg, are still preliminary, but Canal+, which already controls MultiChoice (Showmax’s parent company), is clearly moving to consolidate its streaming empire across the continent.

Catch up: Comcast entered the picture in 2023 through its NBCUniversal arm, taking a minority stake in Showmax and relaunching it on Peacock. The platform, now available in 44 African countries, has thrived on local storytelling—nine of its ten most-watched titles last year were African originals.

State of play: The incentive for Canal+ to acquire Showmax is to own distribution rights. The French media outfit announced that it plans to export MultiChoice’s content to foreign markets—and not the other way around yet. With Showmax being one of the most visible successes for local titles, it makes sense that Canal+ wants to unlock more content for export.

For MultiChoice, after six years on the Johannesburg Stock Exchange (JSE), the newly acquired company will delist on December 10, with Canal+ buying out all shareholders, including retail investors, at R125 ($7.24) per share—a tidy premium on last Friday’s R123.75 ($7.17) close, and perhaps a fair value for a stock that’s never crossed R155.20 ($9) in its history. Shareholders can challenge the deal within 30 business days, though few are expected to.

The big picture: Canal+ plans to fold MultiChoice into its broader group and pursue a JSE listing, giving retail investors a chance to own shares in the enlarged company. It has already cut decoder prices in South Africa by up to 40%. With its eyes fixed on Showmax, Canal+’s playbook is clear: control distribution, leave creative production to MultiChoice, and rebuild a wounded African media empire on the strength of local content and continental scale.

Join Paystack and Unwind Fest for Founders Rant!

Building a company is exciting and hard. Come hear founders share the real stories behind the highs, lows, and lessons of building in Africa. Buy tickets here →

Funding

NVIDIA bets on Africa’s Cassava Technologies

Cassava Technologies, a pan-African tech infrastructure company owned by Zimbabwe’s richest man, Strive Masiyiwa, closed a strategic investment with NVIDIA, a US chipmaker. The undisclosed investment comes after Masiyiwa announced in March that the company is building Africa's largest AI factory, in partnership with NVIDIA.

As part of that deal, Cassava said it would upgrade its data centres with NVIDIA supercomputers, giving the chipmaker access to power enterprise solutions that will adopt Cassava's new data centres. The investment could likely hinge on that previous deal.

Why NVIDIA chose Cassava: Cassava owns several subsidiaries in cloud and cybersecurity solutions, artificial intelligence platforms, and financial technology services. These solutions support enterprises, governments, and consumers across 94 countries.

State of play: With this deal, NVIDIA wants local customers and a distribution arm that can sell its graphics processing units (GPUs) to banks and startups across the continent. Large global players want to invest in Africa’s compute system, but they lack trusted and scalable local infrastructure. Cassava provides the boots on the ground that NVIDIA wants.

PalmPay is Showing Nigerians the Smarter Way to Bank

Want to stay protected from fraud and scams? Set up your security center in the PalmPay app. PalmPay’s multi-layered security system is built to protect your funds and keep every transaction safe. Say yes to reliable, secure banking with PalmPay. Learn more.

SPECIAL NUMBER

$342 million

Once a symbol of financial inclusion, USSD is losing ground as mobile apps change how Nigerians transfer money. GTCO’s *737#—which helped popularise USSD—saw its transaction value fall from ₦987 billion ($677 million) in H1 2024 to ₦499 billion ($342 million) in H1 2025, with volumes dropping 64%.

Industry-wide, USSD transactions declined from ₦4.84 trillion ($3.3 billion) in H1 2023 to ₦2.19 trillion ($1.5 billion) in H1 2024, according to the Central Bank of Nigeria (CBN)’s most recent update, showing a clear shift in transaction culture.

Learn more about businesses and their many money-making schemes in this week’s Follow The Money column. Every Monday, TechCabal unpacks the most important earnings, business models, and growth strategies shaping the future of Africa’s tech ecosystem.

CRYPTO TRACKER

The World Wide Web3

Source:

Coin Name | Current Value | Day | Month |

|---|---|---|---|

| $115,547 | + 3.45% | + 5.29% | |

| $4,231 | + 7.25% | + 5.19% | |

| $1.14 | - 2.55% | - 42.86% | |

| $204.51 | + 5.62% | + 0.79% |

* Data as of 06.50 AM WAT, October 27, 2025.

Opportunities

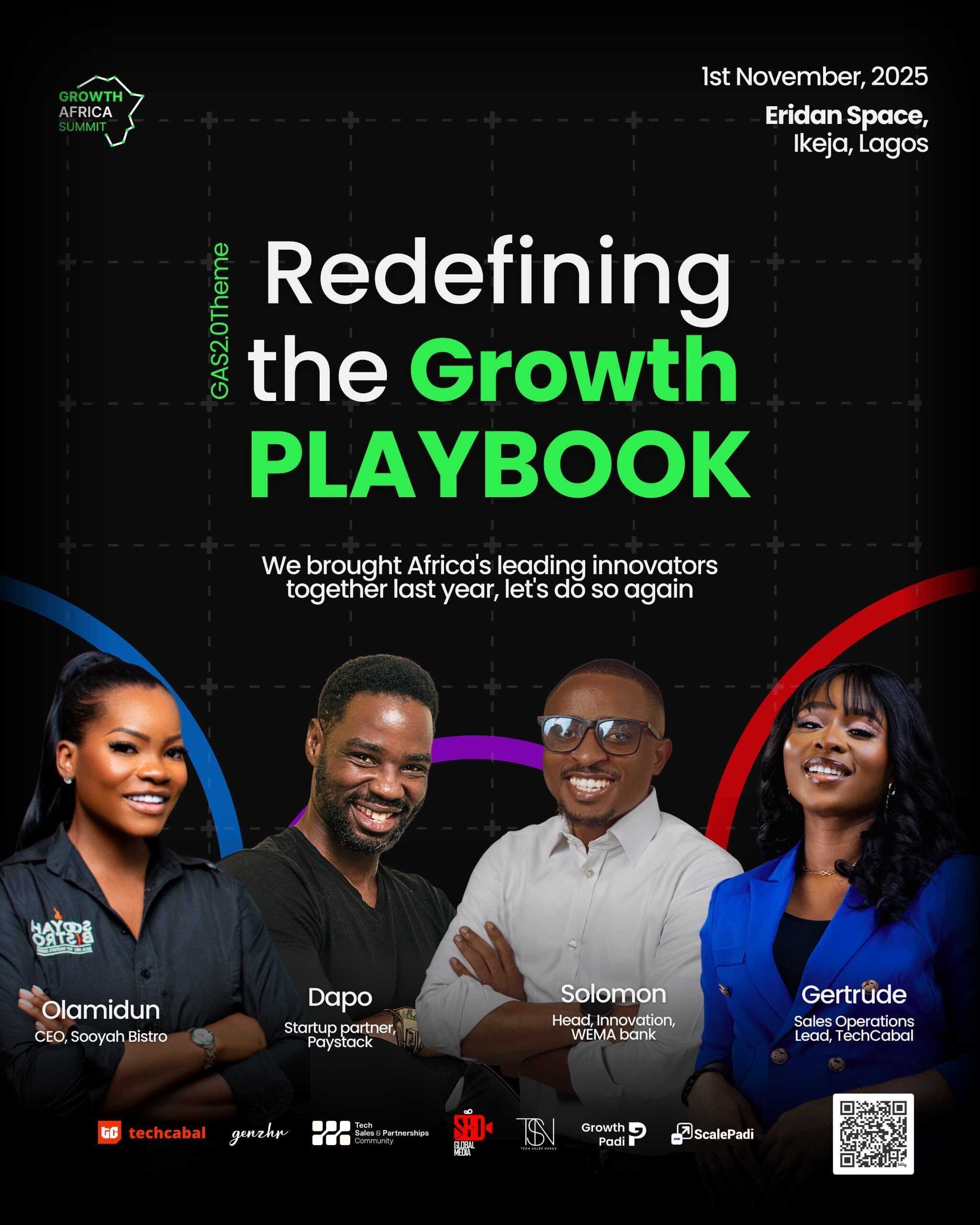

- Bigger, bolder, and more intentional. Following the resounding success of the inaugural summit in 2024, Growth Padi is thrilled to announce Growth Africa Summit 2025 (GAS 2.0) with the trailblazing theme: “Redefining the Growth Playbook.” Set against the backdrop of a fast-evolving entrepreneurial landscape, this year’s summit will challenge outdated strategies and usher in a new wave of radical, resilient, and relevant growth models tailored for African businesses. Register to attend by November 1.

- Calling all AI enthusiasts for Africa’s premier all-expense-paid AI and Data Science learning experience this October, powered by Data Science Nigeria (DSN). The AI Bootcamp 2025 will run from October 20–25 at the University of Lagos, bringing together learners from 36 states and 13 African countries for practical training, mentorship, and collaboration under the theme “AI for All: Democratizing Intelligence and Driving Impact.” Join the free city classes to qualify for the Bootcamp. Register here.

Written by: Opeyemi Kareem and Emmanuel Nwosu

Edited by: Emmanuel Nwosu & Ganiu Oloruntade

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- TC Scoops: breaking news from TechCabal

- TNW: Francophone Africa: insider insights and analysis of Francophone's tech ecosystem

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

How did you find today's edition of #TCDaily? |