- 👨🏿🚀TC Daily

- Posts

- Old dogs, new tricks

Old dogs, new tricks

Cool Stuff: A triage app for women.

Good morning. ☀️

In today’s edition of Francophone Weekly, we take a closer look at Tunisia’s quiet rise as a frontier market and what other African ecosystems can learn from its steady growth. Don’t miss it. Get sat here.

Meanwhile, SWIT has launched a seven-month accelerator for deep-tech and research-driven startups across health, agriculture, energy, and frontier tech. The program helps founders run pilots, validate ideas, and raise capital, offering up to $50,000 in equity for the top 10 startups.

If your startup is rooted in science and based in Southwest Nigeria, apply here by October 31, 2025.

Let's dive in.

Banking

South Africa's FirstRand invests $277 million into JSE-bound Optasia, snaps up 20% share

Old dogs, new tricks. That might be the most fitting way to describe Africa’s banking sector right now. Traditional lenders are no longer watching fintechs from the sidelines; they are moving in. Nedbank set the tone with its R1.65 billion ($96 million) acquisition of iKhokha—the deal received final approval on October 24. Standard Bank Kenya is planning to acquire NCBA Group, which owns challenger bank NCBA Loop.

More tricks: And now, the big one: FirstRand, South Africa’s second-largest bank, flush with cash, has entered the picture with a R4.78 billion ($277 million) investment. It bought a 20.1% stake in Optasia, the soon-to-list credit scoring and lending fintech platform eyeing a unicorn valuation.

State of play: FirstRand’s play is more than a capital investment. Optasia’s model uses mobile money channels such as MTN’s MoMo and Vodacom’s M-Pesa to distribute AI-assessed microloans, serving millions who exist beyond traditional credit systems. This gives FirstRand access to data and markets it cannot reach through its own infrastructure. The acquisition is a data strategy disguised as an equity purchase.

Between the lines: When Optasia lists at an expected valuation above R20 billion ($1.2 billion), FirstRand’s share could evolve from a financial holding into a strategic pipeline. The bank can integrate Optasia’s algorithms to enhance its own credit scoring and lending reach across Africa. It also gains an early position in the next wave of cross-border, mobile-led banking that will define African finance over the next decade.

But look closer, and the move feels less like strategic innovation and more like corporate theater. South Africa’s largest bank suddenly chasing fintech relevance in 2025 looks reactionary. Years of watching smaller players, such as Bank Zero, Tyme Bank, and Discovery Bank, seize growth in unbanked segments have left FirstRand playing catch-up. Faced with squeezed margins and creaking infrastructure, it is seeking balance with an Optasia stake and its planned Kenya entry.

eCommerce Without Borders: Get Paid Faster Worldwide

Whether you sell in Lagos or Nairobi, customers want local ways to pay. Let shoppers check out in their local currency, using cards, bank transfers, or mobile money. Set up seamless payments for your global online store with Fincra today.

Banking

Kenya's Family Bank gets shareholder approval to list on the NSE in 2026

Family Bank, a tier-2 Kenyan commercial bank, has received shareholder approval to list its shares on the Nairobi Securities Exchange (NSE) in 2026, one month after the board approved plans for a public listing.

State of play: The lender will list through a listing by introduction, allowing its existing 1.3 billion shares to trade publicly without issuing new ones—a move that offers liquidity to existing shareholders while avoiding ownership dilution. It also signals confidence in the bank’s continued performance after years of steady growth.

Between the lines: Family Bank has been preparing for this move for years. Net profit rose 39% in H1 2025 to KES 2.2 billion ($17 million), while assets reached KES 193 billion ($1.5 billion) and capital ratios stayed above regulatory limits. Listing turns that financial progress into a market test of investor trust and valuation.

The NSE, which has seen few new banking listings in recent years, could use the boost. Investor participation has been thin, and mid-sized banks have tended to stay private. Family Bank’s entry could help restore some confidence that credible local institutions still see value in public ownership and disclosure.

Zoom out: If Family Bank’s listing proceeds smoothly, it could set a useful precedent for other mid-tier lenders or microfinance banks seeking growth capital through the market rather than private placements.

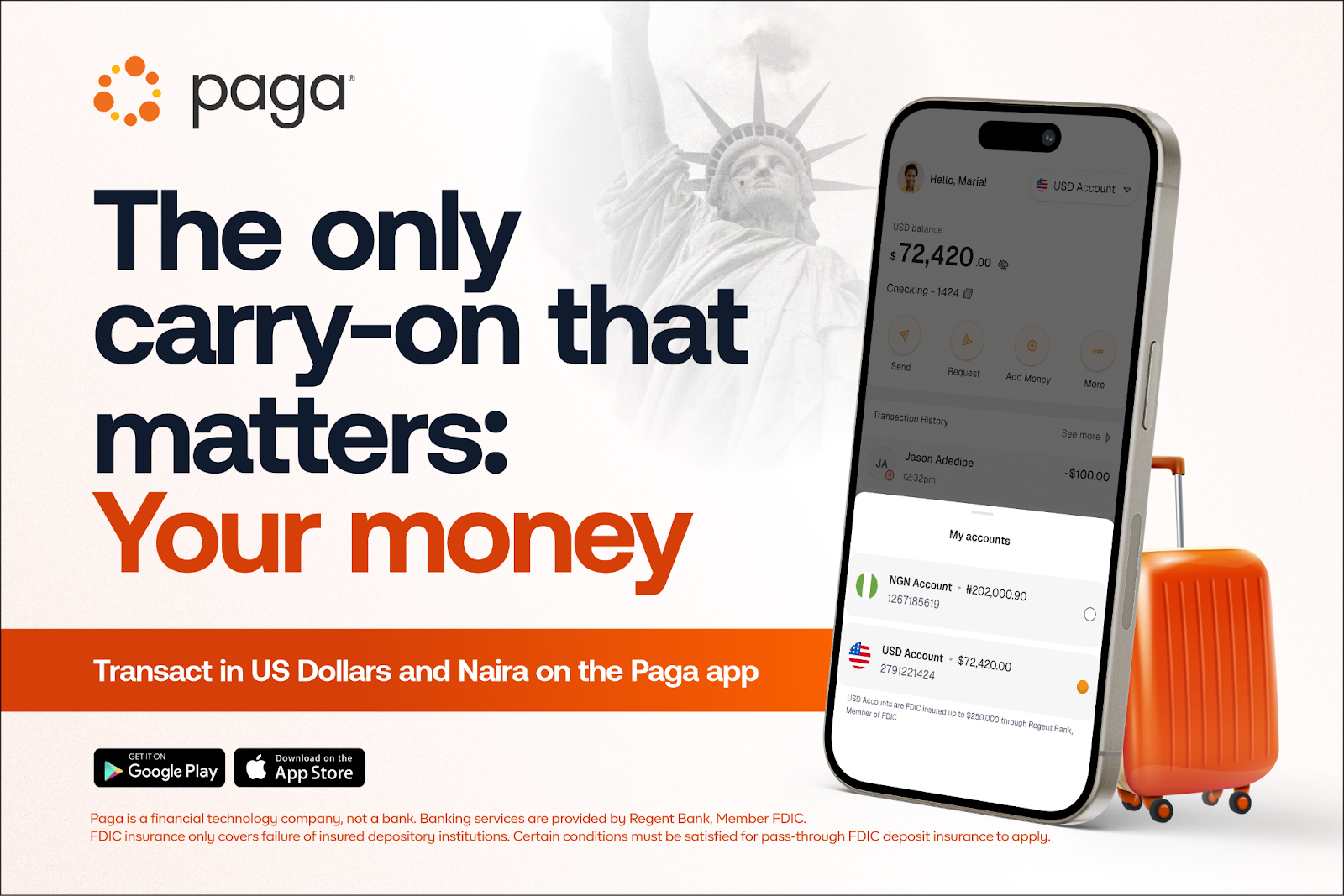

Paga is in USA

Paga is live in the U.S.! Whether you're in Lagos or Atlanta, manage your money effortlessly. Send, Pay, and Bank in both Naira and US Dollars, all with Paga. Learn more.

Banking

Access Holdings to pay $109 million for NBK acquisition

In May 2025, Access Holdings, the parent company of Nigeria’s largest bank by assets, completed its acquisition of the National Bank of Kenya (NBK), a struggling tier-2 lender previously owned by KCB. But in corporate M&A, a deal is never truly done until the money moves.

Access now says it will make the final $109.6 million payment to close the takeover and fold NBK into Access Bank Kenya. The African Export–Import Bank (Afreximbank) is backing the transaction with a guarantee of up to $89.5 million, a safety net to keep the acquisition on track.

So, what’s in it for Access? The purchase gives Access an immediate foothold in Kenya’s highly competitive banking sector, where it already operates Access Bank Kenya. By adding NBK, Access gains the scale and credibility needed to strengthen its regional play, especially now when its current arm, Access Bank Kenya, reported a loss of $1.47 million in H1 2025. With NBK, Access gets scale and a branch network that can help it fight for market share.

Access 🤝 acquisitions: Access has made a habit of buying its way across Africa, one acquisition at a time. In 2021, it acquired Grobank in South Africa, rebranded it as Access Bank South Africa, and gave itself a seat at the table in one of the continent’s most mature banking markets. In 2020, the bank reached an agreement with ABC Holdings Limited to acquire the African Banking Corporation (ABC) of Mozambique.

Each acquisition followed the same formula of finding a local lender with reach, integrating it into the Access network, and growing through integration. The Kenyan deal is the latest chapter in that expansion story, which is turning Access into a pan-African bank. The integration has quietly begun, with customers of both banks now sharing branch networks.

Pay with Bank Transfer is now live in Paystack Ghana!

Ghanaian businesses can now accept secure, instant bank transfers on Paystack. Learn more here →

Startups

Sun King, a solar financing startup, opens Nairobi plant

Africa’s solar market is maturing, and Sun King wants to build at the centre of it.

The market is expected to pass $20 billion by 2033 due to a deficit in electricity access across rural Africa. Sun King, the off-grid solar company powering homes across Africa, has just opened its first large-scale manufacturing plant in Nairobi to produce more of its products locally.

The sun facility: The facility will assemble solar-powered TVs and smartphones designed to work with the company’s off-grid systems and can produce up to 700,000 units a year, with room to scale as demand grows.

First came money🤑: The move follows a $156 million loan the company secured in July to expand its pay-as-you-go (PAYG) solar programme across Kenya. That funding was meant to connect 1.4 million low-income households and small businesses to reliable energy.

Africa’s clean energy scene is cooking: In the mobility and solar sectors, African startups are shifting from importers to manufacturers, betting that Africa’s next growth wave will be powered by making climate-friendly technology locally. Spiro, a Kenyan electric vehicle startup, recently raised $100 million to expand its e-motorcycle network across the continent. Solar energy startup d.light also secured over $300 million to expand its pay-as-you-go model across African communities.

Zoom out: By manufacturing closer to home, Sun King is cutting shipping costs, shortening supply chains and delivery times, creating jobs for locals, all while tackling the issue of energy deficiency across the continent.

PalmPay is Showing Nigerians the Smarter Way to Bank

Struggling to save? PalmPay’s Spend & Save makes it easy. Build healthy saving habits every time you spend. Simply set a percentage to move automatically into your savings every time you spend. Earn up to 20% interest yearly and enjoy smarter, more rewarding banking with PalmPay. Learn more.

COOL STUFF!

Going to the hospital is an exercise in patience, especially as a woman. From taking time off work to seeing doctors who half-listen to you and prescribe medication based on their preconceived notions, medical misogyny is alive and well in many parts of the world.

That’s why I really like My Débbo App, an AI triage tool that operates as a women-centred healthcare platform, doing everything from helping women identify their symptoms and linking them to doctors they can speak to for further consultation.

—Zia

CRYPTO TRACKER

The World Wide Web3

Source:

Coin Name | Current Value | Day | Month |

|---|---|---|---|

| $113,935 | - 1.35% | + 4.03% | |

| $4,098 | - 3.47% | + 1.80% | |

| $6.88 | + 9.43% | - 8.18% | |

| $200.11 | - 2.34% | - 0.95% |

* Data as of 06.30 AM WAT, October 28, 2025.

Opportunities

- Bigger, bolder, and more intentional. Following the resounding success of the inaugural summit in 2024, Growth Padi is thrilled to announce Growth Africa Summit 2025 (GAS 2.0) with the trailblazing theme: “Redefining the Growth Playbook.” Set against the backdrop of a fast-evolving entrepreneurial landscape, this year’s summit will challenge outdated strategies and usher in a new wave of radical, resilient, and relevant growth models tailored for African businesses. Register to attend by November 1.

- Calling all AI enthusiasts for Africa’s premier all-expense-paid AI and Data Science learning experience this October, powered by Data Science Nigeria (DSN). The AI Bootcamp 2025 will run from October 20–25 at the University of Lagos, bringing together learners from 36 states and 13 African countries for practical training, mentorship, and collaboration under the theme “AI for All: Democratizing Intelligence and Driving Impact.” Join the free city classes to qualify for the Bootcamp. Register here.

- Every startup has a story worth hearing. My Startup in 60 Seconds by TechCabal offers founders a one-minute spotlight to share their vision, challenges, and achievements. Beyond visibility, it connects you to investors, customers, and Africa’s tech ecosystem. Apply to be featured or explore other TechCabal advertorial opportunities. This is a paid opportunity.

- Follow The Money: Apps have taken over USSD in ₦104 trillion mobile payment boom

- Ask An Investor: TLcom’s Philippe Griffiths on his firm’s year, founder pitfalls, and the hardest part of VC

- Malawi’s new farmhand: AI that speaks the local language

- Zambia’s Duniya Healthcare says its distribution model helped avert 578 rural deaths

Written by: Opeyemi Kareem and Emmanuel Nwosu

Edited by: Emmanuel Nwosu & Ganiu Oloruntade

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- TC Scoops: breaking news from TechCabal

- TNW: Francophone Africa: insider insights and analysis of Francophone's tech ecosystem

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

How did you find today's edition of #TCDaily? |