- 👨🏿🚀TC Daily

- Posts

- PalmPay in talks to raise up to $100M

PalmPay in talks to raise up to $100M

Inside: How African startups are fighting dollarisation.

TGIF! ☀️️️

Let’s get into today's dispatch!

Fintech

PalmPay in talks to raise up to $100 million

PalmPay is in talks to raise between $50 million and $100 million in a Series B funding round, according to TechCrunch. It’s unclear how much the company is currently worth, but back in 2021, it was already considered almost a unicorn (meaning nearly worth $1 billion).

For the curious (or confused): A Series B funding round is the second stage of significant venture capital financing for a startup company. It means this isn’t their first funding round. They’ve had a successful Seed and Series A funding round.

Palmpay has raised $140 million across these funding rounds led by big-name investors like Transsion (the company behind Techno and Infinix phones) and MediaTek). And now, they are hoping to get a larger sum of money to grow further.

What will the money be used for? The company declined to comment on the specifics of its fundraising. However, the new capital will fuel PalmPay’s deeper expansion into Nigeria, grow its newer products, and enter new markets across Africa and Asia. This new capital will also fuel PalmPay’s intended expansion to South Africa, Côte d’Ivoire, Uganda, and Tanzania, building on momentum from processing 15 million daily transactions during the first quarter. The expansion will bring PalmPay’s footprint to six African countries, following earlier launches in Ghana and Kenya.

The company, which has 35 million registered users, is now profitable.

If this funding round is successful, PalmPay will be pulling further ahead in the fintech race. PalmPay wants to be the platform across payments, credit, and mobile banking on a continental and global stage. For competitors like OPay, Moniepoint, and FairMoney, it raises the bar on speed, scale, and staying power. In a space where some players are still burning cash, PalmPay’s momentum and profitability put it in a different weight class.

Join Fincra for an Exclusive Side Event at Money20/20 Europe

Fincra is co-hosting “Stablecoins & The Future of Payments” at Money20/20 Europe with Utila, Rail, Wirex & more. Join fintech leaders for insightful panels & networking. Limited spots - RSVP here.

Economy

Kenya’s tax net widens, moves to scrap ESCOP tax breaks

The Kenyans got a whiff of Moniepoint’s latest cash out and thought, 'We want a piece of that pie too!’

The government has included a proposal in the Finance Bill 2025 that scraps tax breaks on Employee Stock Ownership Plans (ESOPs) for early-stage startups. If passed, employees will have to pay income tax within 30 days of receiving shares whether or not those shares can be sold.

That’s a big shift from the current rule (introduced in 2023), which lets workers defer tax until they sell, leave, or hit a five-year mark.

Employee Stock Ownership Plans (ESOPs) are shares that startups give employees instead of, or in addition to cash as part of their pay.

Why is this a big deal? This move effectively deflects one of the few levers that startups have left to attract talent without blowing their budgets. If employees now get heavily taxed on shares they can’t sell, many will walk away from such offers.

Why is this happening? It's no news that Kenya's debt is bad. This proposal, which was first introduced in 2024 but turned down due to rising protests, can be seen as a push by Kenya to widen the tax net amid falling revenue and growing pressure to manage public debt.

First, Kenya tried to sell its own Safaricom shares. Now it wants to tax yours. The question now isn’t just how Kenya plans to pay off its loans, but how far it’s willing to go.

Order physical Paga cards, spend with confidence.

Tired of declined payments? Avoid the side-eyes at the cash till with Paga's physical prepaid card. Designed to give you control, security, and ease. Fund and spend with confidence. Get yours today!.

Startups

The dollarisation squeeze, and how founders are hitting back

Not long ago, building a Nigerian startup was straightforward: create something people want, secure investment, and scale with global tools like AWS, Slack, and top hires from abroad. With plenty of funding, the numbers made sense. But since 2023, the weakening naira has turned dollar-priced essentials into existential threats. Local revenue, no matter how fast it grows, barely registers in USD, while costs for cloud services, software, and foreign talent keep soaring.

Recently, we gathered a group of founders to discuss this dollarisation crisis and how to adapt. Deji Olowe, founder of LendSqr and chairman at Paystack (now Stripe-owned), shared practical strategies in a fireside chat with TechCabal’s Fuad Lawal. Olowe’s key message: you don’t always need the priciest, dollar-denominated tools to get the job done. Why pay $7 per user for Slack when open-source alternatives work? Do you really need all that cloud storage?

Olowe also challenged the habit of hiring expensive foreign executives, arguing that local talent, when properly trained, delivers better value and strengthens the ecosystem. Banks have long invested in local talent—why shouldn’t startups?

The founders present were already making changes: switching to local or open-source alternatives, auditing every dollar-based subscription, and even considering on-premise solutions to control costs. This tough environment is forcing startups back to first principles: focus on what truly creates value and cut expensive habits.

Despite the challenges, this squeeze is driving a new wave of efficiency and innovation. Meanwhile, our partner CloudPlexo, and AWS provider, is offering free AI strategy consultations to tech startups. If you're looking for ways to optimise, it's worth a chat. Email us, and we'll connect you.

How Paystack protects your business from cyber fraud

Discover how Paystack uses Static Application Security Testing to identify and prevent security threats before they become issues. Learn more →

Insights

Funding Tracker

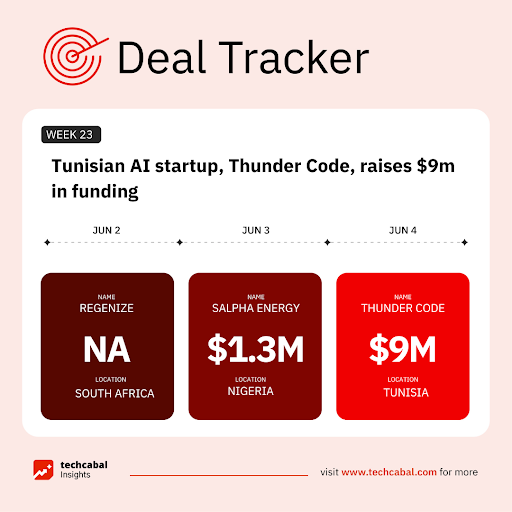

This week, Tunisian AI startup Thunder Code raised $9m in seed funding. The round was led by Silicon Badia, with participation from Janngo Capital, Titan Seed Fund, and strategic angels like Roxanne Varza of Station F and Karim Beguir of InstaDeep. (June 4)

Here are other deals for the week:

- Nigerian startup Salpha Energy secured a $1.3 million investment from All On. (June 3)

- South African recycling startup Regenize secured undisclosed funding from E Squared Investments. (June 2)

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements. Before you go, how can Nigeria compete in the emerging AI economy? Our latest policy brief, Building AI Literacy: Preparing Nigeria’s Future Workforce Through Education Policy, presents practical steps to transform education and prepare tomorrow's workforce today. Download it here.

Introducing, The Naira Life Conference by Zikoko

This August, the Naira Life Con will bring together wealth builders, entrepreneurs, financial leaders, and everyday Nigerians to share their experiences with earning, managing, and spending money. Think: bold conversations, immersive workshops, and content tracks that hand you a playbook for building real wealth. Get early bird tickets now at 30% off only for a limited time.

CRYPTO TRACKER

The World Wide Web3

This section is brought to you by:

Coin Name | Current Value | Day | Month |

|---|---|---|---|

| $102,950 | - 2.06% | + 6.73% | |

| $2,466 | - 6.10% | + 44.98% | |

| $2.14 | - 3.09% | - 0.14% | |

| $147.41 | - 3.89% | + 1.05% |

* Data as of 06.15 AM WAT, June 6, 2025.

Get pitch deck templates built for African crypto startups, brought to you by Quidax.

Raising funds? Use the pitch deck template built for African crypto & fintech startups. Proven structure, investor-ready format. Get noticed, get funded. Drop your email now to get it instantly

Opportunities

- Are African creators really making money? TC Insights and partners are uncovering the real state of creator earnings, support, and opportunities for creators across the continent — and we want your voice in the story. Take our 4-minute survey and tell us what it's really like.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- TC Scoops: breaking news from TechCabal

Written by: Opeyemi Kareem

Edited by: Faith Omoniyi

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

How did you find today's edition of #TCDaily? |