- 👨🏿🚀TC Daily

- Posts

- Put your Monie where your mouth is

Put your Monie where your mouth is

App Idea: A first aid tutor for all emergencies.

Good morning. ☀️

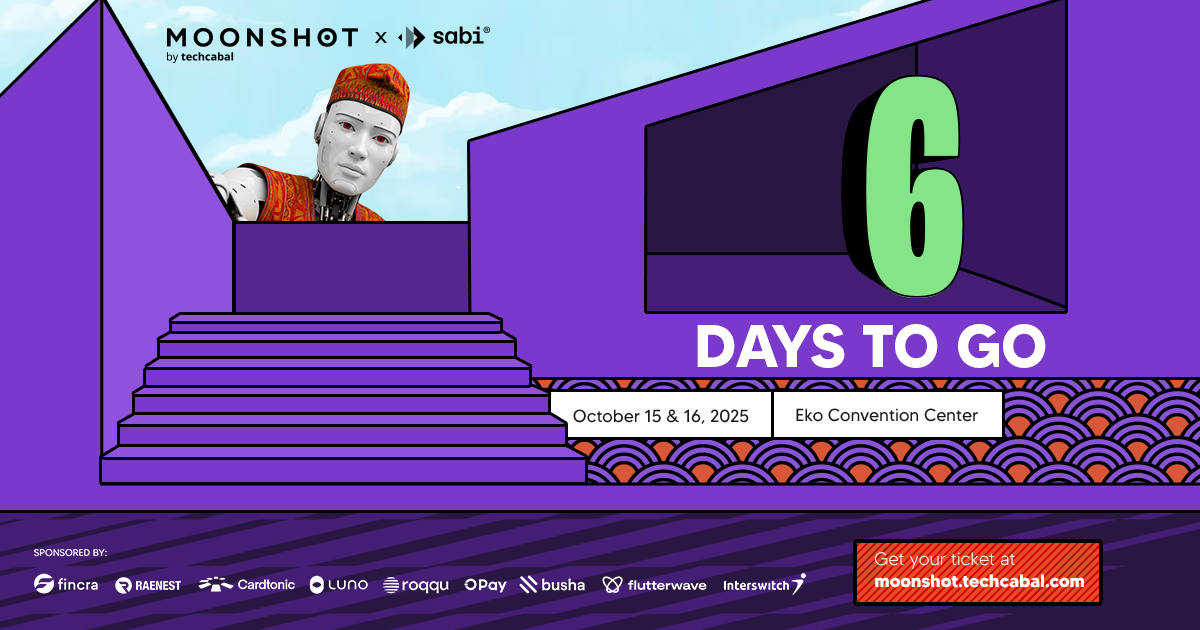

We’re excited to welcome Sabi, our headline sponsor, to the Moonshot 2025 stage!

Launched in 2021, Sabi is building the digital backbone of African trade, transforming how the world sources African commodities by bringing transparency, trust, and efficiency to fragmented mineral supply chains across the continent.

Here’s Sabi’s CEO, Anu Adedoyin Adasolum, on what building momentum means for the company as it scales impact and accelerates growth for its users.

Moonshot tickets are still selling as we near the landmark event on October 15 & 16, 2025. Snag yours here—only six days left!

Fintech

Moniepoint has spent half of its UK expansion budget for a shot at the remittance market

Moniepoint, the Nigerian fintech unicorn, has spent nearly half of the $7.39 million it earmarked for its UK expansion since setting up shop in London in February 2024. The startup has used the funds to incur costs, including $1.26 million on administration and infrastructure and a $2.5 million equity deposit for Bancom, a licenced electronic money firm that gave Moniepoint the regulatory keys it needed to operate across the UK and Europe.

It’s a calculated entry. The UK remittance market is expected to reach $40 billion by 2035. Over 290,000 Nigerians live in the UK, and in 2021 alone, they sent home roughly $3.69 billion. Moniepoint wants a slice of this market.

Heads up! Competition. Moniepoint entered the UK remittance market, where players like LemFi already play on home turf. LemFi, which serves over 2 million users, recently acquired Pillar, a UK-based credit card startup, to provide immigrant credit in Europe. But Moniepoint’s infrastructure and brand power could quickly shift that balance.

In April 2025, the startup rolled out MonieWorld, a remittance app that lets UK users send money straight to Nigerian accounts via cards or Apple and Google Pay. So far, it has grown by 70%, according to insiders, with the company describing transaction volume as “healthy.”

Moniepoint’s UK push is a signal of intent. By investing heavily pre-revenue, the fintech unicorn is betting on ownership of a high-value remittance corridor that could anchor its global ambitions.

eCommerce Without Borders: Get Paid Faster Worldwide

Whether you sell in Lagos or Nairobi, customers want local ways to pay. Let shoppers check out in their local currency, using cards, bank transfers, or mobile money. Set up seamless payments for your global online store with Fincra today.

Companies

Safaricom’s internal fraud problem cost 113 jobs

Safaricom, Kenya’s biggest telecom operator, is quietly fighting a growing internal war. The company fired 113 employees in 2024 for fraud-related offences, a jump from 95 the previous year.

What happened? The company alleged that several of its employees were complicit in fraud schemes and cash-handling mistakes that have cost users and the company money. It also says that some employees make fake overtime claims, dragging the business down as they earn more money for doing nothing.

Safaricom fights back. Safaricom has introduced automated detection systems to flag high-risk SIM swaps and expanded staff training to tackle fraud. It also partnered with Kenyan law enforcement agencies to track rogue agents.

A sector under strain. Fraud remains a significant challenge in Kenya’s financial sector, with insider collusion still a key factor in some reported digital fraud cases. Safaricom isn’t an outlier. Big organisations, including KCB Group, dismissed 34 employees in 2024, and Equity Group sacked over 1,200, over the same issue. Executives are now calling for companies to adopt stronger cybersecurity measures to deal with the external threat; however, the internal struggle still hinges on the rational optimism that employees will come correct.

Paga is in USA

Big news! Paga is now live in the United States, with digital banking services designed for Africa’s diaspora! Eligible users can send, pay, and bank in US Dollars & Naira, safe, regulated, and borderless. Learn more.

Banking

21% of KCB’s banking loans have gone to finance green projects

While Kenya is trying to make its large corporations and big businesses moonlight as VCs, banks, too, have been turning to eco-warriors. KCB, Kenya's largest bank by assets, committed KES53.2 billion ($411 million) to finance green projects this year.

Banking on sustainability: So far, 21.32% of KCB’s loan portfolio qualifies as green, as the bank pushes toward its 25% target for the year. The money supports renewable energy, climate-smart farming, green housing, and clean transport. It also funds small women- and youth-led businesses, helping communities adapt to climate change while building local economies, according to Paul Russo, KCB Group CEO.

Catch up: In April, the Central Bank of Kenya (CBK) gave lenders 18 months to start reporting the environmental impact of their financing under the new Kenya Green Finance Taxonomy (KGFT). The guidelines define what counts as “green” and aim to move capital toward cleaner, low-emission investments in the country.

Why it matters: KCB leads other banks in sustainability financing. Its drive shows that while cutting lending rates remains a contentious issue in the banking sector, the big boys, at least, have no problem supporting real impact projects. This would effectively make it twice as likely for entrepreneurs and small businesses building in this area to secure loans.

KCB’s growing green portfolio could inspire more banks to unlock funds for this reason as they race to meet KGFT demands and deadlines.

Paystack introduces Pay with Bank Transfer in Ghana

Ghanaian businesses can now accept secure, instant bank transfers on Paystack. Learn more here →

Economy

Kenya cuts benchmark rate for eighth time in a row

On Wednesday, Kenya's Central Bank (CBK) cut its benchmark rate by 25 basis points to 9.25%, stretching its monetary easing cycle. The regulator has now cut the rate eight times in 20 months, as it continues its uphill battle to encourage borrowing and spending in the country.

Why the rate cut matters: When borrowing costs fall, it encourages banks to lend more, allowing households and businesses to access cheaper credit for things like homes or business expansion. The CBK is still playing on its hunch that easier money will keep the economy growing without letting prices spiral.

Between the lines: The CBK has a lot of wiggle room to cut rates because Kenya's inflation is sitting comfortably below the government's target. The regulator has since urged commercial banks to equally ease the brakes in lending and interest rates to individuals. However, compliance has been uneven, with the CBK threatening fines for months but never punishing anyone.

While Kenya's food inflation ticked up slightly in September, fuel prices decreased, and the shilling has remained stable in recent months, all contributing to economic certainty.

The bigger picture: The economy is showing more life this year, thanks to stronger farm output, transport, and trade. But credit growth has been slow to catch up. By lowering rates again, the CBK hopes banks will finally start loosening their purse strings.

THERE SHOULD BE AN APP FOR THAT! 📱

You know that thing where an accident happens and people start whipping out their phones? What if, instead of using their phones to record videos, they could open an app that gives step-by-step first aid guidance during emergencies? It wouldn’t be generic first aid either. It would be tailored to specific situations.

I’m Boluwatife Ajayi, and there should be an app for that.

If you would like to hear more things there should be apps for, Appstack by TechCabal comes out every Sunday, watch out for that.

CRYPTO TRACKER

The World Wide Web3

Source:

Coin Name | Current Value | Day | Month |

|---|---|---|---|

| $121,954 | + 0.54% | + 9.01% | |

| $4,443 | + 0.32% | + 3.39% | |

| $172.59 | + 30.55% | + 247.17% | |

| $227.78 | + 4.00% | + 6.06% |

* Data as of 06.30 AM WAT, October 9, 2025.

Events

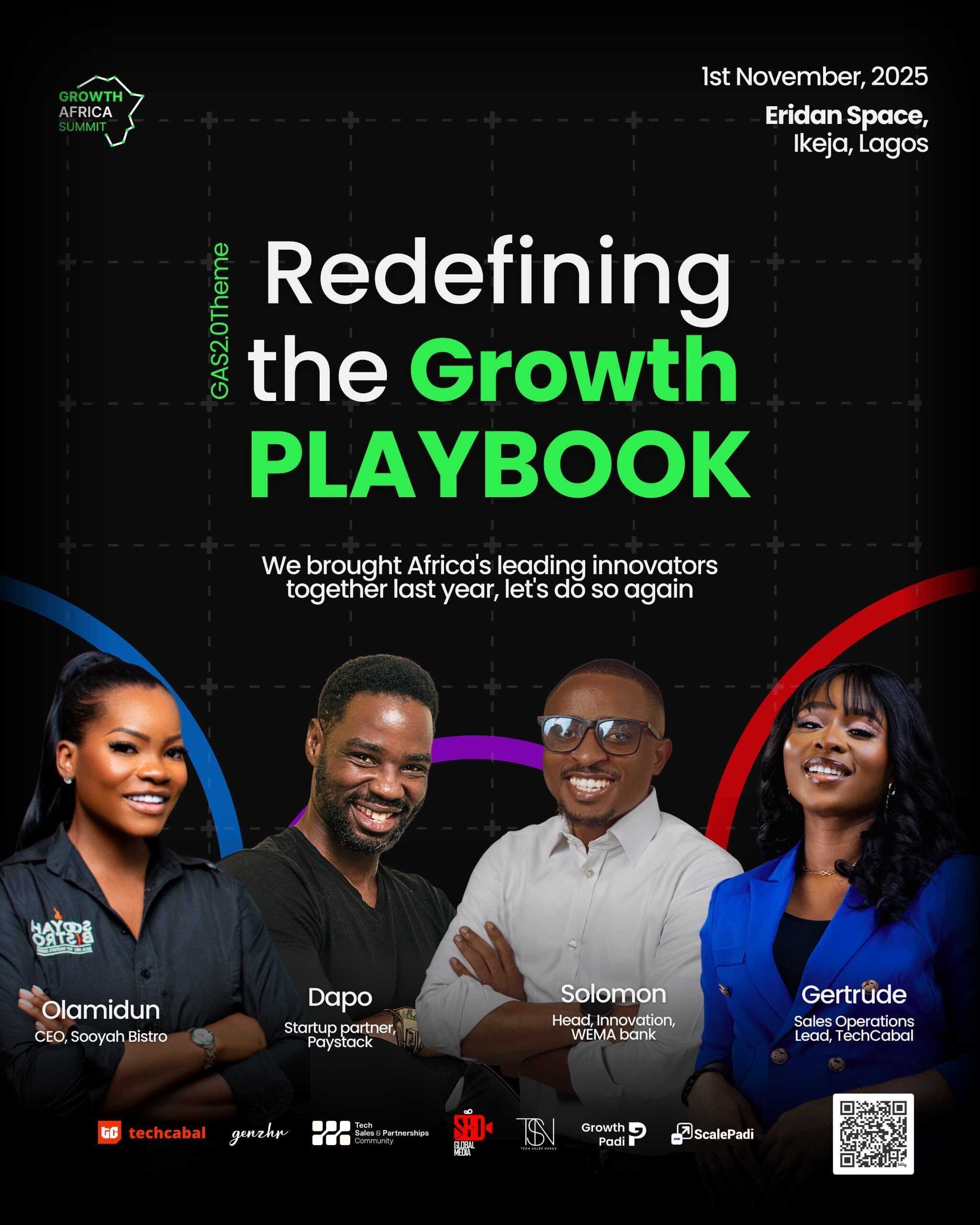

- Bigger, bolder, and more intentional. Following the resounding success of the inaugural summit in 2024, Growth Padi is thrilled to announce Growth Africa Summit 2025 (GAS 2.0) with the trailblazing theme: “Redefining the Growth Playbook.” Set against the backdrop of a fast-evolving entrepreneurial landscape, this year’s summit will challenge outdated strategies and usher in a new wave of radical, resilient, and relevant growth models tailored for African businesses. Register to attend by November 1.

- Got a startup story worth telling? My Startup in 60 Seconds is TechCabal’s one-minute spotlight for founders to share their journey, from vision and challenges to major wins. It’s more than just visibility; it’s a chance to reach investors, potential customers, and Africa’s wider tech ecosystem. Be featured in My Startup in 60 Seconds or explore other TechCabal advertorial opportunities and let the ecosystem hear your story. This is a paid opportunity.

- Countdown to Moonshot 2025. Africa’s biggest gathering of dreamers, doers, and disruptors returns on October 15 & 16, 2025. From startup founders to policy shapers, everyone who’s building the continent’s future will be there. Secure your spot today and be part of the movement..

Written by: Opeyemi Kareem and Emmanuel Nwosu

Edited by: Emmanuel Nwosu & Ganiu Oloruntade

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- TC Scoops: breaking news from TechCabal

- TNW: Francophone Africa: insider insights and analysis of Francophone's tech ecosystem

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

How did you find today's edition of #TCDaily? |