- 👨🏿🚀TC Daily

- Posts

- Q3 ends weakly

Q3 ends weakly

African startups raised $116.7 million in September 2023.

Happy pre-Friday 🎉

We’re six days away from The Moonshot Conference!

That’s 6 days until you can hear Africa’s most audacious thinkers and doers talk about innovation on the continent. You too can be one of 2,000 attendees who can badger Korty EO, Fisayo Fosudo and FK Abudu with questions…but only if you give us your moneybuy tickets.

There’s even a Welcome Mixer on October 10 so you can let your hair down, and nod convincingly into your drink when policymakers talk about stuff you don’t understand. Register here!

1. Funding: Q3 brings in the lowest funding of the year

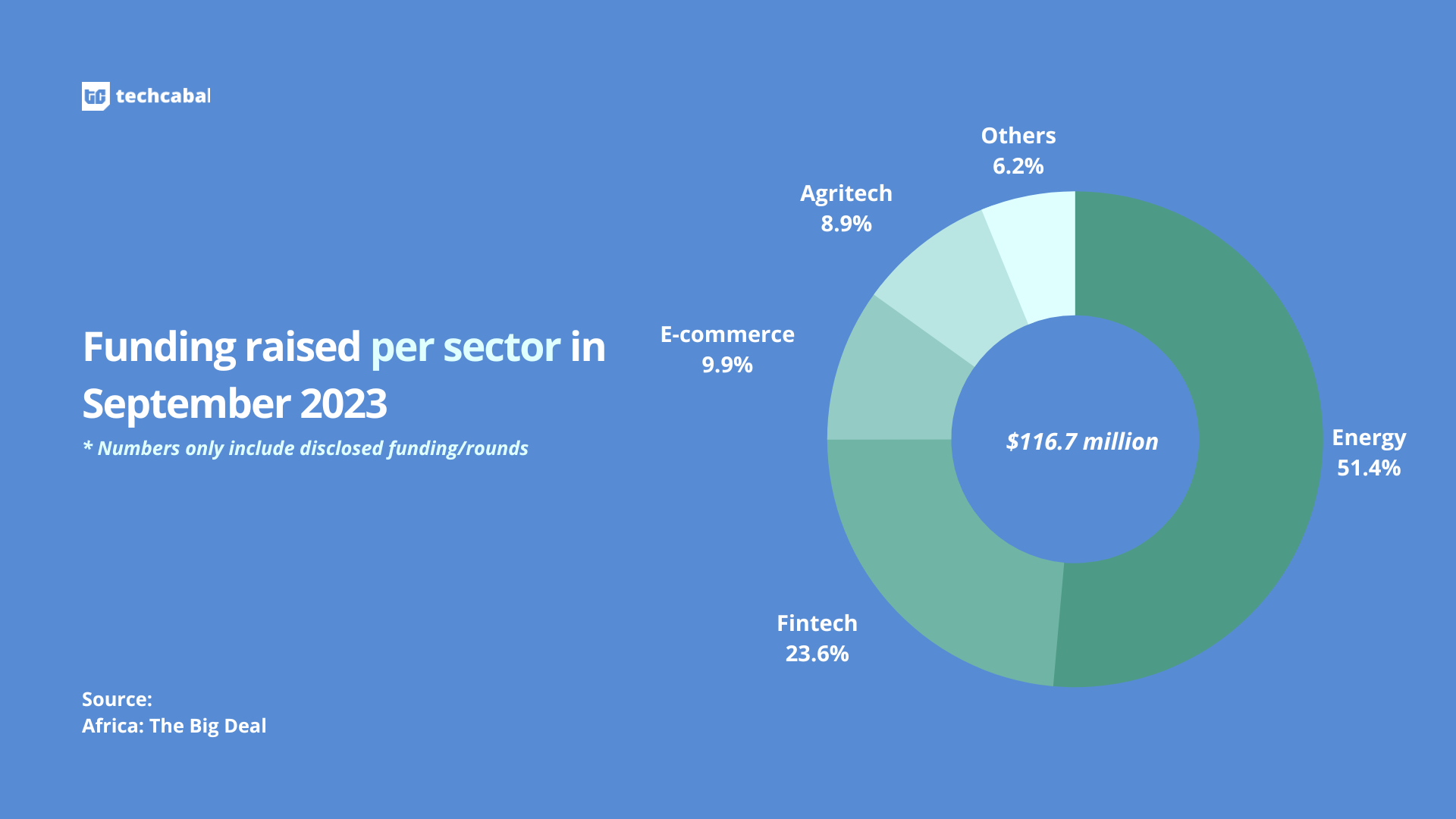

In September 2023, 22 African tech startups raised $116.7 million across 22 fully disclosed* raises. Compared to August 2023’s $243.7 million total raise, this represents a 52.11% decrease.

This also represents a significant YoY decrease—about 69.6%—from September 2022 when African startups raised $383.4 million. With this, September marks the month with the second-lowest funding following March’s $66 million raise.

In total, Q3 saw African startups raise $492.6 million across 67 fully disclosed deals. It’s a decline from Q2’s $877 million total raise, and an even sharper drop from Q1’s $1.3 billion. So far, African startups have raised $2.57 billion.

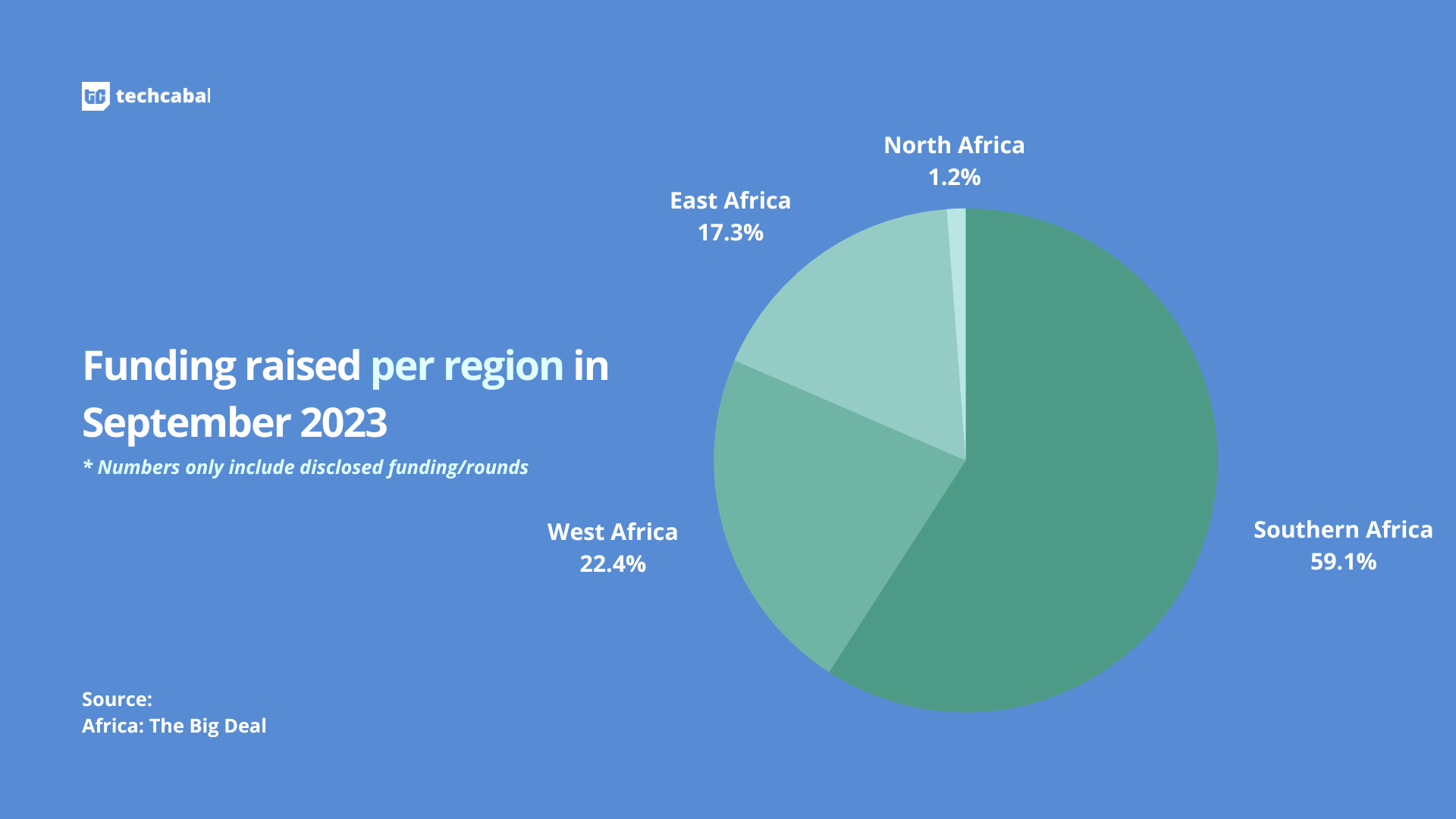

Per region, Southern African startups made a surprising appearance in first place with $69 million in raises, about 59.1% of the total funding. This is mostly led by energy startup Wetility’s $48 million raise. West Africa comes second with $26.1 million, East Africa with $20.2 million, and North Africa with $1.4 million.

Per sector, the top three sectors for September 2023 are energy with $60 million (51.41%)—led by the Wetility raise and Kenya’s SunCulture’s $12 million raise, fintech with $27.5 million (23.56%), and retail/e-commerce with $11.6 million (9.94%).

The top 5 disclosed deals of the month are:

- South African energy startup Wetility’s $48 million debt and equity round.

- Kenyan energy startup SunCulture’s $12 million syndicated debt facility.

- Ghanaian agritech Complete Farmer’s 10.4 million pre-Series A round.

- Zambian fintech Lupiya’s $8.25 million Series A funding.

- South African retail startup Rentoza’s $6 million raise.

*Note: This data is inclusive only of funding deals announced in September 2023. Raises are often announced later than when the deals are actually made. This data also excludes estimated grants from accelerators.

Get a working card from Moniepoint

With the Moniepoint personal banking app, you get reliable payments every time and a card that always works. Enjoy seamless payments powered by the infrastructure that 1.5 million businesses trust. Download the app.

2. Investments: Enza Capital and P1 Ventures launch new funds

In September, Kenyan-based venture firm, Enza Capital, raised $58 million to support startups on the continent.

The VC company, which invests from first cheque, is also kickstarting a new shared ownership model that allows startup founders the ability to own part of the firm. Enza capital has allocated 10% of its carry pool to founders.

Another VC firm, P1 Ventures, also closed a $25 million fund which it plans to invest in African businesses across fintech, SaaS, AI and healthtech ventures.

3. M&As: Risevest acquires Chaka, WhoGoHost acquires SendChamp

Q3 also ended with a few acquisitions.

First, earlier in the month, Nigerian cloud infrastructure company WhoGoHost acquired SendChamp, a cloud communications startup, for an undisclosed amount.

Much later, Nigerian trading startup Risevest announced its acquisition of digital trading startup Chaka for an undisclosed sum.

4. Shutdowns: 54gene shuts down

Last month, TechCabal also confirmed that Nigerian genomics startup 54gene is shutting down. The news was confirmed by ex-CEO Ron Chiarello.

The startup, which raised $54 million since its founding in 2019, struggles through several leadership changes and impulsive spending habits.

Meanwhile, founder and ex-CEO Dr. Abasi Ene-Onong launched a new genomics startup, Syndicate Bio, in the same month.

5. Sendy goes into administration, PayDay searches for a buyer

September saw Kenyan logistics startup Sendy enter into administration—an independent person, Peter Kahi, will take control of the company until it can resolve its financial crisis.

This comes after the company, which was reportedly burning $1 million per month in operating costs, failed to find a buyer.

Meanwhile, Nigerian fintech startup PayDay also confirmed its search for a buyer in September. The company, which raised $3 million in March 2023, faced a series of challenges including contentious salary increases, impulsive management choices and faulty infrastructure.

Accept payments fast with the Paystack Virtual Terminal

Paystack Virtual Terminal helps businesses accept blazing fast in-person payments at scale, with ZERO hardware costs. Enjoy instant transfer confirmations via WhatsApp, multiple in-person payment channels, and more.

👉🏿Learn more.

6.Economy: Kenya joins PAPSS

In September, Kenya became the tenth African country to join the Pan-African Payments and Settlement System (PAPSS).

Trade secretary Moses Kuria made the announcement noting that the Central Bank of Kenya (CBK) had signed the agreement and completed all the necessary formalities.

So far, the service—which is used by nine central banks—has reportedly saved African companies $5 billion in transaction charges.

7. Layoffs: mPharma lays off 150 staff

One year on, and layoffs are still occurring in the tech space.

In September, Ghanaian healthtech mPharma announced that it had laid off 150 employees—including 40 from its Nigerian team. Per CEO Gregory Rockson, the layoff are—unsurprisingly—due “macroeconomic conditions driven by the devaluation of the naira”.

This comes 19 months after the startup raised $35 million in a Series D round.

8. Economy: Sama to provide 2,100 Kenyans with AI jobs

Months after Meta cut ties with it, Kenyan content moderation firm Sama is taking a new turn.

In September, the company announced a pivot from content moderation into artificial intelligence (AI). Per Kenya’s cabinet trade secretary Moses Kuria, the company was set to hire 2,100 Kenyans to work in several AI-focused teams including machine learning, and business process outsourcing (BPO).

9. Social Media: Kenya is still going after TikTok

While Sama might not be interested in moderating content anymore, several other Kenyan players are.

September saw Kenyan officials with a renewed drive to ban TikTok…or at least parts of it. The Kenyan Film Classification Board (KFCB) reportedly requested that TikTok disable its Live feature in the country in a meeting with TikTok CEO Shou Zi Chew. The meeting was held with the Kenyan president to discuss a petition to ban TikTok earlier received by the Kenyan Parliament.

Meanwhile, similar petitions to ban TikTok have surfaced in Uganda and Egypt.

10. Global News: TikTok fined $370 million in the EU

Looks like the social media company is fighting fires everywhere.

In the European Union, TikTok was fined €345 million ($370 million) for violating privacy laws relating to the processing of children’s personal data. Per Ireland’s Data Protection Commissioner, TikTok committed a number of breaches between July and December 2020 including non-verification of age for underage users, and setting visibility for under-16 accounts to “public” by default.

Apply for the Female Founders' Growth Programme

FSDH Merchant Bank has partnered with the IFC (of the World Bank) and WEAV Capital for a female accelerator and investment readiness programme for female founders. Selected startups will partake in a world-class Investment Readiness Programme designed to support high-potential female-led tech companies to raise capital. The programme will end with a Pitch Day and a $10,000 non-equity funding for the winner. Apply here.

The World Wide Web3

Source:

Coin Name | Current Value | Day | Month |

|---|---|---|---|

| $27,727 | + 1.21% | + 7.57% | |

| $1,643 | - 0.49% | + 1.36% | |

$23.17 | - 1.66% | + 20.08% | |

| $7.67 | + 3.07% | + 28.21% |

* Data as of 23:25 PM WAT, October 4, 2023.

Elevate your business with One Liquidity's seamless integration. Choose from 10+ services to craft a custom solution. Join Obiex, Wewire, and others in providing trading, liquidity and compliance services. Start now with zero fees. One Integration. One Solution. One Liquidity.

What else is happening in tech?

Written and Edited by -